Commission trading is the process when the supplier/consignor transfers the goods for the purpose of sale to an intermediary/commission agent. The latter makes the sale to the buyer, reports and transfers the proceeds for the sold goods to the principal, receiving a commission. Program 1C 8.3 provides the opportunity to reflect such trade from the point of view of both sides of the process.

Commissioner's report on 1C sales (1C: Accounting 8.3)

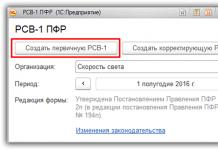

To keep the accounts we are considering, you need to configure the connection of the corresponding functionality, which is located in the “Main/Settings/Functionality/Trade” section. The ability to work with the “Commission Agent Sales Report” is provided by the checkbox “Sale of goods/services through commission agents/agents.” This checkbox may be inactive if such a report has already been created.

Figure 1 – Setting up functionality for displaying commission trading

Our report is located in Sales/Sales.

Bookmark "Main" contains the following details and settings:

- "Document No." And "from" – No. and date of the report received from the intermediary and confirming the fact of the transaction.

Figure 2 – Main tab

Figure 2 – Main tab

- "Number" And "from" contain the number and date of registration of the report in the system, and the number is generated automatically in the program.

- Props "Organization" contains the name of the organization from which records are kept in the program, i.e. in this case we are considering accounting from the principal's side.

- In props "Counterparty" you should select the counterparty who is the commission agent from the “Counterparties” directory.

- Props "Treaty" will be filled in automatically by the program if the “Counterparty” contains an element of the “Counterparties” directory that has an agreement with an intermediary. The “Type” attribute in such an agreement has the meaning “With a commission agent/agent for sale.”

Figure 3 – Link “Agreements” in the directory element “Counterparties”

Figure 3 – Link “Agreements” in the directory element “Counterparties”

Figure 4 – Details “Type of agreement”

Figure 4 – Details “Type of agreement”

- Link “Accounts for settlements with counterparties” Accounts should be set up.

Figure 5 – Settlement account settings

Figure 5 – Settlement account settings

- Group of details "Commission remuneration"

contains settings for the calculation method and percentage, settings for the commission cost account and VAT account, VAT percentage and cost item. Props "Method of calculation"

can take one of the following values:

- Not calculated;

- % of the difference between sales and receipts;

- % of the sale amount.

Figure 6 – Group of details “Commission”

Figure 6 – Group of details “Commission”

If the “Calculation method” attribute is set to percentage of the difference in sales/receipt amounts, then the commission amount will be calculated as follows.

The difference between the values of the “Amount” and “Transfer Amount” details on the “Sales” tab, summed up for all item items. Then a percentage of the received value in the amount set in the “% of remuneration” attribute on the “Main” tab. Let's look at what has been said with an example.

Figure 7 – Details “Amount” and “Transfer Amount” for the first buyer

Figure 7 – Details “Amount” and “Transfer Amount” for the first buyer

Figure 8 – Details “Amount” and “Transfer Amount” for the second buyer

Figure 8 – Details “Amount” and “Transfer Amount” for the second buyer

In our example, the commission will be equal (the sum of the difference between the amounts of sales and receipts):

14,160 – 10,620 = 3,540 – difference for the buyer “Retail buyer”;

30,000 – 26,550 = 3,450 – difference for buyer “I.V. Nikitaeva”;

3,540 + 3,540 + 3,450 = 10,530 – the difference for all customers;

10% of 10,530 = 1 053 rubles – the required value

Including VAT 18% = 18% of 1,053 = 160,63 rubles

Thus, the commission after deducting VAT is equal to 1,053 – 160.63 = 892.37 rubles

Figure 9 – The “Calculation method” attribute is set to the value “Percentage of ...”

Figure 9 – The “Calculation method” attribute is set to the value “Percentage of ...”

If Calculation Method is set to "Percentage of sales amount" then the commission amount is calculated as follows:

The value of the “Amount” attribute on the “Sales” tab is added up for all item items. Then a percentage of what is received is sought in the amount set in the “% of remuneration” detail on the “Main” tab.

In our example, the commission will be equal to:

14 160 + 14 160 + 30 000 = 58 320

10% of 58,320 = 5 832 rubles – Commission

Including VAT 18% = 889,63 rubles

Thus, the commission fee excluding VAT is equal to 5,832 – 889.63 = 4,942.37 rubles

Figure 10 – The “Calculation Method” attribute is set to the value “Percentage of Sale Amount”

Figure 10 – The “Calculation Method” attribute is set to the value “Percentage of Sale Amount”

IN "Realizations" information about the transfer of goods or services from the intermediary to the end customers is reflected. The tabular part at the top contains a list of them, and the bottom part contains a list of sales for each buyer listed at the top. In a collumn "SF date" The date of the invoice that was issued by the commission agent to the buyer must be indicated. IN "Sum" And "Transfer amount" the costs of selling the goods to the buyer and transferring them to the commission agent are found, respectively.

11 – Implementation

11 – Implementation

Indicators in columns "Reward Amount" And "VAT remuneration" will be calculated automatically depending on the “% remuneration” and “% VAT” settings on the “Main” tab. If the “Calculation method” detail on the “Main” tab is set to “Not calculated”, then the remuneration amount must be filled in manually for each item.

12 – Details “Amount of remuneration” and “VAT remuneration” on the “Sales” tab

12 – Details “Amount of remuneration” and “VAT remuneration” on the “Sales” tab

Columns “Account Account”, “Income Account”, “Expense Account” And "VAT invoice" are filled in when specifying items automatically based on the information register “Item Accounts”.

