GKO

STATE TREASURY OBLIGATIONS; GKO(full title

- government short-term zero-coupon bonds) - uncertificated government securities issued on the basis of Decree of the Government of the Russian Federation dated February 8, 1993 No. 107 “On the issue of government short-term zero-coupon bonds.” The issuer of GKOs was the Ministry of Finance. The decision to issue GKOs was made by the Ministry of Finance in agreement with the Central Bank. The sales of GKOs to their first owners took place at a discount from their nominal value (discount). The nominal value of GKOs is 1 million rubles. Redemption of GKOs was carried out in non-cash form by transferring to their owners the nominal value of GKOs at the time of redemption. Income on GKOs was considered the difference between the sale price of GKOs by its owner to a third party (as well as the redemption price) and the purchase price of GKOs by the first owner. The Central Bank is the general agent for servicing the issue of GKOs. It regulated, in agreement with the Ministry of Finance, the issues of placement and circulation of state bonds. All placement and circulation operations, including settlements and accounting of GKO owners, were carried out through Central Bank institutions or authorized organizations (hereinafter referred to as dealers) determined by the Central Bank. Each issue of GKOs was issued with a global certificate stored in the Central Bank. Owners of GKOs can be legal entities and individuals. Based on the instructions of the Central Bank dated August 17, 1998. No. 31 b/1-y operations with GKOs were suspended. In accordance with Decree of the President of the Russian Federation dated August 25, 1998 No. 988 “On some measures to stabilize the financial system of the Russian Federation” and Decree of the Government of the Russian Federation dated August 25, 1998 No. 1007 “On the redemption of government short-term zero-coupon bonds and federal loan bonds with a constant and variable coupon income with maturities until December 31, 1999 and issued before August 17, 1998." The Ministry of Finance and the Central Bank developed a program for refinancing state bonds and federal loan bonds. Instructions for repayment were sent to authorized dealers of the Central Bank. Belov V.A.

Encyclopedia of Lawyer. 2005 .

Synonyms:See what "GKO" is in other dictionaries:

GKO- state regulatory body; state and regulatory body Source: http://www.mtk.bishkek.gov.kg/E Gov%20%2008.07.2003%20UNDP.htm GKO clay acid treatment GKO state short-term government bonds... ... Dictionary of abbreviations and abbreviations

- (GOKO), see State Defense Committee. * * * GKO GKO (GOKO), see State Defense Committee (see STATE DEFENSE COMMITTEE) ... encyclopedic Dictionary

See Government bonds short-term zero coupon Dictionary of business terms. Akademik.ru. 2001 ... Dictionary of business terms

- (GOKO) see State Defense Committee... Big Encyclopedic Dictionary

- (GOKO), see STATE DEFENSE COMMITTEE. Source: Encyclopedia Fatherland ... Russian history

Noun, number of synonyms: 2 bond (14) obligation (25) ASIS Dictionary of Synonyms. V.N. Trishin. 2013… Synonym dictionary

GKO- [geka o], uncl., female (abbr.: government short-term bond) and cf. (abbr.: state treasury obligation) ... Russian spelling dictionary

GKO- Government short-term bonds. Pronounced [ge ka o]... Dictionary of difficulties of pronunciation and stress in modern Russian language

GKO- [ge ka o], unchanged, m. State Defense Committee (1941-1945). ◘ State Defense Committee is an extraordinary highest state body. BES, 329. Members of the military councils were connected with the Central Committee of the party, with the State Defense Committee, and carried out their directives. IKPSS, 482. Cf. GOKO... Explanatory dictionary of the language of the Council of Deputies

An ambiguous term State Defense Committee: State Defense Committee (USSR) State Defense Committee of the People's Republic of China State Defense Committee (DPRK) State Defense Committee (CRI) State securities: ... ... Wikipedia

Books

- State Defense Committee of the USSR. Regulations and activities. 1941-1945 Annotated catalogue. In 2 volumes. Volume 2. 1944-1945, . For the first time, the Russian State Archive of Socio-Political History is undertaking a comprehensive publication reflecting the activities of the State Defense Committee as the highest body of military-political power in the years...

