Writing off expired goods is more typical for companies involved in the trade of perishable goods (for example, food). However, it may be necessary to write off goods that have become unusable in other areas of trading activity. This material will tell you about the features of such a write-off.

IMPORTANT! If the goods are not returned to the supplier, then they will require a conclusion from the relevant state supervision authority (sanitary, veterinary, merchandising, etc.) on what should be done with these goods. It is allowed to destroy without expert assessment:

- food products that have obvious signs of spoilage and may be dangerous when consumed;

- goods whose owner cannot confirm their exact origin.

What is the procedure for writing off commodity losses, see.

The write-off procedure is determined by the company's management. Internal company regulations should establish:

- the procedure for identifying and withdrawing from sale expired goods;

- the procedure for sending them for recycling or destruction;

- the procedure for documenting the entire process.

As a general rule, the identification of goods unfit for sale is activated. The act indicates: names of goods (according to accounting nomenclature), quantity, location at the time of expiration. A separate section of the act must indicate the further fate of expired goods - disposal, destruction or return to the supplier.

The unified album of primary forms (approved by Goskomstat on December 25, 1998) for such purposes proposes the TORG-15 form for recording the fact of damage and TORG-16 for recording withdrawal from circulation and the decision on destruction or disposal.

Look for forms and samples of filling out forms for write-off in the articles:

- “Unified form No. TORG-15 - form and sample” ;

- “Unified form No. TORG-16 - form and sample” .

In this case, the business entity is allowed to develop forms for writing off inventory items independently, taking into account the requirements for the preparation of primary documents, which are specified in Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

The transfer of goods for disposal to a specialized company is formalized in the same way as sales (invoice, UTD, etc.).

To better understand the principle of using a particular account, it is best to consider situations using an example.

Example

On March 31, 2019, we carried out an inventory at the central warehouse of the supermarket chain. Based on the results of the inventory, the following was revealed:

- a batch of rice cereal with an expiration date until 03/20/2019 worth 12,000 rubles;

- a batch of buckwheat with an expiration date until 04/05/2019 worth 16,000 rubles.

- Based on the expiration dates, it was decided to withdraw both batches from sale.

An entry was made in the accounting: Dt 41 / Expired goods (hereinafter referred to as ISG Goods) Kt 41 / Goods for sale

- Both goods had no external signs of damage. Therefore, samples of both cereals were sent for examination.

Expenses for expert analysis (1,770 rubles including VAT) and the cost of transferred samples were reflected in accounting:

Dt 91 Kt 76 — 1,500 rub. — examination;

Dt 19 Kt 76 - 270 rub. — VAT on examination services;

Dt 91 Kt 41 / ISG products - 100 rub. — cost of samples (a sample was taken from each product costing 50 rubles, 2 × 50 = 100).

- Based on the results of the examination, buckwheat groats were allowed to be disposed of, while rice groats were ordered to be destroyed.

3.1. A third-party organization was hired to destroy the rice grains, and they billed RUB 2,360 for their services. (including 360 rubles VAT). The accountant recorded the following entries:

Dt 94 Kt 41 / ISG products - 11,950 rub. (12,000 - 50);

Dt 91 Kt 94 — 11,950 rub. — the cost of destroyed goods is written off;

Dt 91 Kt 76 — 2,000 rub. — expenses for the services of a third-party destruction organization are taken into account;

Dt 19 Kt 76 — 360 rub. — VAT on services provided by a third party.

3.2. Buckwheat was sold to an animal shelter for 8,000 rubles. The following entries were made in accounting:

Dt 62 Kt 90 - 8,000 rub. — revenue from sales accrued;

Dt 90 Kt 68 / VAT - 1,220 rub. — VAT on sales;

Dt 90 Kt 41 / ISG products - RUB 15,950. (16,000 - 50).

Tax nuances of writing off goods

Subp. 49 clause 1 art. 264 of the Tax Code of the Russian Federation provides for the inclusion in expenses for calculating income tax of other expenses related to production and sales. Expenses must meet the criterion of economic justification in accordance with Art. 252, 265 Tax Code of the Russian Federation.

If identifying, removing from circulation, recycling or destroying expired goods is a legal responsibility of the seller, the results of these operations may reduce the tax base for income taxes. These conclusions are also confirmed by letters from the Ministry of Finance, for example letter dated May 26, 2016 No. 03-03-06/1/30409.

see also “[INCOME TAX]: Redemption and disposal of overdue funds is an expense. But there is a condition..." .