13 – Setting up accounts on the “Sales” tab

13 – Setting up accounts on the “Sales” tab

The data on the “Sales” tab can be filled in automatically using the “Fill” button based on the previously created document “Sales: Goods, services, commission”.

Figure 14 – Document “Sales: Goods, services, commission”

Figure 14 – Document “Sales: Goods, services, commission”

On the bookmark "Returns" return operations are entered. For each of them, information about the buyer, the sales document, details of the invoice for the return of the goods, its nomenclature, quantity and cost are indicated. In order for the lower tabular part to be automatically filled in using the “Fill/By sales document” button, you need to select the buyer, the sales document at the top and fill in the date and number of the return invoice. This will happen automatically if the “Commission Agent Sales Report” document for this buyer has already been posted in the program.

Figure 15 – Returns in the report

Figure 15 – Returns in the report

On the bookmark "Cash" DS from the buyer for goods or services of the principal are indicated. After the commission agent sends a report to the principal, the obligation to pay VAT for the goods is transferred to the principal. Information about the DS is entered manually.

Figure 16 – DS of the document “Sales commission agent’s report”

Figure 16 – DS of the document “Sales commission agent’s report”

Bookmark "Additionally" should be completed if the seller is not the shipper or the buyer is not the shipper. This is necessary for the correct entry of data into the invoice.

Figure 17 – “Additional” document “Commission Agent’s Sales Report”

Figure 17 – “Additional” document “Commission Agent’s Sales Report”

After filling out the document, you must submit the commission agent’s report in 1C using the “Post” button.

As a result:

Reflects the write-off of the cost of goods sold. In our example, the cost of production was registered through the “Production Report for a Shift”.

Commission deducted from revenue. The posting was generated because the corresponding checkbox was selected.

Revenue from sales of goods.

Commission costs.

VAT accrual on goods sold.

VAT accrual on remuneration.

As part of displaying this type of trading as commission, we covered: what preliminary settings need to be made for this and how to create and fill out a commission agent’s report on 1C sales.

We continue the series of articles devoted to the technology of accounting for transactions under intermediary agreements in 1C: Accounting 8 (rev. 3.0). We wrote about how to take into account the sale of services from a principal under an agency agreement in the article “Sale of services under an agency agreement from a principal in 1C: Accounting 8” (rev. 3.0) . Read about the reflection of sales of goods from the principal, as well as the specifics of calculating and deducting VAT on advances in the principal's accounting in this article. In preparing the article, materials from the “Accounting and Tax Accounting” section of the 1C:ITS information system from the “Directory of Business Transactions” were used. 1C: Accounting 8" - http://its.1c.ru/db/hoosn#content:70:1 and the reference book "Accounting for Value Added Tax" - http://its.1c.ru/db/accnds# content:1442:2 .

Accounting for sales and VAT with the principal

Under a commission agreement, the commission agent undertakes, on behalf of the principal, for a fee, to carry out one or more transactions on his own behalf, but at the expense of the principal (Clause 1, Article 990 of the Civil Code of the Russian Federation).

In the case where the subject of the contract is the sale of goods, the principal transfers to the commission agent the goods, which he undertakes to sell for a certain fee. In this case, the goods transferred to the commission remain the property of the principal and are listed on his balance sheet in account 45 “Goods shipped”. The commission agent records the goods received in off-balance sheet account 004 “Goods accepted for commission.”

After the sale of commission goods, the principal receives from the commission agent a report on the sale of goods and an invoice for the commission (act of services performed, invoice).

According to the terms of the agreement, the commission may be withheld by the commission agent from the proceeds received from the sale of goods. The principal's revenue will be the amount received from the sale of goods. The commission paid to the commission agent is included in the principal's expenses.

When selling goods (work, services, property rights) through an intermediary, the principal (principal) determines the tax base in the general manner in accordance with the requirements of Art. 154 Tax Code of the Russian Federation.

The date of determination of the tax base for the committent (principal) is the earliest of the dates (clause 1 of Article 167 of the Tax Code of the Russian Federation):

- date of shipment of goods (work, services, transfer of property rights);

- date of receipt of payment (prepayment) for the upcoming shipment.

The date of shipment for the principal (principal) is the date of drawing up the first primary document drawn up by the intermediary in the name of the buyer (letter of the Federal Tax Service of Russia dated January 17, 2007 No. 03-1-03/58@). This means that the principal (principal) determines the tax base on the date of shipment by the intermediary of goods (work, services, property rights) to the buyer.

But when transferring goods (works, services) to an intermediary, the principal (principal) should not charge VAT and issue invoices. After all, the ownership of goods (results of work, services, property rights) until they are transferred to the buyer remains with the principal (principal) and under no circumstances passes to the intermediary (Clause 1 of Article 996, Article 1011 of the Civil Code of the Russian Federation).

VAT is calculated by the principal (principal) in the same way as in the normal sale of goods (work, services) by the seller to the buyer (clause 1 of Article 146, clause 1 of Article 153 of the Tax Code of the Russian Federation).

The date of receipt of an advance payment from the buyer (customer) from the committent is recognized not only the date of receipt of the advance payment from the buyer, but also the date of receipt of the advance payment to the account or cash desk of the commission agent (agent) (letter of the Federal Tax Service of Russia dated February 28, 2006 No. MM-6-03/202 @).

Based on invoices issued by intermediaries to buyers (customers) when selling goods (works, services) or upon receiving an advance payment from them, the principal (principal) reissues invoices with similar indicators to the intermediary.