Content

The stable financial condition of the country is the key to the well-being of the population, which is why the government seeks to control it, including through the issuance of government bonds. Government loan bonds (OFZ) are a means of covering the budget deficit through the issuance of federal securities. Roughly speaking, the state borrows money from citizens at a certain interest rate. Over the past few years, budget revenues have decreased (mainly due to a sharp drop in oil prices) and the issue of government loans has become relevant again.

What are government bonds

Government bonds are a collateral instrument that the government of a country issues to attract funds from the public. An individual who purchased an OFZ will be an investor in relation to the country. The state provides guarantees for the repayment of the debt with interest. The currency of Russian securities is the Russian ruble. At the moment, a government loan bond is considered a way to invest free funds with low risks. There are municipal government papers that are issued by local city authorities.

Federal loan bonds

The Russian Ministry of Finance is again issuing federal loan bonds, that is, securities, the placement of which will replenish the budget. On April 26, 2019, the sale of federal loan bonds for individuals begins. The maximum validity period of OFZ is three years. The total cost will be 15 billion rubles, one government bond will cost 1,000 rubles. The minimum purchase quantity is 30 pieces, the maximum is 15,000 pieces.

Early repayment is possible, but unprofitable. Calculation is provided every six months. The annual income ranges from 7.5 to 10.5%. Government bonds are issued for a certain period, then the buyer receives coupons (interest payments). The state announces the amount and date of payments, which is convenient for private investors who are not too experienced in investing.

Government short-term zero-coupon bonds

The abbreviation GKO, notorious to many, is government short-term zero-coupon bonds; they were issued in 1993 and worked in our market for five years with varying success. As a result, their release led to disastrous consequences. These are registered securities issued by the state. Income was obtained from the difference between the cost of purchasing and selling GKOs. The repayment period is from three to six months. Foreign citizens had the right to purchase GKOs, which brought GKOs to the international level and led to a massive outflow of Russian capital abroad.

By 1998, profits from state bonds were so high that the state began to use them to finance the budget deficit. Everything was going great until on August 17, 1998, it was discovered that there was simply nothing to pay the profit with and the Ministry of Finance declared a default on all GKOs, which had depreciated by 70-80%. This had catastrophic consequences for the country's economy, including the collapse of the national currency; the crisis affected all Russian citizens. All subsequent GKOs were issued (until 2006) with the aim of repaying debts on previous loans.

Types of government securities

Government securities are an important part of the stock market in any country. This way you can regulate the temporarily available funds of financial institutions and individuals. Types of government securities:

- non-cash and cash;

- undocumented and documentary;

- profitable and guaranteed;

- non-market and market;

- bearer and registered.

The functions of government securities differ:

- government long-term coupon obligations;

- government short-term zero-coupon obligations;

- savings loan bonds;

- domestic foreign currency loan bonds;

- government treasury bills;

Who is the issuer

An issuer is an organization that undertakes the issue and provision of securities. In the case of a government loan, the state is used in this role. It must ensure the profitability of its securities and guarantee the rights of their holders to receive income from the return of funds upon expiration of the government loan. This is a condition for the reliability of government bonds. Now the situation in the country is much more stable than in the 90s, so investing in a government loan can be reliable.

Yield of Russian government bonds

The state announced the yield on OFZs issued in 2019 in the amount of 8.5% per annum. Compare - profit on deposits in the largest banks in Russia rarely rises above 7.5-8%. The purchase of government securities can be considered quite profitable. On the other hand, banks charge a commission of 05 to 1.5%, depending on the number of government loans purchased. So, if you pay it off in three years, your return minus fees will be 9.02%.

Is it worth buying federal loan bonds?

They say correctly: “You can’t deceive the state, rather it will deceive you.” Russians already have sad experience of how borrowing money from the population through loans was first voluntarily forced in Soviet times or outright fraudulent, as in the case of GKOs. It is logical that now there is a wary attitude towards government loans. The Ministry of Finance assures: now, when the external debts of the USSR have already been repaid, and there is a budget deficit, but not critical, it is time to invest available funds in securities, as an option.

The situation with government securities of previous years is slightly different. In terms of risks, these investments differ little from other investments on the stock exchange. Moreover, you cannot purchase old OFZs on your own; here it is better to use the services of intermediaries - traders, mutual funds. This will require additional costs, but will reduce the risk of initial investment.