This also implies the possibility of deducting VAT paid for services related to the examination, recycling or destruction of expired goods.

IMPORTANT! Accounting for expenses on written-off goods is possible only with correct documentation of each stage, from identification to write-off.

Results

The procedure for writing off expired goods has its own nuances in terms of documentation, the need for an examination and accounting for expenses (losses) from write-off for tax purposes.

Any write-off of property as a result of events beyond the control of the organization (for example, due to damage, battle, theft, natural disaster, etc.) must be documented. The write-off of damaged goods is documented in an act, for example, in the TORG-15 or TORG-16 form.

Accounting: procedure for writing off goods

The procedure for writing off the subject goods will depend on the reasons as a result of which it was damaged or became unsuitable for use. However, in any case, the cost of products is reflected as a shortage in the debit of account 94 “Shortages and losses from damage to valuables” (Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n). If it is determined that storage conditions have been violated, its damage shall be attributed to the person at fault. In such a situation, the amount of the deficiency in the part reimbursed by the employee is written off to account 73-2 “Calculations for compensation of material damage.” If a product has become unsuitable for use as a result of its expiration date, then its price is written off as expenses in the debit of account 91-2 “Other expenses”. The accounting records of a trading company will look like this:

Debit 94 Credit 41

- the cost of damaged (overdue) goods is written off;

Debit 73-2 Credit 94

- the cost of the damaged goods is written off at the expense of the guilty parties;

Debit 50 (51) Credit 73-2

- the cost of the damaged goods was recovered from the guilty parties;

Debit 91-2 Credit 94

- the cost of expired goods is written off;

Debit 44 Credit 94

- the cost of damaged goods is written off within the limits of natural loss.

Tax accounting: calculation of income tax

EXAMPLE. WRITTEN OFF DAMAGED GOODS IN THE ABSENCE OF GUILTY PERSONS

The store transfers a unit of goods to the sales area for display decoration. The product was purchased at a price of RUB 3,540. (including VAT 540 rub.). After some time, the goods are considered completely damaged and written off. There are no employees at fault. In the company's accounting, transactions should be reflected as follows.

When purchasing a product:

Debit 41 Credit 60

- 3000 rub. – goods have been received (3540 – 540) (supplier’s shipping documents, goods acceptance certificate);

Debit 19 Credit 60

- 540 rub. – reflects the amount of VAT presented (invoice);

Debit 68/VAT Credit 19

- 540 rub. – the submitted VAT (invoice) has been accepted for deduction;

Debit 60 Credit 51

- 3540 rub. – payment has been made to the supplier (bank account statement).

If a damaged product is identified:

Debit 94 Credit 41

- 3000 rub. – the cost of damaged goods is written off (act of damage, damage, scrap goods and materials);

Debit 44 Credit 94

- 3000 rub. – the amount of determined losses is included in the cost of sales (accounting statement).

By mutual agreement

Emma Yagudina, leading auditor at CityAudit, says:

“Most often, the write-off of damaged goods occurs after inventory or unplanned audits. This is especially true for large retail outlets and chain hypermarkets. The volume of goods on them is simply enormous, and it is impossible to monitor its integrity. Some employers apply punitive measures to financially responsible persons, “blaming” them for shortages, damage and scrap of products and thereby covering losses. Is it always possible to find the culprit? Of course not. This is where so-called collective responsibility comes into play. In fact, the company's losses are covered by workers' wages. There are often cases when an employee was not even present when property was damaged, but due to the team agreement, the shortfall will be deducted from his salary.

Organizations that sell food products, whether catering or retail, quite often face the fact of damage to their goods. Firstly, products have a certain, often short, shelf life, and secondly, they require special storage conditions, which cannot always be observed. The legislation of the Russian Federation prohibits the sale of spoiled food products, which means they must be disposed of. Many of the above companies use the simplified tax system. How such an organization can properly remove illiquid goods from the shelves will be discussed in our article.

For trade and catering organizations, damaged goods are a common occurrence. Its deterioration can be due to various reasons, one of which is violation of storage conditions.

We process damaged goods

So, if a product accepted for accounting with an unexpired shelf life has deteriorated as a result of improper storage, then this fact must be confirmed by conducting an inventory. This rule applies to absolutely all organizations, regardless of the chosen taxation system.