In this case, the principal (principal) must take into account the following special requirements for such invoices:

- the date of issue of the reissued invoice, reflected on line 1, must coincide with the date of issue of the invoice by the intermediary to the buyer (customer), and the number must be assigned in accordance with the general chronology accepted by the principal (principal) (clause “a”, clause 1 Rules for filling out an invoice, approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137);

- lines 6, 6a, 6b must indicate the name, address, INN and KPP of the actual buyer (customer), and not the intermediary (subparagraphs “i”, “j”, “l” of paragraph 1 of the Rules for filling out an invoice, letter from the Ministry of Finance of Russia dated 10.05.2012 No. 03-07-09/47);

- all other line and column indicators must fully correspond to the invoice indicators issued by the intermediary to the buyer (customer).

The principal (principal) registers reissued invoices:

- in part 1 of the Journal of accounting of received and issued invoices (clause 7 of the Rules for maintaining a journal of received and issued invoices, approved by Resolution No. 1137);

- in the Sales Book of the tax period in which the goods (work, services) were shipped by the intermediary to the buyer (customer) or an advance payment was received from the buyer (customer) (clause 20 of the Rules for maintaining the sales book, approved by Resolution No. 1137).

The principal (principal) can claim tax as a deduction on an advance payment received from the buyer (customer):

- after the intermediary has shipped goods (work, services), for which an advance payment was received (clause 8 of Article 171, clause 6 of Article 172 of the Tax Code of the Russian Federation);

- when changing the conditions or terminating the contract and returning the amounts of advance payments to the buyer (customer) (clause 5 of Article 171, clause 4 of Article 172 of the Tax Code of the Russian Federation).

At the same time, re-issued invoices for the prepayment received from the buyer (customer) as the right to a tax deduction arises are included in the purchase book (clauses 2, 22 of the Rules for maintaining the purchase book, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137) .

In addition, the principal (principal) has the right to a tax deduction for the intermediary’s remuneration, as well as for expenses reimbursed to him.

Let's look at the following example to reflect the position of the principal in the 1C: Accounting 8 program (rev. 3.0) when selling goods under a commission agreement.

Example

CJSC TF Mega (committent) entered into a commission agreement with CJSC Platinum (commission agent), under which the commission agent sells the principal's goods to customers for a fee. Both companies apply a common taxation system and are VAT payers. Under the terms of the agreement, the commission agent sells goods at prices not lower than those indicated in the invoice for the transfer of goods, and participates in settlements. The commission agent's remuneration is 10 percent of the proceeds. The commission agent deducts the remuneration from the funds received from the buyer.

On March 3, 2014, the principal transferred to the commission agent 8 Electrosila vacuum cleaners in the amount of RUB 40,000.00. (including VAT 18% - RUB 6,101.69). On March 31, 2014, the commission agent presented the principal with a sales report for the month in the amount of goods sold of RUB 50,000.00. (including VAT 18% - RUB 7,627.12). According to the report, the commission agent shipped:

- On March 10, 2014, the buyer of NPO Monolit received 3 vacuum cleaners for RUB 6,500.00. (including VAT 18%);

- On March 17, 2014, the buyer of Plotnik+ LLC received 5 vacuum cleaners for RUB 6,100.00. (including VAT 18%).

A set of supporting documents is attached to the commission agent's report (invoice, act, invoice for commission, copies of payment documents confirming receipt of funds from customers).

At the same time, the commission agent provided information on invoices issued to customers when selling the principal's goods. During the reporting period, the commission agent issued two invoices:

- to the buyer NPO Monolit: March 10, 2014 in the amount of RUB 19,500.00. (including VAT 18% - RUB 2,974.58);

- to the buyer Plotnik+ LLC: March 17, 2014 in the amount of RUB 30,500.00. (including VAT 18% - RUB 4,652.54).

The commission agent also provided information about advance invoices issued to customers upon receipt of an advance payment from them for upcoming deliveries of goods. During the reporting period, the commission agent issued one invoice for prepayment:

- to the buyer Plotnik+ LLC: March 10, 2014 in the amount of RUB 30,500.00. (including VAT 18% - RUB 4,652.54).

From the amount received from the sale of the principal's goods, the commission agent withheld a remuneration in the amount of 10 percent of the proceeds in the amount of RUB 5,000.00. (including VAT 18% - 762.71 rubles). Cash for the proceeds in the amount of RUB 45,000.00. the commission agent transferred to the principal on April 3, 2014.

Accounting Settings

To properly organize the accounting of transactions within the framework of commission trading in the 1C: Accounting 8 program (rev. 3.0), you need to make the appropriate settings.

To organize CJSC "TF Mega" in Accounting parameters(chapter Main) on the tab Trade need to set a flag Activities are carried out under sales commission agreements(Fig. 1).

Rice. 1. Setting up accounting parameters for commission trading

Transfer of goods to the commission agent

To register the transfer of goods to a commission agent, you need to create a document in the program Sales of goods and services with the type of operation Goods, services, commission(Fig. 2).

Rice. 2. Registration of the transfer of goods from the principal to the commission agent

When filling out the details of the document header, you must fill in the fields Warehouse, Contractor And Agreement. When filling out the field Agreement Please note the following:

- in the contract selection window, only those contracts that have the contract type are displayed With buyer or ;

- in the directory Contracts of counterparties in the form of the contract used, it is necessary to establish the type of contract With a commission agent (agent) for sale;

- in the directory Contracts of counterparties in the form of the contract used, you can immediately set the calculation method and the commission percentage (in the example under consideration, the calculation method is selected as Percentage of the sale amount, and the percentage of remuneration is 10%), then when filling out the document the commission will be calculated automatically.

Sales of goods and services the following transactions will be generated:

Debit 45.01 Credit 41.01 - for the cost of the goods transferred to the commission agent.

For tax accounting purposes for corporate income tax, the corresponding amounts are also recorded in resources Amount NU Dt And Amount NU Kt.