Maturity

The government loan system does not provide for penalties for early repayment of money; a guarantee is given for 100% repayment of the loan, and any amount can be returned. If you want to receive interest income, do not expect to withdraw the money earlier than in a year. Otherwise, the owner of the OFZ pays a commission to the bank twice (for early repayment, a commission is also charged). But in a year, the value of your OFZs will increase by 6-8.5%, and in three – by 10.5 percent. The price of bonds is constantly changing depending on the economic situation on the Russian stock exchange.

Sale and purchase of bonds

Individuals can purchase OFZ-17 from April 26, 2019 until October 25, 2019. They will be sold in the branches of Sberbank and VTB 24. The 2019 government loan cannot be purchased on the stock exchange or through intermediaries. This is done to prevent speculation. OFZ-N (folk) cannot be accepted as collateral for lending, and donation transactions cannot be made with them. The only way to transfer securities to another person is by inheritance.

How to buy federal loan bonds for an individual

The procedure for purchasing 2019 federal loan bonds is simple: you come to a branch of Sberbank or VTB (don’t forget to first find out if OFZs are sold there). You sign an agreement and purchase. Another option is to purchase OFZ online through your personal account on bank websites. A government bond is the property of the purchaser and cannot be gifted or sold.

Where to buy bonds

It is expected that the sale of federal loan bonds will take place in large Russian banks - Sberbank and VTB24. Not every bank branch provides this service; OFZs will be sold in large branches that offer the Sberbank-Premier service. Legacy government securities are purchased on the stock exchange, in person, or through brokerage houses or mutual funds with a small commission.

How much do government bonds cost?

The face value of one government loan bond is 1 thousand rubles. This applies to both old government securities and new ones that will be issued in 2019. Moreover, a new restriction has been introduced - the minimum batch of OFZ is 30,000 rubles, the maximum is 15,000,000 rubles. Bonds issued before 2019 also have a nominal value of one thousand rubles, but are unlimited in quantity.

How much can you earn on bonds?

The new OFZ-2017 have a fixed income. The income of OFZ-17 for a period of three years is around 9% per annum, taking into account the payment of commission. Other government securities promise higher returns - long-term bonds (10-15 years) up to 14-16% per annum, short-term bonds for one to two years - up to 11% per annum. There are also higher interest rates, but as you know, the higher the profit, the greater the risk of not getting it. Management of purchased government loans is carried out either through intermediaries, or independently, subject to the creation of an electronic digital signature and your own personal account on the stock exchange.

Video: Federal government securities of the Russian Federation

Found an error in the text? Select it, press Ctrl + Enter and we will fix everything!The main types of government securities on the Russian market were government short-term zero-coupon bonds (GKOs), federal loan bonds with a variable coupon (OFZ-PK) and domestic currency loan bonds (OVVZ).

The GKO market has existed since 1993, and during this time it has become an independent segment of the stock market. GKOs were discount securities that were placed at auctions and then traded on the secondary market. The circulation of GKOs took place in the form of purchase and sale transactions through the Trading System - an organization authorized, on the basis of an agreement with the Bank of Russia, to ensure the procedure for concluding purchase and sale transactions of GKOs.

Redemption of GKOs was carried out in non-cash form by transferring to their owners the nominal value of the bonds at the time of redemption (now the nominal value of the bonds is 1000 rubles). The difference between the redemption price (par) and the purchase price at auction or secondary trading represents the investor's return.

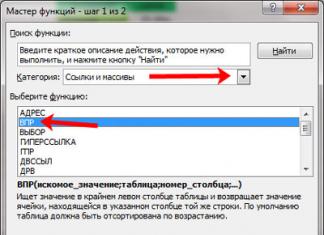

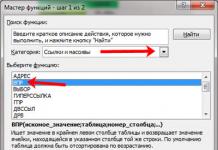

A relative indicator of the profitability of investing in GKOs was profitability, which was calculated as the ratio of the income received to the amount of invested funds, normalized to an annual period. To calculate the yield of GKOs, the following indicators were used:

1) minimum auction price (cut-off price) is the lowest price of a bond, starting from which competitive bids at the auction are satisfied;

2) weighted average price equal to the ratio of GKO turnover to the total number of bonds participating in transactions:

Where P 1- the price of the bonds involved in the transaction i-th type (for auction the value P i Not

below the cut-off price);

n j- number of bonds involved in the transaction i-th type;

To- the number of price values used in calculating the average price of GKOs.