During the inventory, inventory items are necessarily recalculated, reweighed or remeasured, that is, their actual availability is checked. The received data is documented in an inventory list (form N INV-3).

Next, based on the accounting data and inventory list, a matching statement is drawn up (form N INV-19), which reflects the identified discrepancies. Simultaneously with the above documents, an act of damage (form N TORG-15) and an act of write-off of goods (form N TORG-16) are drawn up for the cost of spoiled food products.

Let us remind you that currently the use of these primary accounting documents is advisory in nature. The organization has the right to use independently developed document forms, provided that they contain details that are required to be filled out (clause 2 of article 9 of the Federal Law of December 6, 2011 N 402-FZ).

We reflect damage to goods in accounting

Please note that the list of expenses taken into account when calculating the single tax according to the simplified tax system is closed. In the Tax Code of the Russian Federation, costs in the form of the cost of damaged goods are not indicated, and, therefore, the costs of its acquisition are not included in the single tax base. Financial departments also share a similar opinion (for example, Letter of the Ministry of Finance of Russia dated May 12, 2014 N 03-11-06/2/22114). However, tax legislation does not prohibit “simplers” from including damaged goods in expenses within the limits of natural loss norms approved in the prescribed manner (clause 5, clause 1, article 346.16, subclause 2, clause 7, article 254 of the Tax Code of the Russian Federation).

Natural loss norms are used to determine the maximum amount of irrecoverable losses from shortages (damage) of inventories. This takes into account the technological conditions of transportation and storage of metallurgical products, as well as climatic and seasonal factors affecting natural loss. These standards are developed by ministries and departments of the relevant sectors of the economy and are subject to revision as necessary, but at least once every five years (Resolution of the Government of the Russian Federation of November 12, 2002 N 814).

For food products, the norms of natural loss were approved by Order of the Ministry of Industry and Trade of Russia dated 03/01/2013 N 252. To calculate commodity losses due to natural loss, you can use the following formula (Methodological recommendations, approved by the Letter of the RF Committee on Trade dated 07/10/1996 N 1-794/32- 5, Letter of the Ministry of Trade of the RSFSR dated May 21, 1987 N 085):

E = T x H: 100,

where T is the cost (weight) of the goods sold;

N - rate of natural loss, %.

Since it is impossible to write off goods within the specified standards without conducting an inventory, when calculating losses, it is advisable to take the cost of goods sold for the inter-inventory period. Please note that if the product item is not indicated in Order of the Ministry of Industry and Trade of Russia dated March 1, 2013 N 252, then damaged goods cannot be taken into account within the limits of natural loss. In this case, the cost of the illiquid property is recovered from the guilty parties, if any, or written off at the expense of the organization.

The perpetrators have not been identified

If the fact of damage to the goods is established, but the culprit is not, then losses in excess of loss norms are taken into account as expenses that do not reduce the taxable base for the single tax.

Example 1. Voskhod LLC provides catering services and applies the simplified tax system with the object of taxation “income minus expenses”. On June 1 of this year, the organization purchased 30 kg of cauliflower. On June 15, the product was found to be damaged. However, the perpetrators were not identified. The inventory commission found that 6 kg of cabbage were spoiled and should be written off. The cost of one kg of cabbage is 150 rubles. During the inter-inventory period, 20 kg of product were released. The natural kill rate for cauliflower stored in the warehouses of catering enterprises is 1.2% in the summer.

The following entries must be made in the accounting records of the organization:

Debit 94 Credit 10

- 900 rub. (RUB 150 x 6 kg) - the cost of spoiled cauliflower has been written off;

Debit 20 Credit 94

- 36 rub. (150 rub. x 20 kg x 1.2: 100) - the cost of cauliflower was written off within the limits of natural loss;

Debit 91 Credit 94

- 864 rub. (900 rubles - 36 rubles) - the cost of spoiled cabbage was written off in excess of the norms of natural loss.

Since the perpetrators were not identified, the cost exceeding the norm was 864 rubles. included in non-operating expenses. And losses within the limits of natural loss (36 rubles) should be reflected in the book of income and expenses for the second quarter.