Commission agent's report on sales

In No. 6 (June) “BUKH.1S” for 2014 on page 22, we examined in detail the procedure for filling out the document Commission agent's report on sales. This document is intended to reflect sales transactions for both the principal and the principal, the calculation of VAT on sales, as well as the calculation of remuneration and its deduction from the principal’s (principal’s) proceeds.

We remind you that the document form consists of several bookmarks. On the bookmark Main the main details of the commission agent's report are indicated: the number and date of the report, the name of the commission agent and the number of the agreement with him, the method of calculating the commission fee, the VAT rate of the commission fee, the procedure for accounting for the fee, and the date and number of the invoice for the fee are also registered (Fig. 3).

Rice. 3. Filling out the title details of the commission agent’s report

Amounts in fields Total And VAT (incl.), both in relation to the sale of the principal and in relation to the commission, are calculated automatically according to the data filled in on the document form tab Implementation.

On the bookmark Implementation There are two tabular parts connected to each other (Fig. 4):

- at the top of the document there is a table of buyers - third parties to whom the commission agent sold the principal's goods;

- at the bottom of the document the name, quantity and cost of goods sold by the principal through the commission agent, as well as the commission fee, are indicated.

Rice. 4. Goods sold to customers through a commission agent

In accordance with the requirements of the legislation of the Russian Federation, goods sold by the commission agent are indicated in the context of final buyers and the date of the transaction, that is, the date indicated in the invoice issued by the commission agent to the final buyer. After recording the document for the same dates, the program will automatically create invoices issued by the principal to the commission agent.

On the bookmark Cash Based on the documents submitted by the commission agent, information about funds received from buyers for goods sold is indicated (Fig. 5):

- in relation to the buyer NPO "Monolit" in field Payment report type select payment option Payment;

- in relation to the buyer LLC "Plotnik+" in field Report type For payments, select a payment option Prepaid expense;

- in the fields The date and amount of funds received from the buyer, including VAT, are indicated.

Rice. 5. Registration of funds received from buyers

Filling out a bookmark Cash important in the case of receiving an advance payment from the buyer, since upon approval of the report on funds received, the responsibility for accrual passes to the principal VAT on advance.

In our example, the information displayed on the tab Cash, in relation to the buyer, NPO Monolit is for informational purposes only.

On the bookmark Calculations the accounts of settlements with the commission agent for the sold goods of the principal, as well as the accounts of settlements for commission remuneration, are indicated. We remind you that settlement accounts are set by default in accordance with the accounts specified in the settings Accounts for settlements with counterparties via the hyperlink of the same name in the directory Contacts(chapter Directories).

When posting a document Commission agent's report on sales The following transactions are generated in the information base:

Debit 90.02.1 Credit 45.01 - for the cost of goods sold by the principal; Debit 76.09 Credit 90.01 - for the total amount of goods sold by the principal; Debit 90.03 Credit 68.02 - for the amount of accrued VAT on the sale of goods of the principal; Debit 60.01 Credit 76.09 - for the amount of commission deducted from the commission agent's revenue; Debit 44.01 Credit 60.01 - for the amount of accrued commission excluding VAT; Debit 19.04 Credit 60.01 - for the amount of VAT on commission fees.

For tax accounting purposes for corporate income tax, the corresponding amounts are also recorded in the registers Amount NU Dt And Amount NU Kt.

In addition, entries are made in the following accumulation registers:

- with a view of movement Coming the amount of value added tax on the prepayment received;

- VAT presented with a view of movement Coming the amount of VAT on the commission presented by the commission agent;

- VAT sales for the amount of VAT on the principal's sales.

VAT accounting and registration of issued invoices

When posting a document Commission agent's report on sales documents are automatically generated Invoices issued in the quantity in which the commission agent issued invoices to customers. The invoice data is reissued to the commission agent of CJSC Platinum, and in the field Organization the principal is indicated CJSC "TF Mega", and in the fields Counterparty- final buyers of goods NPO "Monolit" And LLC "Plotnik+".

If the goods were shipped by the commission agent after receiving an advance payment from the buyer, and the invoice issued by the commission agent to the buyer contains information about the payment document, then the new document Invoice issued it is necessary to manually transfer information about the payment document to the transfer of the advance payment by the buyer to the commission agent.

After posting the “Invoice issued” documents, entries will be made for each document in the “Invoice Log” register.

To register invoices for advance payments, including on the basis of a document Commission agent's report on sales, you must use standard processing via the hyperlink of the same name on the navigation panel from the group Registration of invoices(chapter Bank and Cashier). Processing can be performed in one day or in any user-specified period.

By button Fill processing will automatically generate a list of advances received from customers for each date for the specified period, and by clicking Execute- generates invoices for advance payments, including an invoice for advance payments received from the buyer LLC "Plotnik+"(Fig. 6). This invoice is reissued to the commission agent JSC "Platinum", moreover, in the field Organization the principal is indicated CJSC "TF Mega", and in the field Counterparty- buyer of goods LLC "Plotnik+", who transferred the advance to the commission agent.

Rice. 6. Invoice issued for advance payment

In order to comply with legal requirements regarding the coincidence of all other indicators of lines and columns, which must fully correspond to the indicators of invoices issued by the commission agent to the buyer, and taking into account that in the document Commission agent's report on sales There is not enough information, some details of the reissued invoice will have to be filled in manually. This applies, in particular, to the date and number of the payment document, and the name of the goods supplied.

When posting a document Invoice issued for advance payment the following transactions are generated:

Debit 76.AB Credit 68.02 - for the amount of VAT on the prepayment received.

