Alexey Ananyev completely left the financial and development business. Dmitry Ananyev stepped down from managing the Technoserv group of companies

Dmitry (left) and Alexey Ananyev. 2007 (Photo: Kirill Tulin / Kommersant)

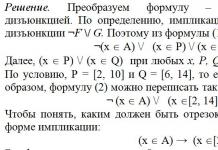

The former owners of Promsvyazbank, where the Central Bank introduced a temporary administration in December, Alexey and Dmitry Ananyev divided their assets. Alexey Ananyev spoke about this in an interview with the Vedomosti newspaper.

“We decided to divide the assets soon after the temporary administration was introduced into the bank,” Ananyev said. “I made an offer to Dmitry and I am grateful that he accepted this offer.” He also added that it was a no-cash deal. “We exchanged shares in assets<…>. The assets are divided based on who historically did what,” the businessman said.

In particular, the Technoserv group of companies was completely transferred to Alexey Ananyev, and Promsvyazkapital became 100% owned by Dmitry.

“Thus, I am no longer a shareholder of Promsvyazbank and Vozrozhdenie, I no longer have anything to do with financial assets. And the PSN group and media always belonged to Dmitry,” explained Ananyev.

Last December, Promsvyazbank, in which Alexey and Dmitry Ananyev, through the Dutch Promsvyaz Capital B.V. owned 50.03%, became the third private bank in the Banking Sector Consolidation Fund (FBS). As reasons for this step, the regulator cited, in particular, a significant volume of problem loans, the reorganization burden on the bank due to participation in the rehabilitation of AvtoVAZbank, as well as a chronic lack of liquidity.

Assets of the Ananyev brothers

Information Technology

Brothers Alexey and Dmitry Ananyev began building their business empire with the establishment of the Technoserv A/S company in 1992. Today it is the largest system integrator in Russia, which also specializes in IT services and software development. In the 2017 financial year, the turnover of the Technoserv group of companies amounted to more than 50 billion rubles. In June 2018, it became known that 40% of Technoserv belonged to VTB.

Banking

In 1995, the Ananyev brothers, together with OJSC Moscow Intercity and International Telephone (MMT), opened Promsvyazbank. Over time, MMT's share has been diluted. The bank showed rapid growth: at the beginning of 2001 it ranked 46th in terms of assets, and at the end of 2006 it ranked 13th. According to Interfax-CEA, over the past 10 years, the bank’s assets have increased more than five times, from 214 billion rubles. according to the results of the second quarter of 2007, up to 1.2 trillion rubles. based on the results of the second quarter of 2017. In 2015, the Ananyev brothers bought Vozrozhdenie Bank for $200 million, merged Pervobank, controlled by Leonid Mikhelson, and accepted AvtoVAZbank for reorganization, receiving 18.2 billion rubles for this. from the Central Bank and DIA. The Ananyevs' financial assets were merged into the Promsvyazkapital investment group. According to data posted on the company’s website at the end of 2017, its assets amounted to almost 1.5 trillion rubles, capital - 86 billion rubles, profit - more than 8 billion rubles. At the end of 2017, the Bank of Russia announced the reorganization of Promsvyazbank. After this, the brothers divided the assets, and the banking business remained with Dmitry Ananyev. According to the instructions of the Bank of Russia, Ananyev’s structure from shares in Vozrozhdenie is being negotiated by VTB to purchase the bank. Since the end of 2015, Promsvyazcapital has also included the Cypriot trading company PostScriptum Capital Ltd. Entrepreneurs invested €100 million in it. In the spring of 2018, Promsvyazcapital announced its intention to file for bankruptcy.

Media and publishing business

In 2000-2006, the Ananyev structures bought the newspapers Trud and Argumenty i Fakty (AiF), Extra-M, as well as the printing houses Extra-M and Media-Press. Adding to this the Center Plus newspaper, in 2007-2008 the assets were combined into the Media 3 holding and created the largest distribution network in Russia in terms of revenue, First Page. In 2011-2013, the Ananyev structures invested in the Tvigle video service, free classifieds portals Dmir.ru and Zarplata.ru, and bought the real estate website Cian.ru. By 2014, the Promsvyazkapital group, leaving the printing house, distribution and Internet division.