The methodology for calculating the yield on GKOs for redemption was proposed by the Central Bank of the Russian Federation in accordance with its Letter No. 28-7-3/A-693 dated September 5, 1995, according to which:

GKO yield to maturity = ![]()

Where N - bond par value, rub.;

R - bond price, rub.;

t- term until bond maturity, days.

As a bond price R the weighted average auction price or the price of the last transaction at the auction for which the corresponding indicator was calculated could be used. Thus, this indicator characterized the effectiveness of investing in state bonds at an auction or secondary auction, taking into account the fact that the investor holds the bonds until their maturity.

For example, GKOs with a circulation period of 91 days were sold at a rate of 87.5% to par. Yield to maturity on an annualized basis in this case

![]()

If the weighted average auction price for the initial placement of GKOs was used as the price of bond P, then the yield to maturity calculated using the formula characterized the cost of borrowed funds (interest rate) at which the issuer borrows funds from investors.

In this case, during the initial placement of GKOs, the possible weighted average price is limited, on the one hand, by the maximum demand price corresponding to the minimum return on investment acceptable to investors, and on the other hand, by the minimum price that determines the maximum interest rate acceptable to the issuer.

Thus, at the auction for the placement of the second issue of three-month GKOs, the weighted average price was 76.78% of the face value. Hence the cost of borrowed funds:

In the case of the sale of GKOs at secondary auctions before their maturity date, the calculation of the yield for the auction of these bonds could be performed using the formula:

auction yield =

Where R - bond price as a percentage of par value;

R a - weighted average auction price in % of face value;

t- the number of days that have passed since the auction.

The closing price at secondary trades was used as the bond price, from which the corresponding indicator was calculated. This indicator characterized the effectiveness of a speculative operation when an investor purchased GKOs at an auction at the weighted average price and, without waiting for their redemption, sold them at secondary auctions at the closing price. So, if we assume in the previous example that an investor, having bought bonds with a circulation period of 91 days at a rate of 87.5% of par, sold them 30 days later at a rate of 95% of par, then the current yield of GKOs as a result of their sale (yield to auction) on an annual basis was:

![]()

If the weighted average price at secondary auctions is used as the price of bond P, then the yield at the auction is called the weighted average yield.

The effective return on investing in GKOs was calculated at a compound interest rate based on the assumption that bond holders can reinvest their income during the year. When calculating profitability, the following formula could be used:

Where N - bond par value;

R - weighted average auction price (or closing price);

t- number of days until maturity.

This formula more accurately reflected the effectiveness of investing in state bonds with their subsequent reinvestment throughout the year, but only under stable market conditions and little changing prices for bonds of each issue. In case of inflation and interest rate fluctuations, the real rate of return on a particular issue of GKOs can be calculated using the previously discussed Fisher formula:

Where i r - real interest rate (security yield level);

iH- nominal interest rate;

i inf - inflation rate.

![]()

In order to restructure the domestic government debt in favor of securities with a longer circulation period, the volume of medium-term securities on the government bond market has increased significantly. Thus, in accordance with the Decree of the Government of the Russian Federation dated May 15, 1995 No. 458, which approved the General Conditions for the Issue and Circulation of Federal Loan Bonds, the Conditions for the Issue of Federal Loan Bonds with Variable Coupon Yield were developed and approved, and on June 14, 1995, an auction was held for placement of the first issue of federal loan bonds with variable coupon income - OFZ-PK.

OFZ-PK are registered coupon medium-term securities placed at a discount and giving their owner the right to receive the par value of the bond upon redemption, as well as coupon income. The timing of coupon payment and the duration of the coupon period are established for each specific issue, and the interest rate for each coupon is announced in advance, no later than seven days before the start of the next coupon period.

The procedure for trading OFZ-PK differs from the procedure for trading GKOs in that when purchasing OFZ-PK it is necessary to pay the seller, in addition to the transaction amount, the amount of coupon income accumulated up to that time.