The goods are damaged due to the fault of the financially responsible person

If the goods are damaged due to the fault of a financially responsible person, then the amount of compensation for damage is reflected in non-operating income (clause 3 of Article 250 of the Tax Code of the Russian Federation). The amount of damage to goods within the limits of natural loss norms is attributed to production or distribution costs, and the amount in excess of the norms is attributed to the guilty parties.

Example 2. LLC "Imbir" is engaged in the retail trade of vegetables and fruits in Moscow and applies the simplified tax system with the object of taxation "income minus expenses." On June 1 of this year, the organization purchased 50 kg of cauliflower. On June 15, product damage was discovered due to violation of storage conditions. The culprit has been identified - storekeeper E.A. Morozov. According to the inventory commission, 10 kg of product were damaged and must be written off. During the inter-inventory period, 30 kg of product were sold. The cost of 1 kg of cabbage is 100 rubles, the product was stored in an unrefrigerated warehouse. Moscow is located in the second climate zone. The store is not a supermarket and is not suitable for long-term storage of goods. The rate of natural loss for cauliflower during short-term storage is 2.1% in summer.

Debit 94 Credit 41

- 1000 rub. (RUB 100 x 10 kg) - the cost of spoiled cauliflower has been written off;

Debit 44 Credit 94

- 63 rub. (100 rubles x 30 kg x 2.1: 100) - the cost of cauliflower was written off within the limits of natural loss;

Debit 73 Credit 94

- 937 rub. (1000 rubles - 63 rubles) - the amount of losses exceeding the norm is attributed to the perpetrators;

Debit 50 Credit 73

- 937 rub. - the guilty person (storekeeper Morozov E.A.) deposited funds into the cash register.

The amount of compensated damage (937 rubles) is included in taxable income on the date of actual receipt of money at the organization’s cash desk or to its current account (clause 1 of article 346.15 and clause 3 of article 250 of the Tax Code of the Russian Federation, Letter of the Ministry of Finance of Russia dated 02/27/2013 N 03-11-06/2/5588).

We discount the goods

However, a situation may arise when the product has not yet deteriorated, but has already lost its original qualities. Such a product can still be sold by first discounting it. In this case, it is also necessary to make an inventory and draw up an act for the revaluation of goods (according to form N TORG-15 or according to a form developed by the organization).

Example 3. LLC "Ginger" is engaged in the retail trade of vegetables and fruits and applies the simplified tax system with the object of taxation "income - expenses". In July of this year, the organization purchased 100 kg of raspberries, the actual cost of which was 150 rubles. for 1 kg. The selling price of 1 kg of product was 200 rubles. Due to hot weather, the marketability of the berries deteriorated, but the culprits were not identified. In this regard, the organization made a markdown for the entire amount of the trade margin. After the price was reduced, all raspberries were sold.

For the discounted goods, an act of revaluation of goods was drawn up in form N TORG-15.

Based on the receipt documents and the act of revaluation of goods, the accountant needs to make the following entries:

Debit 41 Credit 60

- 15,000 rub. (150 rub. x 100 kg) - the actual cost of raspberries is reflected;

Debit 41 Credit 42

- 5000 rub. ((200 rub. - 150 rub.) x 100 kg) - the amount of the trade margin is reflected;

Debit 41 Credit 42

- 5000 rub. - the trade margin attributable to discounted goods was reversed;

Debit 62 Credit 90

- 15,000 rub. - revenue from retail sales of raspberries is reflected;

Debit 90 Credit 41

- 15,000 rub. - the sales value of sold raspberries is written off.

Any organization acquires materials for the company’s activities not for their own sake. And the purchased valuables will not lie dead weight in the warehouse for the director to admire. They are intended for use in production, sales or administrative purposes. Therefore, purchased materials are subsequently consumed in production.

However, in the warehouse the storekeeper or warehouse manager is responsible for them, and the materials are taken into account on account 10. When the materials leave the warehouse, the situation will change: the account and the person in charge will change. In this article we will analyze the write-off of materials with step-by-step instructions for this procedure for you.

1. Accounting entries for writing off materials

2. Registration of write-off of materials

3. Write-off of materials - step-by-step instructions if not everything is consumed

4. Standards for writing off materials for production

5. Example of a write-off act

6. Methods for writing off materials for production

7. Option No. 1 – average cost

8. Option No. 2 – FIFO method

9. Option No. 3 – at the cost of each unit

So, let's go in order. If you don't have time to read a long article, watch the short video below, from which you will learn all the most important things about the topic of the article.