Former owners of Promsvyazbank Dmitry and Alexey Ananyev are getting rid of companies for which they were both beneficiaries and creditors. If the company fails to sell, it goes bankrupt according to a simplified procedure. It seems that PSB, which has come under state control, will not get much, but the government and the Central Bank do not seem to notice anything.

The Arbitration Court of the Moscow Region declared JSC Printing Complex Extra M insolvent. Bankruptcy was initiated by the company itself and will follow a simplified procedure. The bankruptcy trustee Elena Ilaya will have to report to the court on the activities carried out on December 19, 2018.

The scale of the event is difficult to overestimate: Extra M is one of the largest newspaper printing houses in Russia, where Rossiyskaya Gazeta, Kultura, Pravda, Gudok, Vedomosti and the Moscow version of the Metro newspaper are printed. The owners of the printing house are brothers Alexey and Dmitry Ananyev, the shares of the enterprise were pledged to Promsvyazbank and AvtoVAZbank.

In 2016, according to SPARK-Interfax, the company’s revenue amounted to 1.35 billion rubles. Data for 2017 have not been published, but according to press reports, the company was profitable and had a stable flow of orders, that is, there were no prerequisites for bankruptcy. Nevertheless, in the summer of 2018, shortly after the transfer of the sanitized Promsvyazbank to the state treasury, the shareholders of the printing house decided to liquidate it.

At the end of June, the liquidator they appointed, Maxim Kobalyan, filed a bankruptcy petition for the company. The application was considered by the Arbitration Court of the Moscow Region on August 1. Despite the fact that more than a month has passed since the decision to liquidate PC Extra M JSC, information about this was not published in the State Registration Bulletin.

– That is, until now your creditors do not know that you are in a state of liquidation? – asked judge Elvira Gilyazova.

“Well, obviously so,” answered the representative of “Extra M” Anton Denisov. He explained the current situation by the fact that information about the liquidator Maxim Kobalyan was only entered into the Unified State Register of Legal Entities on July 25.

Anton Denisov reported in court that the accounts payable of PC Extra M JSC amounted to 2.591 billion rubles - 400 million rubles more than its property was worth. This is what caused the bankruptcy filing. A representative of Extra M also said that the difference between the debt and the value of the printing house’s property partly arose due to the fact that Extra M owns shares in the Kursiv JSC enterprise worth about 80 million rubles. According to Denisov, Kursiv is also in bankruptcy today, so its shares will be devalued.

In addition, PC Extra M JSC has receivables in the amount of more than 100 million rubles, and among the debtors is the same Kursiv JSC. However, the liquidator of Extra M did not try to collect the receivable; as of August 1, the printing house did not manage to enter the register of creditors of Kursiv JSC. It is likely that the arbitration manager will collect debts in favor of Extra M, if, of course, he manages to do this. According to the materials presented to the court, there are 8 million rubles and 40 thousand euros in the settlement accounts of Extra M - this should be enough for the bankruptcy procedure.

Today, the Extra M printing complex continues to print newspapers, but how it will function during bankruptcy proceedings is still unclear. Some market participants consider the most likely scenario in which the manager puts the printing house's property up for auction. Then several options are possible. The first, in which the printing house is bought by one of its major competitors, seems unlikely. In Moscow and the Moscow region today there is no shortage of printing capacity. Operating printing houses can simply win over Extra M's large clients, and therefore are unlikely to take on the debts of a troubled company.

Of course, we can assume that the printing house will be bought at a large discount by structures close to the current owners, the Ananyev brothers. In this situation, they will probably be able to count on writing off part of the debt to the bank, but it is difficult to believe in such a development of events.

Dmitry Ananyev has long been looking for a buyer for Extra M, the last fragment of the Media 3 holding owned by the brothers, which failed to survive the 2008 crisis. There was no buyer, so bankruptcy and the sale of the printing house's property may be the only way out. True, if we consider that “Extra M”, although a large printing house, is far from the only one of its kind, today its equipment can only be sold at the price of the metal from which it is made.