In addition, the specified amount of VAT is reflected in the entries in the accumulation registers:

- Sales VAT;

- Invoice journal.

Deduction of VAT from the buyer's advance payment in an intermediary scheme

To register a VAT deduction from an advance payment transferred to Plotnik+ LLC, you need to create another document Commission agent's report on sales. In which you only need to fill in the bookmarks Main And Cash.

On the bookmark Cash in relation to the buyer of Plotnik+ LLC, information about the amount of the offset advance is indicated (Fig. 7):

- in field Payment report type select payment option Advance offset;

- in the fields Event date, Amount including VAT (rub.), % VAT, VAT (rub.) the date of shipment of the goods and the amount of the offset advance from the buyer, including VAT, are indicated.

Rice. 7. Registration of offset of advance payment from the buyer

As a result of the document Commission agent's report on sales With this filling option, the following transactions will be generated:

Debit 68.02 Credit 76.AB - for the amount of credited VAT from the prepayment.

In addition, entries are made in the following accumulation registers for the amount of credited VAT:

- VAT advances under commission agreements with a view of movement Consumption;

- VAT purchases.

Deduction of VAT on commission fees

VAT deduction on an invoice received from a commission agent can be registered in two ways:

- when conducting a document Commission agent's report on sales with flag set Record VAT deduction in the purchase ledger in a subordinate document Invoice received for receipt;

- regulatory document Generating purchase ledger entries.

The deduction of VAT on commission fees is reflected in the accounting entry:

Debit 68.02 Credit 19.04 - for the amount of VAT on commission fees.

In addition, for the amount of VAT presented by the commission agent, entries are made in the following accumulation registers:

- VAT purchases;

- VAT presented with a view of movement Consumption;

- Invoice journal.

Based on register entries VAT Purchases And VAT Sales without additional data processing, the purchase book and VAT declaration are filled out.

Receipt of funds from the commission agent for goods sold

To determine the amount of the commission agent's debt after commission deduction, you can use the report Balance sheet for account 76.09 “Other settlements with various debtors and creditors”(Fig. 8).

Rice. 8. SALT for account 76.09

As can be seen from the balance sheet, the debit of account 76.09 reflects the receivables of TF Mega CJSC in the amount of 45,000.00 rubles. The debt will be repaid upon reflection of the payment received from the commission agent for goods sold. Payment can be registered with a document based on document Commission agent's report on sales. When filling out the document Receipt to the current account in the fields Settlement account And Advance account Account for settlements with commission agent 76.09 “Other settlements with various debtors and creditors” is used.

Before the commissioner's (agent's) report is approved, the funds received by the principal (principal) from the intermediary cannot be clearly identified as an advance payment, therefore, in any case, it is recommended to use account 76.09

If in the field Advance account use settlement account 62.02 “Settlements for advances received”, then the program will determine the funds received from the commission agent as an advance payment, and when processing Registration of invoices for advance payments an invoice for the advance payment will be generated and automatic accrual will occur VAT on prepayment, which may not be such. If the funds received are still an advance payment from the buyer, then VAT will be calculated again along with the calculation of VAT on the advance payment based on the commission agent’s report.

Taking into account the specifics of intermediary agreements, and in order to eliminate errors in accounting, when concluding an agreement with a commission agent (agent), it is necessary to clearly define the procedure for document flow, the deadlines for submitting reports and transferring funds, as well as the responsibilities of the parties.

One of the manifestations of the financial crisis is the lack or insufficiency of funds from trading organizations to purchase goods from manufacturers. This situation encourages product manufacturers and trade organizations to look for optimal ways to sell goods to the final consumer, who is the main source of funds in a crisis. One solution to the problem is to transfer products to trade organizations under a commission agreement. Doctor of Economics, Professor of the Financial Academy under the Government of the Russian Federation S.A. talks about accounting in “1C: Accounting 8” for sales of products under a commission agreement with the manufacturer. Kharitonov.

Firstly

Secondly

Third

Rice. 1

Table 1

Example

Accounting procedure

The sale of products under a commission agreement is regulated by Chapter 51 of the Civil Code of the Russian Federation. The peculiarity of such sales is that when products are shipped under a commission agreement, ownership does not transfer from the consignor (manufacturer organization) to the commission agent. Accordingly, in accounting, the actual cost of products transferred for sale is written off from the credit of account 43 “Finished products” to the debit of account 45.02 “Finished products shipped” (and not account 90 “Sales”, as in normal sales). In account 45.02, products are accounted for until a notification is received from the commission agent about the transfer of products to the buyer.

The sale of products under a commission agreement has a number of features.

Firstly, the principal has the right to reclaim unsold products back, and such an operation will not be considered as receipt of goods from the supplier, as in the case of a contract for the supply of goods. In accounting, the return is formalized by reverse posting: to the debit of account 43 “Finished products” from the credit of account 45.02 “Finished products shipped”.

Secondly, the amount of revenue of the principal is the entire amount of cash proceeds received by the commission agent from buyers.

Third, the commission agent is required to submit an invoice for the amount of the commission, regardless of the method of calculating the commission (percentage of the sales price; everything that exceeds the established price; etc.).

Figure 1 shows a diagram for reflecting in “1C: Accounting 8” operations for the sale of products under a commission agreement in a situation where an intermediary (trade organization) is involved in settlements (the most typical situation).

Rice. 1

Table 1 summarizes the records for reflecting these transactions in the accounting and tax records of the manufacturing organization.

Table 1

We will consider the order of reflection in “1C: Accounting 8” of individual operations given in Table 1 using the following example.