In accordance with the Letter of the Central Bank of the Russian Federation dated October 5, 1995 No. 28-7-3/A-693, it is recommended to determine the yield on OFZ-PK using the formula

![]()

Where N- bond par value, rub.;

R - bond price, rub.;

C - coupon value, rub.;

A- income accumulated since the beginning of the coupon period, rub.;

t- period until the end of the current coupon period, days.

Coupon value

![]()

Where T - coupon period, days;

R- annual coupon rate, %.

The amount of accumulated coupon income

![]()

The total current yield of a bond characterizes the efficiency of the operation from the moment of purchase to the expected moment of sale of the bond. It is determined for the current coupon period using the formula

Where R 1, R 2 - purchase and expected sale prices of the bond, respectively;

A 1 - coupon income paid upon purchase;

A 2- accumulated coupon income;

K i- previously paid coupon income.

Accumulated income at the estimated date of sale

Where K p - coupon payment amount (coupon income);

T k- coupon period;

T - investment period (bond ownership).

After substituting the amount of accumulated coupon income into the formula, the total current yield will be:

The calculation of the yield to maturity at auction prices is carried out taking into account the fact that the accumulated coupon income is zero,

Where R A- auction (cut-off) price;

TO- coupon income;

T in - period before payment of coupon income.

Yield on weighted average foam

![]()

Where R c in - weighted average price of bonds at auction.

The effective yield to maturity of bonds with a variable coupon takes into account coupon income and also assumes the reinvestment of intermediate coupons until the maturity date of the bonds. An accurate determination of the effective yield is possible when the values of all coupon payments and the maturity date are known.

Effective profitability can be determined from the condition of equality of cash flows of costs and revenues given to the present moment:

Where K i- coupon payments;

T i- the period from the purchase of a bond to payment i- th coupon;

T n- period until bond maturity;

I e- effective yield (discount rate).

The financial market crisis in August 1998 destroyed the existing mechanism for the functioning of GKOs and OFZs. The Government of the Russian Federation announced the decision to restructure the internal debt in accordance with the conditions set out in the Appendix to the order of the Government of the Russian Federation "Basic conditions for the implementation of innovation on government short-term zero-coupon bonds and federal loan bonds with constant and variable coupon income with maturities until December 31, 1999. and released into circulation before the Statement of the Government of the Russian Federation and the Central Bank of the Russian Federation dated August 17, 1998 by replacing, in agreement with the owners, new obligations on newly issued federal loan bonds with fixed and constant coupon income and partial payment of funds" No. 1787-r dated December 12, 1998

The amount of new obligations was determined by discounting the nominal value of GKOs and OFZs with maturities before December 31, 1999 and issued before August 17, 1998, based on a yield of 50% per annum in the period from August 19, 1998 to the maturity date indicated under release conditions. At the same time, for federal loan bonds with constant and variable coupon income, the discounted value includes the amount of unpaid coupon income. For unannounced coupons, the rate is assumed to be 50% per annum.

To secure the obligations of the Government of the Russian Federation, federal loan bonds with a fixed coupon income will be issued, the amount of which is determined in clause 3 of the Appendix (OFZ-FD) with circulation periods of four and five years, as well as federal loan bonds with a constant coupon income (OFZ-PD) with a maturity of three years. OFZ-PD have a zero coupon income; their investment attractiveness lies not in the opportunity to receive the amount from repayment, but in the ability to pay off debts to the budget as of July 1, 1998, as well as payment for participation in the authorized capital of credit institutions.

Payment of funds in an amount equal to 10% of the amount of new obligations in relation to bonds, the maturity of which occurred before the date of innovation, increases depending on the deferment period at the rate of 30% per annum. At the same time, owners of GKOs and OFZs with constant and variable coupon income with maturities before December 31, 1999 and issued before August 17, 1998 - individuals and a number of non-profit organizations are given the right to receive the full repayment amount in cash within the time limits established by issuing bonds they own.

The result of the innovation was that the government bond market lost its main attractiveness - reliability and liquidity with investment terms of up to a year.

With regard to domestic foreign currency loan bonds, the decision on novation has not yet been made.