The most promising option for the printing house would be an external manager who would allow the company to gradually pay off its debts - after all, the enterprise is profitable. At the same time, it would be nice to figure out where money has been withdrawn from the company recently. The debt structure is far from typical for this business, both in structure and in the time of its formation. Was it possible that money was deliberately withdrawn from the company in recent months in anticipation of its liquidation?

The Extra M printing house is not the only enterprise of the former owners of Promsvyazbank that is experiencing collapse today. Their agricultural holding "White Bird" is closing a poultry complex in the Rostov region, about a thousand people will be laid off.

It is likely that the same fate awaits other enterprises of the holding in the Belgorod and Kursk regions. The Ananyev brothers unsuccessfully searched for a buyer for Belaya Ptika, but the company with gigantic debts turned out to be unclaimed on the market - industry participants expect it to go bankrupt.

The example of “White Bird” is convenient for studying the so-called offshore credit scheme for asset ownership, which, apparently, was used by Alexey and Dmitry Ananyev. From a formal point of view, the agricultural holding belongs to the Cyprus company Stephont Developments Limited (99%) and the Shelling Limited company registered in the British Virgin Islands (1%). At the same time, the business of “White Bird” was critically dependent on cheap loans from Promsvyazbank. When the bank went under reorganization last winter, problems immediately began at poultry farms in three regions of Russia.

Agroholding "South of Siberia"

The Altai agricultural holding "South of Siberia" associated with the Ananyevs is also in the process of liquidation. The holding unites large enterprises for the production of vegetable oils and meal (approximately 15% of the Russian market): Barnaul and Biysk oil extraction plants and the Prodex-Omsk enterprise. 74.99% of shares in South of Siberia LLC belong to Petumil LLC and are pledged to Promsvyazbank. Petumil LLC, in turn, belongs to Champton LLC, and this company is 99% controlled by the Cyprus offshore Silvary Holdings Limited.

The decision to liquidate South of Siberia LLC was made at the general meeting of the company’s owners on June 12, 2018. The corresponding message was published in the State Registration Bulletin of July 25, 2018; creditors’ claims can be submitted within two months from this date. Back in June, Promsvyazbank announced its intention to file for bankruptcy of South Siberia LLC, but this has not yet happened.

True, unlike the Extra M printing house, it seems that a buyer has been found for the assets of South Siberia LLC. The company stated that it does not plan to stop production and continues to operate by attracting a strategic partner - the Blago group of companies. However, it is still unclear whether the Altai agricultural holding will be able to pay off its debts to Promsvyazbank.

Meanwhile, bankruptcy proceedings began in the Russian Forest Group. We are talking about a major borrower of Promsvyazbank and one of the largest timber processors in the Irkutsk region. Russian Forest Group LLC is owned by Juston Holdings LTD, a company registered in the British Virgin Islands; the offshore shares in the Russian company are pledged to Promsvyazbank. The group's enterprises employ more than 2 thousand people. One of them, “LDK Igirma”, was even mentioned in the Strategy for the Socio-Economic Development of Siberia until 2020. Apparently, it will not live to see the results of this program.

Scheme of the Ananyev brothers

It seems that the “Ananyev” scheme is as follows - enterprises belong to nominal owners, are controlled from offshore and are extremely burdened with loans. Therefore, the legal successor of their debts cannot effectively collect them.

If we are talking about large-scale production, then the liquidation of such a company can threaten serious economic and social problems for the region in which it is located. It is not without reason that back in the spring, the governors of three regions at once asked the government to help the Belaya Ptitsa agricultural holding. At the same time, the businessmen responsible for creating “colosses with feet of clay” do not worry about anything - they do not even try to involve the former owners in the restoration of enterprises destroyed by their financial games. But in this way it would be possible to restore the value of the collateral base, as a result of which significantly less money would be required to recapitalize Promsvyazbank.

Or is this option not interesting to the curators of the process? The Central Bank, as always, will turn a blind eye to the fact that the formation of such credit conglomerates occurred during the period when reporting was controlled by Elvira Nabiullina, and even after the collapse of the bank it will not investigate possible violations? What was it all about - a fraudulent withdrawal of capital from a bank, illegal entrepreneurship, withdrawal of capital from taxation? Or maybe all of the above at once?