(if the video is not clear, there is a gear at the bottom of the video, click it and select 720p Quality)

We will look at write-offs of materials in more detail than in the video later in the article.

1. Accounting entries for writing off materials

So, let's start by determining where the purchased materials can be sent. It should be noted that materials are truly ubiquitous and there are ways to, as they say, “plug a hole” in any problem area of the organization:

- - serve as the basis for the production of products

- - be an auxiliary consumable material in the production process

- — perform the function of packaging finished products

- - used for the needs of the administration in the management process

- — assist in the liquidation of decommissioned fixed assets

- - used for the construction of new fixed assets, etc.

And the accounting entries for writing off materials depend on what materials are released from the warehouse for:

Debit 20"Primary production" - Credit 10– raw materials were released for production

Debit 23"Auxiliary production" - Credit 10– materials were sent to the repair shop

Debit 25"General production expenses" - Credit 10– rags and gloves were provided to the cleaning lady servicing the workshop

Debit 26"General running costs" - Credit 10– paper for office equipment was issued to the accountant

Debit 44"Sales expenses" – Credit 10– containers for packaging finished products were issued

Debit 91-2"Other expenses" - Credit 10– materials were released for the liquidation of fixed assets

It is also possible for a situation where it is discovered that the materials listed in the accounts are actually missing. Those. there is a shortage. For such a case, there is also an accounting entry:

Debit 94“Shortages and losses from damage to valuables” – Credit 10– missing materials written off

2. Registration of write-off of materials

Any business transaction is accompanied by the preparation of a primary accounting document, and write-off of materials is no exception. The step-by-step instructions in the next paragraph contain the study of the primary documents that accompany the write-off process.

Currently, any commercial organization has the right to independently determine the set of documents that will be used to formalize the write-off of materials, so the registration of write-off of materials may vary from organization to organization.

The main thing is that the documents used are approved as part of the accounting policy and contain all the mandatory details provided for in Article 9 of Law No. 402-FZ “On Accounting”.

Standard forms that can be used when writing off materials (approved by Resolution of the State Statistics Committee of October 30, 1997 No. 71a):

- — demand-invoice (Form No. M-11) is applied if the organization has no limits on receiving materials

- — limit-fence card (Form No. M-8) is applied if the organization has established limits on the write-off of materials

- — invoice for the issue of materials to the side (Form No. M-15) is applied to another separate division of the organization.

The organization can modify these forms - remove unnecessary details and add details that the organization needs.

The invoice requirement is suitable for accounting for the movement of material assets within an organization, between financially responsible persons or structural divisions.

The invoice in two copies is drawn up by the financially responsible person of the structural unit handing over material assets. One copy serves as the basis for the handing over unit to write off valuables, and the second copy serves as the basis for the receiving unit for the receipt of valuables.

3. Write-off of materials step-by-step instructions if not everything is consumed

Usually, when preparing these documents, it is assumed that the released materials were immediately used for their intended purpose, which means they are accompanied by the postings that we discussed above - for credit 10 of the account and debit 20, 25, 26, etc.

But this does not always happen, especially in large production. Materials transferred to the work site or workshop may not be immediately used in production. In fact, they simply “move” from one storage location to another. In addition, when dispensing materials, it is not always known what type of product they are intended for.

Therefore, those materials that are released from the warehouse but not consumed should not be taken into account as expenses of the current month, neither in accounting nor in tax accounting for income tax. What to do in this case, how to write off materials, step by step instructions below.

In such situations, the release of materials from the warehouse to the production department should be reflected as an internal movement, using a separate subaccount to account 10, for example, “Materials in the workshop.” And at the end of the month, another document is drawn up - a materials consumption act, where the direction of materials consumption will already be visible. And at this moment the materials will be written off.

Such tracking of material consumption will allow you to achieve greater reliability in accounting and correctly calculate income tax.

Please note that this applies not only to materials that go into production, but also to any property, including stationery used for administrative needs. Materials should not be issued “in reserve”. They must be used immediately. Therefore, a one-time operation to write off 10 calculators for an accounting department of 2 people, during an audit, will certainly raise questions as to what purpose they were required in such quantities.