Domestic foreign currency loan bonds are bonds with a fixed coupon and are sold at a discount. This assumes the presence of two types of yield: coupon and discount. Total return includes both types.

The coupon income on them is paid once a year and amounts to 3% of the face value.

To estimate the yield of an internal currency loan bond (OVVZ) to maturity, you can use the simple interest formula

Where i n- annual yield calculated using the simple interest formula;

C j – size j th coupon payment as a percentage of the nominal value, taken as 100%;

j = 1, ... k;

R o- bond price upon purchase;

A- accumulated coupon income;

That- number of calendar days in a year;

tk- term until maturity of the bond in days.

Typically, the purchase price of bonds includes the accrued income, then

In the trading and depository system of the Moscow Interbank Currency Exchange (MICEX), the yield of OVVZ is calculated using the effective yield formula:

Where t j- number of days until j th coupon payment.

This formula determines the transaction price based on the yield to maturity, taking into account the exact number of days until coupon payments. When using it, it is necessary to take into account that when assessing the profitability on the day of purchase of OVVZ, the accumulated income is calculated on the day of their delivery, i.e. second business day after purchase.

The total current profitability of OVVZ characterizes the efficiency of investment during the time from the moment of purchase to the expected sale:

![]()

Where P 1- purchase price taking into account accumulated income;

R 2 - the proposed sale price taking into account accumulated income;

T - investment period (from the date of purchase to the date of sale).

When determining the yield of foreign currency bonds, it is necessary to multiply the price value by the coefficient of change in the dollar exchange rate:

Where To v1 - dollar exchange rate on the day the bond was purchased;

K v2- dollar exchange rate on the day the bond is sold.

Full current yield of OVVZ taking into account changes in the dollar exchange rate

Example. Determine the current yield and yield to maturity of OVVZ of the 3rd tranche when purchasing on October 22, 1995 and selling on February 28, 1996, provided:

Coupon rate - 3% per annum;

Coupon period - 365 days;

Investment period - 98 days;

Exchange rate coefficient - 1.055:

Bond par value (dollars) - 1000;

Period to maturity (days) - 1261.

Current yield of OVVZ 3rd tranche

Yield to maturity of OVVZ 3rd tranche

for prices in foreign currency

Since it is not possible to track the dollar exchange rate over a long period, the yield on long-term tranches is calculated only for currency prices.

When performing transactions on the government bond market, it becomes necessary to choose the most profitable instruments. It is difficult to choose a universal indicator for comparing the effectiveness of investments in different types of securities, so the investor uses an assessment mechanism depending on specific goals.

Self-test questions

1. How are current yield and effective yield understood?

2. What methods are used to determine the return on investment (NPV method, IRR method)?

3. How is the return on shares assessed if dividends tend to increase?

4. What is the stock return if the company is at zero growth?

5. How is the yield on a discount security determined?

6. How is the yield of a coupon security determined?

Government short-term zero-coupon bonds (GKOs)

The income from GKOs is a discount, i.e. the difference between the selling price (at redemption, this price is equal to the par value of the bonds) and the price of their acquisition during the initial placement or on the secondary market. The maturity of GKOs is up to 1 year. The face value of the bond is 1,000 rubles.

Federal loan bonds with variable coupon yield (OFZ-PK)

OFZ-PK refer to bonds with an unknown coupon income. Bonds with unknown (variable) coupon income give its owners the right to periodically receive interest (coupon) income. The frequency of coupon payments is 2 or 4 times a year. The size of each OFZ-PK coupon is announced immediately before the start of the corresponding coupon period based on the current yield of GKO issues, which are redeemed approximately at the same time as the date of payment of this coupon. At the same time, it is also possible to receive a discount if the purchase price of bonds (at the primary placement or at secondary auctions) is less than their sale price, including when the bonds are redeemed at their par value. The face value of the bond is 1,000 rubles. The circulation period of OFZ-PK is from 1 to 5 years.

OFZ-PD, OFZ-FD, OFZ-AD refer to bonds with a known coupon income. Bonds with a known coupon income (the amounts of which are announced in advance by the Issuer) are securities that give its owners the right to periodically receive interest (coupon) income. At the same time, it is also possible to receive a discount if the purchase price of bonds (at the primary placement or at secondary auctions) is less than their sale price, including when the bonds are redeemed at their par value.