The high-profile story of the reorganization of Promsvyazbank is moving towards its finale. Its former owners, apparently, do not face criminal prosecution. Brothers Alexey and Dmitry Ananyev will be able to work safely in Russia. And this circumstance suggests that we have learned only a small part of the facts about the business of the founders of PSB.

The law according to which Promsvyazbank will be transferred to state ownership has come into force. PSB will be additionally capitalized by almost 1 trillion rubles through the transfer of loans from the military-industrial complex from other banks to it. Neither the loss of credit files worth almost 110 billion rubles, nor other “signs of illegal actions of management” of PSB, which were mentioned by the first deputy chairman of the Central Bank Vasily Pozdyshev, became the reason for the criminal prosecution of the Ananyev brothers. The situation can be considered unique. The owners and managers of other problem banks became defendants in criminal cases after the loss of much smaller amounts. We remember how law enforcement agencies were involved in the fraud of the former owner of Globexbank, Russian Credit and M Bank, Anatoly Motylev, over “some” 700 million rubles.

However, Alexey and Dmitry Ananyev do not fear for their freedom and plan to continue doing business, including in Russia. Not long ago, the brothers divided their assets: Alexey will remain with his Tekhnoservice, Dmitry will remain with Promsvyazkapital. At the same time, if the youngest of the brothers is most likely now abroad, Alexey Ananyev does not intend to leave the country.

« Everything that is important to me in life is here: parents, family, work. I can’t imagine my life in another country - I haven’t left and don’t plan to leave“, he said in a recent interview with the Vedomosti newspaper.

In that interview, Ananyev Sr. again spoke about how unexpected the introduction of a temporary administration at the end of last year was for the owners of Promsvyazbank.

« The fact that the bank had problems, bad assets, was no secret to anyone. The regulator, the auditor, and the rating agencies knew about this. This topic was constantly heard at the board of directors. We saw that the bank was operationally profitable, that the bank was increasing this profit, and that there was potential for solving accumulated problems in the future.", said Alexey Ananyev.

Indeed, it is difficult to believe that the regulator did not notice for a long time, and then suddenly “discovered” the bank’s problems, which supposedly required an urgent increase in reserves by 100 billion rubles. What made the Central Bank change its position? Why, after the discovery of a multibillion-dollar hole in the balance sheet of PSB and a public attack on the owners, the Ananyev brothers are free, are not involved in criminal cases, and even got the opportunity to sell their shares in Vozrozhdenie Bank?

Since we do not have clear answers to these questions, we can assume that the introduction of a temporary administration in the PSB had reasons not related to the activities of this credit institution. Simply put, at Neglinnaya they wanted to hit not the Ananyevs, but one of their partners. It is likely that these were the clients of Promsvyazbank whose names and surnames appear in the missing credit files. If we take into account the “defense” background of Alexey Ananyev, it is easy to imagine that PSB’s “secret” clients were companies associated with representatives of the so-called “siloviki clan” in the broad interpretation of this concept. They also say that Alexey and Dmitry Ananyev are close to one of the members of the Security Council. If so, then even now on the paradise islands the team of Orthodox bankers should be extremely careful in securing their obligations to their senior comrades.

The Central Bank's order to increase reserves was issued to Promsvyazbank on December 14, 2017, that is, on the eve of the announcement of the verdict against Alexey Ulyukaev, the former Minister of Economic Development and a prominent representative of the “liberal” clan opposing the “siloviki”. Some may find it absurd to attempt to connect these two events. But just recently, a story in which a minister personally comes to the office of a state corporation to receive a bribe might have seemed crazy. By the way, Ulyukaev’s defenders used this circumstance in public opinion to point out the allegedly ordered nature of the criminal case against the ex-minister.

According to rumors, it was not Ulyukaev who was waiting for the money, but a smaller figure. By imprisoning the “pawn,” the “siloviki” wanted to send a signal to the “liberals” in the economic bloc of the government. By that time, the leaders of large state-owned companies were tired of baseless forecasts and the constant search for the “bottom” of the economy. But Alexey Ulyukaev personally came to the Rosneft office to collect the money, and therefore the case became more resonant than its initiators expected.