4. Example of a write-off act

- - or you issue and immediately write off only what is actually consumed (in this case, the requirement of an invoice is quite sufficient)

- - or you draw up an act for writing off materials (transmitting a demand invoice, and then gradually writing off acts for writing off).

If you use write-off acts, do not forget to also approve their form as part of the accounting policy.

The act usually indicates the name, and, if necessary, the item number, quantity, accounting price and amount for each item, number (code) and (or) name of the order (product, product) for the manufacture of which they were used, or number (code) and (or) the name of the costs, the quantity and amount according to consumption standards, the quantity and amount of consumption in excess of the standards and their reasons.

An example of what such an act might look like is in the picture below. I repeat, this is just an example; the type of act will very much depend on the specifics of the enterprise. Here, as a basis, I took the form of the act that is used in budgetary institutions.

5. Standards for writing off materials for production

Accounting legislation does not establish standards in accordance with which materials should be written off for production. But paragraph 92 of the Methodological Guidelines for the accounting of MPZ (Order of the Ministry of Finance dated December 28, 2001 No. 119n) states that materials are released into production in accordance with established standards and the volume of the production program. Those. the amount of materials written off should not be uncontrolled and the standards for writing off materials into production should be approved.

In addition, for tax accounting it would be useful to remember Article 252 of the Tax Code: expenses are economically justified and documented.

The organization sets its own standards for materials consumption (limits). . They can be fixed in estimates, technological maps and other similar internal documents. Documents of this kind are not developed by the accounting department, but by the unit that controls the technological process (technologists), and then they are approved by the manager.

Materials are written off for production in accordance with approved standards. You can write off materials in excess of the norm, but in each such case you need to explain the reason for the excess write-off. For example, correction of defects or technological losses.

The release of materials in excess of the limit is carried out only with the permission of the manager or his authorized persons. On the primary accounting document - the demand invoice, the act - there must be a note about the excess write-off and its reasons. Otherwise, the write-off is illegal and leads to a distortion of the cost and accounting and tax reporting.

On the topic of expenses in the form of technological losses, you can read: Resolution of the Federal Antimonopoly Service of the North Caucasus District dated 02/04/2011. No. A63-3976/2010, letters from the Ministry of Finance of Russia dated July 5, 2013. No. 03-03-05/26008, dated January 31, 2011. No. 03-03-06/1/39, dated 10/01/2009 No. 03-03-06/1/634.

6. Methods for writing off materials for production

So, now we know what documents we need to write off materials, and we also know the accounts to which they are debited. From the documents we know how much materials were written off. Now all that’s left to do is determine the cost of their write-off. How can we determine how much the materials sold cost, and what amount will be the write-off entry? Let's look at a simple example, based on which we will study the methods of writing off materials for production.

Example

Sladkoezhka LLC produces chocolate candies. Cardboard boxes are purchased for their packaging. Let 100 such boxes be purchased at a price of 10 rubles. a piece. A packer comes to the warehouse to pick up boxes and asks the storekeeper to give him 70 boxes.

So far we have no question about how much each box costs. The packer receives 60 boxes for 10 rubles, for a total of 600 rubles.

Even if 80 boxes were purchased, but the price is already 12 rubles. a piece. The same boxes. Of course, the storekeeper doesn't keep the old and new boxes separate, they are all kept together. The packer came again and wants more boxes - 70 pieces. The question is: at what price will the boxes sold for the second time be valued? It is not written on each box exactly how much it cost - 10 or 12 rubles.

Different answers can be given to this question, depending on which method of writing off materials for production is approved in the accounting policy of Sladkoezhka LLC.

7. Option No. 1 – average cost

After the packer left the warehouse with the boxes for the first time, there were 40 boxes left for 10 rubles each. – this will be, as they say, the first game. Another 80 boxes were purchased for 12 rubles. - This is already the second batch.

Let's count the results: we now have 120 boxes for a total amount of: 40 * 10 + 80 * 12 = 1360 rubles. Let’s calculate how much a box costs on average:

1360 rub. / 120 boxes = 11.33 rub.

Therefore, when the packer comes for the second time for boxes, we will give him 70 boxes for 11.33 rubles, i.e.

70*11.33=793.10 rub.

And we will have 50 boxes left in the warehouse worth 566.90 rubles.

This method is called average cost (we found the average cost of one box). As new batches of boxes continue to arrive, we will again calculate the average and issue boxes again, but at a new average price.