Federal loan bonds with constant coupon yield (OFZ-PD)

In the case of OFZ-PD, the sizes of all coupons are determined as a constant value for the entire period until maturity. The circulation period of these bonds is from 1 year to 30 years, the frequency of coupon payments is once a year. Denomination 1,000 rubles.

Federal loan bonds with fixed coupon income (OFZ-FD)

In the case of OFZ-FD, the amount of coupon income is established upon issue as a fixed value, which may vary for different payment periods. The maturity of the bonds is more than 4 years, the frequency of coupon payments is 4 times a year. Denomination 10 or 1000 rubles.

Federal loan bonds with debt amortization (OFZ-AD)

This is a relatively new tool, first released in May 2002. The main feature of OFZ-AD is that the par value of the bonds is repaid in installments on different dates. The maturity of bonds can be from 1 year to 30 years (the nearest maturity year for bonds currently in circulation is 2006). The frequency of coupon payments is 4 times a year. Denomination 1000 rubles.

Although the full coupon amount is paid by the issuer of bonds to the person who owns them on the payment date, or coupon date, each previous owner is also entitled to receive income in proportion to the period of ownership. This is achieved by the fact that when purchasing bonds, their buyer must pay the previous owner, in addition to the actual price (the “net” price) of the bonds, also the amount of the accumulated coupon income.

| Characteristics of GKOs and OFZs | ||||||

| GKO | OFZ-PK | OFZ-PD | OFZ-FD | OFZ-AD | ||

| Full title | Government short-term zero-coupon bonds | Federal loan bonds with variable coupon yield | Federal loan bonds with constant coupon income | Federal loan bonds with fixed coupon income | Federal loan bonds with debt amortization | |

| Known/unknown coupon income | zero coupon bonds | unknown coupon bonds | bonds with a known coupon yield | bonds with a known coupon yield | ||

| Determining the coupon size | - | announced before the start of the coupon period based on the current yield of GKO issues | as a constant value for the entire period until maturity | is set upon issue as a fixed value, which may vary for different payment periods | ||

| Issuer | Ministry of Finance | Ministry of Finance | Ministry of Finance | Ministry of Finance | Ministry of Finance | |

| Issue form | documentary with mandatory centralization. storage | documentary with mandatory centralization. storage | documentary with mandatory centralization. storage | documentary with mandatory centralization. storage | ||

| Type of bond | personalized zero coupon | personalized coupon | personalized coupon | personalized coupon | personalized coupon | |

| Loan currency | Ruble | Ruble | Ruble | Ruble | Ruble | |

| Denomination, rub. | 1000 | 1000 | 1000 | 10 or 1000 | 1000 | |

| Deadline | up to 1 year | from 1 year to 5 years | from 1 year to 30 years | more than 4 years | from 1 year to 30 years | |

| Coupon payment frequency | - | 2 or 4 times a year | 1 time per year | 4 times a year | 4 times a year | |

| Placement and circulation | MICEX | MICEX | MICEX | MICEX | MICEX | |

| Possibility of receiving a discount | Yes | Yes | Yes | Yes | Yes | |

Another concept from the 1990s may return to Russia: the Russian Ministry of Finance is considering the possibility of using the mechanism of government short-term bonds (GKOs) next year. This was stated by the First Deputy Minister.

“Starting this year, we are creating a REPO - placement of budget funds even for one night. And, probably, we will again restore, if necessary, the GKO instrument. Because when you can place money for one day, you also need to be able to borrow for a very short time,” Nesterenko explained at a meeting of the Budget and Tax Committee.

“For now, the possibility of issuing such securities is only being discussed theoretically,” the Ministry of Finance told Gazeta.Ru.

As the department noted, the GKO instrument can be used directly by the Treasury to cover its short-term liquidity needs. Such needs may arise if the volume of funds placed on deposits with commercial banks and repo transactions increases.