In the history of modern Russia, this was the first “landing” of a sitting minister. It is easy to assume that Ulyukaev’s former colleagues from the Central Bank could not leave this without a reaction, and the result was an attack on Promsvyazbank.

Let us repeat, this is just a version. Maybe someone can tell us a more reasonable explanation for the events that took place around Promsvyazbank and its owners over the past three months?

Several facts support the fact that Alexey and Dmitry Ananyev are affiliated with the security forces. Firstly, in December 2017, despite the very real threat of criminal prosecution, the brothers were able to travel abroad without hindrance. Secondly, the defense industry actively supported the PSB. After reorganization, it should turn into a specialized defense bank that will serve the defense industry and will be protected from Western sanctions. As is known, the renewed credit institution will be led by Pyotr Fradkov, the son of the former director of the Foreign Intelligence Service of the Russian Federation, Mikhail Fradkov.

If everything is as we assume, then we should expect a new round of behind-the-scenes struggle between the “siloviki” and the “liberals,” which will intensify on the eve of the renewal of the government. And the question also arises: have the former owners of PSB settled with their clients?

Next time we will try to figure out whose secrets Alexey and Dmitry Ananyev are keeping, and who can demand a refund from them.

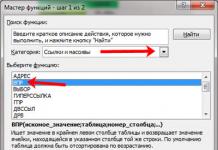

"We are all a little bitIT»

The basis for Promsvyazbank was the IT company Technoserv, created by Alexey Ananyev in the first half of the 1990s.

Alexey is the older brother. He was born in August 1964. Dmitry was born in February 1969. At the same time, Dmitry was the company’s deputy marketing director, and Alexey was the director.

He got into a prestigious university through a quota for children of workers

The media note that the brothers have rather modest origins. For example, Alexey, when he was 23 years old, still lived in the same apartment with his parents. He graduated with honors from the Maurice Thorez Institute of Foreign Languages (now MSLU). He got into a prestigious university through a quota for children of workers, and got a job as a translator from Portuguese at the Committee of Youth Organizations (KMO USSR). The younger brother served in the army at that time.

Give the USSR five years of large computer productionIBM!

Ananyev Sr. already in the early 90s of the last century knew that in the West there was a market for used large computers - computers made by IBM, which had worked for five to seven years at most and which the owner companies wanted to sell as obsolete. But for the USSR in the early 90s, these were still supercomputers that could replace Soviet computer technology - “Goliaths”. The center based on the EU computer could occupy an area of 1 thousand square meters. meters, and the Western analogue - the mainframe - could be installed in a room of 20 square meters. meters. Dmitry Ananyev decided to buy such machines from brokers abroad and install them at former Soviet enterprises. At that time, Ananyev’s idea seemed wild to his competitors.

Mainframes were installed at AK named after. Ilyushin, TAPO named after. Chkalov, NPO Mashinostroenie, AvtoVAZ and the Izhmash plant.

How Promsvyazbank appeared

As both brothers often recalled, the idea of creating a bank was born during one of the projects to automate the business processes of another client. Promsvyazbank was founded on May 12, 1995 in Moscow. At the first stage, his clients were mainly telecommunications companies. In 1998 it entered the top 100 by assets, and in 2005 it entered the top 15. By 2007, it had sales points in more than 90 locations throughout Russia.

When creating the bank, the brothers took Moscow Intercity and International Telephone (MMT) as partners.

When creating the bank, the brothers took Moscow Intercity and International Telephone (MMT) as partners. Before Technoserv helped MMT automate the accounting of subscriber debt, a car drove between five MMT computer centers, delivering ancient reels with information about calls. MMT CEO Boris Zverev, according to the brothers, was very pleased with the services of their company and offered to help them set up a company to deal with debts - in fact, he invited them to engage in what is now called factoring).

In response, the Ananyevs suggested that Zverev jointly create a small bank that would provide factoring services in combination with other banking services, and at the same time finance the development of Technoserv. Initially, MMT's share in the capital of Promsvyazbank was 35%, but since then this telecommunications company has not made any investments in the bank's capital, so its share has diluted over time to 0.2%.

Time for a senator

He resigned due to the adoption of a law prohibiting government officials from having accounts and shares abroad.