Example

Commission agreement No. 24 was concluded between the manufacturer Belaya Akatsiya LLC (committent) and the trade organization Averton CJSC (commission agent), within the framework of which on January 30, 2009, 3 units of the “Women’s Coat” product were shipped from the consignor’s finished product warehouse for its sale at a price of 11,800 rubles. per unit (including VAT).

The terms of the agreement stipulate that the commission agent is instructed to sell the products to end customers at a specified price, and transfer the proceeds from the sale of the products to the principal. The remuneration for execution of the commission agreement is set at 15% of the sales amount based on the commission agent’s report. The commission amount is withheld by the commission agent from the amount to be transferred for the products sold.

On February 5, a report on the sale of products was received from the commission agent.

On February 9, the funds for the products sold minus the withheld remuneration were credited to the current account.

Shipment of products to the commission agent

To register the transaction of shipment of products to the commission agent and reflect it in accounting, we enter the document Sales of goods and services with the operation Sale, commission.

In the details of the header of the document form we indicate (see Fig. 2):

- document date - 01/30/2009 (shipment date);

- counterparty (commission agent) - CJSC "Averton" (choice from the directory Counterparties);

- agreement with the counterparty - Commission Agreement No. 24 (selected from the directory Contracts of counterparties, in the contract parameters you should specify Type of agreement - With commission agent).

Rice. 2

On the tab Goods We indicate the data for accounting of products transferred to the commission agent:

- nomenclature - Women's coat (choice from the directory Nomenclature);

- quantity - 3 pieces;

- selling price (excluding VAT) - 10,000 rubles.

- VAT rate is 18%.

Column VAT amount, as well as columns with accounting accounts, the program fills in automatically based on the context of the transaction reflected by the document.

Please note that the sales price in document form is used only for the purpose of generating a printed form of the invoice. When posting a document to the accounting registers, entries are entered from the credit of account 43 “Finished products” to the debit of account 45.02 “Finished products shipped” at the planned cost of production.

Please also note that there is no need to issue an invoice for this product shipment operation, since it is not recognized as a sales operation for the purposes of calculating value added tax.

Reflection of the commission agent's sales report

To reflect the report received from a trade organization in the principal's accounting, enter the document .

In the header of the document we indicate (see Fig. 3):

- document date - 02/05/2009 (date of the commissioner's report);

- counterparty (commission agent) - Averton CJSC (selected from the Counterparties directory);

- agreement with the counterparty - Commission Agreement No. 24 (selected from the directory Contracts of counterparties).

Rice. 3

Commission calculation method ( Percentage of the sale amount) and commission percentage (15) the program fills in by default in accordance with the values specified in the contract properties in the directory Contracts of counterparties.

In props VAT ex. The program defaults to the default tax rate for the current user. If necessary, the VAT rate can be selected from the list of rates.

Tab Goods for the example under consideration, it should be filled in using the command Fill -> Fill by implementation data from the document Sales of goods and services for shipment of goods to the commission agent.

The tabular part in this case will contain the following information:

- column Nomenclature- Coat female;

- column Quantity- 3 pieces;

- speakers Price, Amount, Transfer price, Transfer amount, % VAT And VAT amount filled in according to the shipping document data;

- speakers Reward And VAT amount of remuneration are filled in automatically based on data on the amount of sales, the method of calculating remuneration and the commission percentage;

- speakers Accounting account (BU) And Accounting account (NU)- account 45.02 “Finished products shipped”;

- speakers Income account (IU) And Income account (IA)- account 90.01.1 “Proceeds from sales not subject to UTII”;

- column VAT account- account 90.03 “Value added tax”;

- speakers Expense account (AC) And Expense account (OU)- account 90.02.1 “Cost of sales not subject to UTII” of the chart of accounts of accounting and the corresponding account 90.02 “Cost of sales” of the chart of accounts of the tax accounting program (for income tax);

- speakers Subconto (BU) And Subconto (NU)- Sewing outerwear.

The value of the value added tax rate and subconto are entered according to the product description data in the Nomenclature directory, the value of income and expense accounts, VAT accounting accounts - according to the data on the default accounting accounts for the item included in the group Products.

To reflect the costs of remuneration to the commission agent in accounting and tax accounting, fill out the tab Cost accounting. We indicate:

- Cost account (AC) And Cost Account (CO)- account 44.02 “Business expenses in organizations engaged in industrial and other production activities”;

- Cost items (BU and NU)- Other expenses (selected from the directory Expenditures).

Go to the tab Settlement accounts(see Fig. 4). Check the box Withhold commission. For other accounts we leave the default value.

Rice. 4

Go to the tab Invoice received, check the box An invoice for remuneration has been presented and indicate the details of the commission agent’s invoice issued for services for the sale of goods.

We record the document in the information database and post it, after which we open the document form through the invoice input field Invoice issued to prepare an invoice for the sale of products. We also record and post this document (see Fig. 5).

Rice. 5

When posting a document Commissioner's sales report Postings 2-6 from the table will be entered into the accounting registers. 1, as well as wiring 8.

If in the accounting policy parameters the sign of simplified administration of value added tax is set, and on the tab Invoice received checkbox checked Record VAT deduction in the purchase ledger, then when posting the document Commissioner's sales report An additional entry is made to the debit of account 68.02 “Value added tax” from the credit of account 19.04 “VAT on purchased services”, reflecting the application of the deduction of the amount of VAT on commission fees.

Cash settlements with the commission agent

The commission agent is obliged to transfer the funds received from buyers (as an advance payment for products or as payment for products transferred to buyers) to the principal (in full or less remuneration) within the time limits established by the commission agreement.