GKOs may also be required for liquidity management. “The Treasury may need it two or three times a year - on days on which very large one-time payments occur and for which it is necessary to keep around 600 billion rubles. always on the federal budget account. The introduction of such a short-term instrument will allow us to reduce the average level of balances in treasury accounts and place more funds additionally on financial markets through treasury deposits in repo transactions,” Siluanov’s department told Gazeta.Ru. “The instrument is not considered as a debt instrument - as a source of covering the budget deficit, it will not replace other types of borrowing,” the Ministry of Finance explained.

The return of GKOs is due to the difficult economic situation in the country, as well as the closure of access to foreign capital markets, summarize experts interviewed by Gazeta.Ru.

“The Ministry of Finance is now thinking about where to find funds for the investment program, which were previously financed through external borrowings,” the deputy head of the financial market committee told Gazeta.Ru. “Given the small budget deficit, we have the opportunity to close it with the help of short-term liabilities. At the same time, we cannot follow the example of the United States, where external debt exceeds 100% of GDP. A reasonable level is no more than 30% of GDP and no more than 3% of the budget deficit. Moreover, it is advisable to formalize the restriction legislatively, for example, by fixing it in the Budget Code. Then there will be opportunities to finance investment programs and economic growth.”

The chief economist of BKS also agrees with Aksakov in his assessment of the reasons for the return of state bonds. “The need for state bonds arose because the political situation between Russia and the West changed, which negatively affected the ability to borrow on world markets,” Tikhomirov notes. — The income gap can be covered in two ways: reducing expenses or making up for missing income. The government will try not to waste the Reserve Fund in order to minimize risks. Taking into account the fact that external borrowing is impossible, it turns out that we are talking about increasing internal debt - state bonds.”

Back to 1998

Government short-term bonds (GKOs) began to be issued in the Russian Federation in May 1993 and were the prototype of US Treasury bills. State bonds were issued for a short-term period and were intended to cover the state budget deficit.

GKOs were initially issued with a nominal value of 100,000 rubles, later their nominal value was increased to 1 million non-denominated rubles. The investor received income due to the fact that GKOs were sold at auctions at a discount, that is, at a price below par. The Ministry of Finance redeemed the bonds at par in a non-cash form - transferred the money to the owner’s account. The income was the difference between the nominal value of GKOs and the price of their acquisition at an auction during the initial placement or on the secondary market.

Bonds were issued with maturities of 3, 6 and 12 months (at first only for three and six months, then the Ministry of Finance increased the share of bonds with longer maturities, and in the first half of 1997 completely got rid of three-month securities). Due to the fact that GKOs were issued for a short-term period in alternating series, the issuer of bonds (i.e.) had a real opportunity to repay previous series by issuing new ones.

“In the early 1990s, we lived with a chronic deficit; the budget was actually financed by state bonds - and with high returns. It was a kind of “pyramid” when new ones were issued to pay off previous issues,” Tikhomirov comments on the then policy of the Ministry of Finance.

In 1995, net budget revenues from the sale of GKOs, minus the costs of repaying previous issues, amounted to 28 trillion non-denominated rubles, which made it possible to finance more than 50% of the federal budget deficit. In 1996, proceeds from the placement of GKOs reached more than 50 trillion rubles.

By the end of the 1990s, the GKO market became the main source of financing the Russian budget deficit. However, in 1997, against the backdrop of the economic crisis in Asia and falling oil prices, the situation in the Russian financial market became more complicated.

As a result, by mid-August 1998, the yield on GKOs reached 140%, and the government was forced to default on them on August 17.

“If the government enters the domestic debt market, it will pull financial resources away from the corporate bond market, complicating debt and investment problems in the real sector of the economy,” Tikhomirov notes. — State bonds will be issued in the presence of the Reserve Fund, that is, given that the government has funds that ensure its solvency in addition to future income. In the 1990s, the situation was completely different: huge debt, almost complete absence of reserves: the government had no reserves at all.”

“Generally speaking, we need to use all mechanisms - look for opportunities for new income, optimize expenses and use the borrowing mechanism,” notes the head of Gazeta.Ru. “But here you need to act carefully: the more the state borrows, the less opportunities there are for corporate borrowing, since the market is single. At one time, the GKO mechanism worked like a “pyramid,” but this outcome was clear long ago, at least nine months before it happened. In general, I don’t think that the Ministry of Finance needs to fuss now.”