Dmitry Ananyev served as senator of the Yamalo-Nenets Autonomous Okrug from 2005 to mid-2013. He resigned due to the adoption of a law prohibiting government officials from having accounts and shares abroad. While working in the Federation Council, Alexey was the first deputy chairman of the budget and financial markets committee for the last two years.

Owners of factories, newspapers, ships

The Ananyevs acquired the newspapers “Arguments and Facts” and “Trud”, a printing house on Pravdy Street (the same one where all the central newspapers are printed) and the advertisement newspaper “Extra-M” with its printing house in Krasnogorsk near Moscow. They also own the Karacharovsky Mechanical Plant, the largest manufacturer of elevators in Russia, and the Cryogenmash plant in Balashikha near Moscow, the largest manufacturer of gas liquefaction units.

Distribution of land

The Ananyev brothers did not participate in the privatization of large enterprises, in the so-called pledge and check auctions. But they couldn’t get past the distribution of land. They had to negotiate with the collective farm chairmen about the redemption of shares. Perhaps that is why the brothers do not like to be frank on this topic.

According to Forbes, the Ananyevs own more than 60 thousand hectares of land, mainly in remote areas of the Moscow region

However, according to Forbes, the Ananyevs own more than 60 thousand hectares of land, mainly in remote areas of the Moscow region. In total, Promsvyazbank acquired 15 farms around the capital. In addition, the brothers bought two more farms in the south of the Tver region, on the border with the Moscow region.

Humble Workers

Alexey Ananyev said that the phrase “social responsibility” seems artificial to him. “Some factory dumps toxic chemicals into the river, nothing lives there anymore, the pipes smoke, everyone is suffocating, children get sick, but the factory took over and financed some chapel. This is probably the social responsibility of business - ticked the box,” Vedomosti quoted him as saying. - We are trying to do things differently. We do not have any items in the budget - social responsibility. We don’t advertise what we do and don’t publish albums about it.”

Dmitry Ananyev also believes that it is better and more correct to talk less about yourself, your plans and achievements. “You feel more psychologically comfortable when, while doing business, you are more or less in the shadows. Willy-nilly, any interview is a story about certain plans, but not always everything works out as we would like,” he also told Vedomosti.

Religion

Alexei was brought to the Orthodox Church by his wife Daria

Both brothers never hid the fact that they are Orthodox believers. For many years, Alexey Ananyev took part in services on Sundays at the Moscow Church of the Life-Giving Trinity in Serebryaniki. Alexei was brought to the Orthodox Church by his wife Daria. He was baptized in 1991 and introduced his brother to the religion. Dmitry was baptized in 1992. The brothers helped the Pskov-Pechersky Monastery and are on the board of trustees to support the Central Clinical Hospital of St. Alexy, Metropolitan of Moscow. The Ananyevs also participated in the restoration of the Valaam Monastery and the Trinity-Sergius Lavra.

Fraternal relations

“Shared moral values allow us to put brotherly relationships above business. We can argue with Dmitry on some issue, sometimes quite long and harshly, but as soon as I feel that things are getting personal, this issue loses interest for me. I’d rather reconsider and correct my point of view than quarrel with my brother,” said Alexey Ananyev.

“As a child, I always drew something...”

Alexey Ananyev began collecting a collection of paintings in 2000, and in 2011 he founded the museum and exhibition complex “Institute of Russian Realistic Art” in a three-story building of the former boiler room of the Tsindel calico-printing factory on Derbenevskaya embankment.

Ananyev's passion for painting began at the age of 9, when he got tired of music school and went to take exams at art school. “A simple city children's art school No. 3, not at the Surikov Institute. He studied drawing, painting, composition, sculpture and art history there for four years,” Forbes quoted him as saying. - As a child, I always drew something - war, airplanes, ships. But by the middle of my schooling I realized that I would not be an artist and that I needed to build my life in some other way. Nevertheless, thanks to art school, I received the basis that allows me to perceive art and see something in it, including my own.”

In recent years, Ananyev has not been so active in buying Russian realistic art: it used to be cheaper

Basically, the billionaire's collection is associated with Russian realists of the 20th century. Now it contains more than 6 thousand works. True, in recent years Ananyev has not been so active in buying Russian realistic art: it used to be cheaper.