If the commission agent makes a transfer by payment order, then the committent registers the transfer of funds to the current account in accounting using a document Incoming payment order with surgery Payment from the buyer. In this case, the commission agent performs the function of the buyer. If the funds represent an advance (advance payment), then the corresponding account for the posting generated when posting the document will be subaccount 62.02 “Settlements for advances received.” If funds are credited to the current account to pay off the commission agent's receivables for goods sold, then the received amount is reflected in the credit of subaccount 62.01 "Settlements with buyers and customers."

The terms of the agreement may provide for payment of the commission by a separate payment order after approval of the report on the sale of products. In this case, to prepare an order to the bank, a document is entered Outgoing payment order with surgery Payment to the supplier.

In conclusion, we note that some accounting experts recommend using account 76 “Settlements with other debtors and creditors” instead of accounts 60 and 62 to conduct settlements with the commission agent regarding remuneration for the provision of services, as well as for funds received from customers. . If the committing organization wishes to follow these recommendations, then when reflecting in "1C: Accounting 8" the commission agent's sales report on the tab Settlement accounts settlement accounts need to be replaced default to the corresponding subaccounts of account 76. In particular, instead of subaccounts 60.01 and 60.02, subaccount 76.05 “Settlements with other suppliers and contractors” should be indicated, and instead of subaccounts 62.01 and 62.02, subaccount 76.06 “Settlements with other buyers and customers”.

In cases where prices for products and services are set in conventional units, instead of subaccounts 76.05 and 76.06, subaccounts 76.35 “Settlements with other suppliers and contractors (in cu)” and 76.36 “Settlements with other buyers and customers (in cu)".

Two more sub-accounts have been opened to account 76 of the 1C: Accounting 8 chart of accounts, which can be used to conduct settlements with the commission agent: sub-accounts 76.26 and 76.25. Subaccount 76.26 "Settlements with other buyers and customers (in foreign currency)" should be used to account for settlements when selling products through a commission agent under a foreign economic contract with payment in foreign currency, and subaccount 76.25 "Settlements with other suppliers and contractors (in foreign currency)" if in this case, the commission must be paid in foreign currency.

The commission agent's income will include only the amount of the commission as of the accrual date. The principal's income includes the cost of goods sold as of the date indicated in the commission agent's report (clause 137.5 of the Tax Code) and expenses that constitute the cost of goods sold (clause 138.4 of the Tax Code). Income and expenses will be reflected in the income tax return in lines 02 and 05.1, respectively. In addition, the principal includes the remuneration due to the commission agent as of the date of signing the relevant act as expenses and reflects it in line 06.2 as sales expenses of the income tax return. As for VAT, according to paragraphs. "e" pp. 14.1.191 of the Tax Code of Ukraine, the delivery of goods is equivalent to their transfer under an agreement under which a commission is paid for the sale or acquisition. And operations for the supply of goods are subject to VAT.

Tax liabilities and tax credits must be formed according to the “first” event rule. Based on this, in the case of concluding a commission agreement for the sale of goods, the principal’s tax obligations and the commission agent’s tax credit are formed on the date of shipment of the goods. If, according to the commission agreement, the commission agent acquires goods at the expense of the principal, then the date on which the commission agent’s tax obligations and the principal’s right to a tax credit arise will be the date on which the first of the events occurs: the transfer of funds by the principal to the commission agent or the transfer of goods by the commission agent to the principal. When determining the VAT tax base, the contractual value of the supply must not be lower than the level of regular prices.

In the “Accounting for Ukraine” configuration, you need to pay attention to the correct execution of contracts with counterparties: commission agents and principals. In the contract form, you must select the appropriate type of contract: “With a commission agent” or “With a principal.” In this case, on the “Basic” tab, the “Complex VAT accounting” option will be automatically enabled; on the “Tax accounting” tab in the “Tax accounting scheme” line, the choice “With a commission agent (since 2011)” or “With a committent (since 2011)” will be made. .)" and "Type of agreement under the Civil Code (for a tax invoice)" - Commission Agreement." Let's look at examples.

Accounting with the principal

The principal purchased goods at a price of 120 UAH including VAT and transferred 40 units of goods to the commission agent at a price of 240 UAH including VAT. The amount of commission is 1500 UAH including VAT.

The goods were sold by the commission agent.

The name of business transactions, documents, postings in the “Accounting for Ukraine” configuration, as well as the lines of the Income Tax Declaration are presented in Table 1.

We document the transfer of goods to the commission agent with the document “Sales of goods and services”, which we open on the basis of the document “Receipt of goods and services”, with the help of which the goods are capitalized. We enter the name of the commission agent in the “Counterparties” directory and carefully fill out the agreement form as described above.

Table 1

| Contents of operations | Documentation | Postings | Profit declaration |

|---|---|---|---|

| The goods were transferred to the commission agent | Sales of goods and services |

Dt 283, Kt 281 4000 Dt 6431, Kt 64321600 |

|

| The commission agent's report is presented: the sale of goods is reflected and commission accrued | Commissioner's sales report |

Dt 902, Kt 283 Dt 361, Kt 702 Dt 702, Kt 6431 Dt 631, Kt 361 Dt 93, Kt 361 Dt 6442, Kt 361 |

|

| VAT tax obligations have been completed | Tax invoice |

Dt 6432, Kt 6412 |

|

| The received Tax Invoice from the commission agent has been registered |

Dt 6412, Kt 6442 |

||

| Commission transferred |

Dt 631, Kt 311 |

In the tabular part of the document, under the “Products” tab, we indicate the number of goods 40 and the price 240 UAH including VAT. The document will generate a posting for the transfer of goods from account 281 to account 283 “Goods on commission” at the cost of receipt of goods and will reflect VAT tax obligations based on the transfer price. The wiring is shown in Fig. 1.