8. Option No. 2 – FIFO method

So, by the time of the packer’s second visit, we have 2 batches in our warehouse:

No. 1 - 40 boxes for 10 rubles. – according to the time of acquisition, this is the first batch – the “older” one

No. 2 – 80 boxes for 12 rubles. - according to the time of acquisition, this is the second batch - more “new”

We assume that we will issue the packager:

40 boxes from the “old” one - the first batch purchased at the price of 10 rubles. – total for 40*10=400 rub.

30 boxes from the “new” one - the second batch in time to purchase at a price of 12 rubles. – total for 30*12=360 rub.

In total, we will issue in the amount of 400 + 360 = 760 rubles.

There will be 50 boxes left in the warehouse at 12 rubles, for a total of 600 rubles.

This method is called FIFO - first in, first out. Those. First, we sort of release material from an older batch, and then from a new one.

9. Option No. 3 – at the cost of each unit

At the cost of a unit of inventory, i.e. Each unit of materials has its own cost. This method is not applicable for ordinary cardboard boxes. Cardboard boxes are no different from each other.

But materials and goods used by the organization in a special manner (jewelry, precious stones, etc.), or inventories that cannot normally replace each other, can be valued at the cost of each unit of such inventories. Those. If all our boxes were different, we would put a different tag on each one, then each of them would have its own cost.

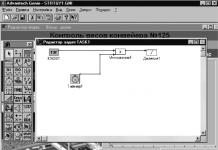

Here are the most important questions on the topic of writing off materials: step-by-step instructions are now before your eyes. For those who keep records in the 1C: Accounting program, watch a video tutorial on writing off materials in this program.

What problematic issues do you have regarding the write-off of materials? Ask them in the comments!

You can also, which were mentioned in the article, on the issue of technological losses.

Write-off of materials step-by-step instructions for accounting

If there is a shortage of goods, you have to write them off as losses or look for those responsible. Only an inventory can confirm the fact of theft or damage (for example, with an expired shelf life). For some categories of goods, there are norms of natural loss, within which the missing inventory items in tax accounting can be written off as company expenses.

- Debit Credit 41.

If the shortage concerns a category of retail goods, then their markup must also be written off. To do this, the posting is reversed:

- Debit () Credit 42.

Write-off according to the norms of natural loss is documented by the following entries:

- Debit 96 Credit - if the organization has a reserve for writing off losses.

- Debit 44 Credit – writing off the shortfall in the absence of a reserve.

If the perpetrators are identified

An appropriate agreement is concluded with the employee who is responsible for the safety of inventory items. If a shortage is detected, the amount of material damage is determined in fact, at current market prices.

To reflect recovery in case of a shortage exceeding the rate of natural loss in accounting, the following entries are used:

- Debit 73 Credit – reflection of the shortage in the employee’s account.

- Debit 73 Credit 98 - reflects the difference between the amount collected from the employee and the accounting price of the shortage.

- Debit Credit 73 - deduction of shortfall from salary

- Debit 98 Credit 91-1 - write-off of the amount collected from the employee for the shortage.

If the perpetrators are not identified

If it is not possible to identify the culprit, then the shortage is written off within the limits of natural loss as expenses to account 91.2. Over-limit shortages are reflected by posting:

- Debit 91.2 Credit - reflects the amount of the shortage exceeding the norms of natural loss.

In this case (if the shortage exceeds the norm), it is also necessary to restore the input VAT previously accepted for deduction: Debit Credit 68 VAT.

Posting example

After taking inventory, theft of 10 kg was discovered in the organization. butter (natural loss rate 500 grams) with an accounting value of 6,400 rubles. (market value 8,100 rubles) The shortfall was withheld from the seller for 4 months.

| Account Dt | Kt account | Wiring description | Transaction amount | A document base |

| Shortage written off | 6400 | Inventory act, inventory list | ||

| 44 | The shortage was written off according to the norms of natural loss | 320 | Accounting information | |

| 73 | The shortage is attributed to the seller | 6080 | Manager's orderAccounting certificate | |

| 73 | 98 | Difference between holding price and discount price | 1615 | Accounting information |

| 73 | ¼ of the shortfall was withheld from the salary | 1520 | Payroll T-49 | |

| 98 | 91.1 | The difference between the book price and the market price after collection is included in other income | 403,75 | Accounting information |