Publications were used in preparing the materialForbes, "Kommersant"», "Vedomosti" Banki.ru, Bankir.ru, Newsru. com

2018-01-24 841

Alexey Ananyev's business is a series of risky events. But time will tell how justified this approach is. And if the fate of his main brainchild, Promsvyazbank, is already known - the organization is undergoing a reorganization procedure with the further creation on its basis of an “anti-sanctions bank for the defense industry,” then the future of the banker himself raises many questions. But even the businessman’s shaky positions could not affect his financial ratings - at the end of 2017, according to Forbes, his fortune was estimated at $1,400 million, which corresponds to 58th place in the ranking of “200 richest businessmen in Russia.”

Dossier:

- FULL NAME:

- Date of Birth: August 24, 1964.

- Education: Moscow Institute of Foreign Languages named after. Maurice Thorez, specialty "translator-referent".

- Date of start of business activity/age: 1992/28 years old.

- Type of activity at start:"Technoserv A/S", sale of used computers.

- Current activity: Chairman of the Board of Directors of Promsvyazkapital.

- Current state:$1,400 million, as of 2017 according to Forbes.

The name of banker Alexey Ananyev and his partner, younger brother Dmitry, has been on the front pages of the business press since the end of 2017. After all, it is precisely with his risky approaches to doing business that the collapse of one of the country’s systemically important banks, Promsvyazbank PJSC, is associated.

Rice. 1 Brothers Alexey and Dmitry Ananyev.

Source: bankir.ru

The policy of the Promsvyazkapital group, which united the main assets of the Ananyev brothers, was called risky and even harsh before this scandal. After all, they expanded their empire inorganically. Through bankruptcies and takeovers, the purchase of depreciated assets, Ananiev became the owner of Yarsotsbank, Nizhny Novgorod Bank and Volgaprombank, Samara Pervobank. In 2016, AvtoVAZbank was reorganized, and Vozrozhdenie Bank was also acquired.

“In my opinion, the possibility of a successful merger of two large organizations is very low, and if these are strong companies, then the merger often ends with one team eating the other. This is a long, painful process that is not always for the benefit of shareholders,” A. Ananyev. Source: Vedomosti.

In addition to banks, Ananyev was also interested in other assets, including in the field of residential real estate, the agricultural sector and media.

It was Ananyev’s foray into the media market that at one time made him a public figure. Although the businessman himself has an extremely negative attitude towards fame, which is confirmed by the statement of his younger brother:

“You feel more psychologically comfortable when, while doing business, you are more or less in the shadows. Willy-nilly, any interview is a story about some plans, but not always everything works out the way we would like,” - D. Ananyev.

His Promsvyaznedvizhimost Group is actively developing projects related to residential and commercial real estate. He also owns 15 agricultural farms around the capital and 60 hectares of land, primarily in the Moscow region.

It is still unknown how the story of Alexey Ananyev will end, connected with the opening of a number of criminal cases during the rehabilitation of PSB Bank. After all, the accusations against the management, including the Ananyev brothers, are serious: from conducting “dubious” transactions and financing their own subordinated obligations without being reflected in the statements, to the destruction of credit files of corporate borrowers totaling 109.1 billion rubles and manipulations related to sale of shares and disposal of assets.

Ananyev’s urgent departure to London after the announcement of the bank’s reorganization could be qualified as an “escape” of the Chairman of the Board of Directors of PSB from responsibility. But in mid-January 2018, Alexey Nikolaevich returned to the capital, as a new problem surfaced - the regulator’s requirement to reduce the share in the ownership of Bank Vozrozhdenie to 10% within 90 days.

Whether Ananyev’s career as a banker will end on this sad note and how the current problems will affect his financial condition, time will tell. Perhaps new pages will appear in the short biography of Alexey Ananyev, completely unrelated to banking activities. After all, he has excellent experience in various fields.

Rice. 2. Ananyev Sr. is known as a collector of socialist realism paintings.

Source: Forbes

But will the billionaire have enough money for new ideas? According to Forbes, his fortune at the end of 2017 was estimated at $1,400 million, but the lion’s share of this capital was the share in PSB, which depreciated after the Central Bank’s decision on January 12, 2018 reducing the bank's capital to 1 rub.