Figure 1. Postings generated by the document “Sales of goods and services”

Based on the date of submission of the report by the commission agent, we draw up the document “Commission Agent’s Sales Report”. We open the document form based on the document “Sales of goods and services”. Enable the “Withhold commission” option. In the “Calculation method” line, select “Not calculated” for this example. The tabular part of the document will be filled with data from the base document. The “Price” column indicates the price at which the goods were sold by the commission agent. It does not have to coincide with the price at which the goods were sold. In our problem, these two prices are the same. We indicate the remuneration amount 1250, the program will calculate the VAT remuneration, “Sales scheme” - “Goods”. The form of the document is presented in Fig. 2.

Figure 2. Fragment of the document “Sales commission agent’s report”

Under the “Cost Accounting” tab, we indicate cost account 93, the cost item “Costs for commissions to sellers, sales agents and employees of departments, maintenance”, which corresponds to line 06.2 of the Income Tax Declaration; under the “Settlements Account” tab, we indicate account 361. So, the document is completed. The transactions generated by the document are presented in Fig. 3. As you can see, the program generated transactions for the sale of goods, but also accrued a commission. Automatically, the amount of income will be included in line 02, the cost of goods in line 05.1, and the amount of commission in line 06.2 of the income tax return. Based on the document “Sales commission agent’s report”, we enter the document “Tax invoice”, which will generate VAT tax obligations based on the cost of goods sold, in the amount of 1600 UAH, as well as the document “Registration of an incoming tax document”, which will generate a tax credit in the amount of 250 UAH, tax base - the amount of commission. Based on the “Commission Agent’s Sales Report”, we prepare the transfer of commission using the document “Outgoing Payment Order” with the choice of the “Payment to Supplier” form.

Figure 3. Postings generated by the document “Commission Agent’s Sales Report”

Accounting with a commission agent

The name of business transactions, documents, postings in the “Accounting for Ukraine” configuration, as well as the lines of the Income Tax Declaration are presented in Table 2.

table 2

| Contents of operations | Documentation | Postings | Profit declaration |

|---|---|---|---|

| Product accepted for consignment | Receipt of goods and services |

Dt 6442, Kt 6441 |

|

| Reflection of tax credit for goods received from the consignor | Registration of incoming tax document |

Dt 6412, Kt 6442 |

|

| Products sold and shipped | Sales of goods and services |

Dt 361, Kt 702 Dt 702, Kt 6432 |

|

| Reflection of VAT tax obligations | Tax invoice |

Dt 6432, Kt 6412 |

|

| Payment received for goods | Incoming payment order |

Dt 311, Kt 361 |

|

| Deduction from income of the amount due to the principal and commission calculation |

Report to the consignor on sales of goods |

Dt 704, Kt 631 Dt 6441, Kt 704 Dt 631, Kt 361 Dt 361, Kt 703 Dt 703, Kt 6432 |

|

| Reflection of tax liabilities VAT commission fees | Tax invoice |

Dt 6432, Kt 6412 |

|

| Funds transferred to the principal | Outgoing payment order |

Dt 631, Kt 311 |

|

| Receiving a commission from the principal | Incoming payment order |

Dt 311, Kt 361 |

Acceptance of goods for commission is documented with the document “Receipt of goods and services”. To reflect goods under account 0241, you must indicate this account in the tabular part of the document. You can do it differently. In the “Nomenclature” directory, create a folder “Goods for commission” and using the “Go” button open the “Item Accounting Accounts” window, in which indicate accounting account 0241, fill in the lines “Sales scheme” - “Goods”, “Tax purpose” - "Region VAT", "Tax purposes of income and expenses" - "Households. d-st.” Enter the name of the goods in the “Items on commission” folder. The document “Receipt of goods and services” will post not only with account 0241, but also with the accrual of the VAT tax credit (see Fig. 4).

Figure 4. Postings generated by the document “Receipt of goods and services”

Based on this document, we enter “Registration of an incoming tax document”, which reflects the VAT tax credit. Based on the document “Receipt of goods and services”, we formalize the sale of goods with the document “Sales of goods and services”. Based on the document “Sales of goods and services” to reflect VAT tax obligations, we draw up the document “Tax Invoice”. Based on the document “Receipt of goods and services,” we draw up the document “Report to the principal on sales of goods.” It is presented in Fig. 5.

Figure 5. Fragments of the document “Report to the principal on sales of goods”

In the tabular part of this document, it is possible to enter the price of the goods at which it is received from the principal, as well as the price of the goods at which the commission agent can sell this product. In our problem this price is the same. Here you can specify the amount of the reward. Regarding the commission, in the “Calculation method” line we can select “Not calculated”, since in our task this amount is fixed. On the “Settlement Accounts” tab, the “Withhold commission” option is enabled. In the lines “Account for accounting of settlements (remuneration)” 361, “Account for accounting of settlements with the counterparty” and “Account for accounting of settlements for advances” 631. On the tab “Income accounts” in the line “Remuneration service” in the reference book “Nomenclature” in in the “Services” folder, enter the name “Commission” and select it, and in the “Implementation scheme” line, select “Services”. So, the document is completed. The postings generated by the document are presented in Fig. 6. Based on the document “Report to the Principal on Sales”, we reflect the VAT tax obligations on commission fees with the document “Tax Invoice”. Thus, the commission agent’s VAT tax obligations in the amount of UAH 1,600 will be repaid with a VAT tax credit for the same amount. And VAT obligations in the amount of 250 UAH will need to be paid according to this example. As for income tax, the commission agent, the amount of commission without VAT will be included in income.

Figure 6. Postings generated by the document “Report to the principal on sales of goods”