Changes in the banker's condition over time are clearly displayed on the graph.

Where it all began

Alexey Ananyev cannot boast of influential connections, “blue blood” or inherited business acumen.

Friendship with his brother Dmitry, moral values and determination - these are the factors that led the boy, who was born in Moscow in August 1964 in a simple working-class family, to a billion-dollar fortune.

“Common moral values allow us to put fraternal relations above business,” A. Ananyev.

It was with his brother that Alexey created his first company, Technoserv A/S, in the early 90s, where he himself took the position of director, and his brother became his deputy.

Before this event, the future banker managed to try his hand as a translator from Portuguese in the USSR Youth Organization Committee. He came here after graduating with honors from the Institute of Foreign Languages. Maurice Thorez.

Reference! Ananyev entered a prestigious university under a quota for children of workers.

In parallel with his work as a translator, Alexey worked until 1992 as deputy general director of the Soviet-Danish joint venture Technoserv.

It was perhaps here that he learned about the market for used computers. But he began to supply them already, being the owner of the Technoserv A/S company.

Rice. 3. Founder of the company Technoserv A/S.

Source: rbc.ru

Information about the sources of initial capital required for the purchase of foreign equipment is not disclosed. But the idea turned out to be successful and profitable. Supercomputers of the early 90s in the USSR were outdated ES computers that occupied up to 1,000 square meters. m.

Undoubtedly, Western analogues - mainframes, which companies got rid of after five years of operation as obsolete, were the ultimate dream for Soviet enterprises. Ananyev recognized this niche in time, although his competitors perceived the idea as wild.

He began purchasing used cars abroad and supplying them to Soviet enterprises. The Ananyev company equipped AvtoVAZ, the Izhmash plant, NPO Mashinostroenie, TAPO im. Chkalov, AK im. Ilyushin.

Rice. 4. Alexey Ananyev, Chairman of the Board of TechnoServ A/S and Leonid Vinokurov, Deputy Chairman of the Board of the company, 2004.

Source: m.sotovik.ru

The company developed rapidly:

- 1993 - installation of a mainframe in the main computer control center of Russian railways. From this moment on, the Ministry of Railways, and later Russian Railways, will become the company's largest customer.

- 1994 - turnover reached $10 million.

- 1995 - enter into a direct contract with IBM for the supply of new mainframes.

It was at this time that the brothers came up with the idea of creating their own financial organization. But even after the opening of Promsvyazbank, the IT direction of Ananyev’s business did not stop developing, and the prefix “A/S” was excluded from the original name of the company.

Today the Technoserv company is one of the largest system integrators.

Rice. 5. A. Ananyev and V. Yakushev - governor of the Tyumen region. after signing a memorandum of cooperation.

Source: website t-l.ru

The company has major development and implementation projects in its portfolio:

- Photo image analysis systems for Sberbank of Russia.

- Backup data center for Aeroflot.

- Data processing center for JSC "Tander" ().

- Videoconferencing networks for the Supreme Court of the Russian Federation.

- Wireless indoor network coverage (Beeline brand) at Domodedovo Airport.

- IT infrastructure of RIA Novosti for the Olympic Games in Sochi and much more.

Presentation video about the Technoserv company:

"Promsvyazbank"

The need to create your own bank was dictated by life itself. Against the backdrop of a rapidly increasing volume of orders, the need for the provision of factoring services has arisen. In addition, it was by this time that Ananyev had developed a good partnership with the MMT company (Moscow Intercity and International Telephone) - Technoserv automated the accounting of subscriber debt.

Boris Zverev, the general director of MMT, suggested that the Ananyev brothers organize a company to deal with debts. It was this company that co-founded a new financial organization - Promsvyazbank, which opened in 1995 in Moscow. Initially, MMT owned 35% of the shares, the rest were divided equally between Alexey and Dmitry.

In the future, the share of the telecommunications company will decrease to 0.2% due to the infusion of funds into the bank by the Ananyevs themselves and new investors.

The bank developed rapidly. In 1998, it entered the TOP-100 in terms of assets, and by 2005 it was already in the TOP-15.