Ministry of Education and Science of the Russian Federation

Federal State Budgetary Educational Institution of Higher Professional Education

"Transbaikal State University"

(FSBEI HPE "ZabGU") Faculty of Law

Department of Administrative Law and Customs Affairs

Course work

Budget forecasting and planning: essence, methods and role in organizing the budget process

Completed:

student of group YUV-10-4

Ishchenko Ya.V.

Checked by: Ph.D.

Savosina N.G.

Introduction

2 The essence of budget planning and forecasting and their role in organizing the budget process

3 Budget forecasting methods

Conclusion

Introduction

The topic of this work is relevant for study, because a budget is a form of formation and expenditure of a fund of funds intended for financial support of the tasks and functions of the state and local self-government, therefore, studying the fundamentals of the procedure for drawing up not only the federal budget, but also the budgets of the constituent entities of the Russian Federation and local self-government is an important aspect of the study of budget planning and forecasting in in general.

Planning is one of the important methods of state regulation of the economy. It is carried out by developing tasks for targeted influence on the reproduction process. As one of the main functions of management, planning ensures not only targeted, but also dynamic and proportional development of the management object.

The purpose of this course work is to consider the essence, methods of budget planning and forecasting, as well as the role in organizing the budget process.

To achieve the goal, the following tasks were set and solved: to determine the essence of budget planning and forecasting; consider methods of budget planning and forecasting and their characteristics; study what methods of budget planning and forecasting are used in Russia; identify areas for improving methods used in budget planning and forecasting.

The object of the study is the planning methodology in the system of monetary relations associated with the receipt of taxes and fees in budgets of different levels and their expenditure in accordance with the functions and tasks of state authorities and local self-government.

The subject of the study is a set of theoretical and practical problems caused by the process of planning relations on the formation and expenditure of budgetary funds of authorities at all levels.

The theoretical basis of the study was the works of Russian and foreign economists and financiers.

The methodological basis of the study was a systematic and comparative analysis, fundamental conceptual provisions contained in the works of domestic and foreign economists on the effectiveness of budget planning methods in a market economy, improving the mechanism of budget forecasting and planning revenues and expenses of budgets at all levels.

The scientific novelty of this work lies in a detailed analysis of the essence of the concept of planning and forecasting, methods and principles of the current budget planning mechanism, as well as ways to develop the system of budget forecasting and planning.

1 Basic aspects of planning and forecasting

The idea of the future is called foresight. It can be both scientific and non-scientific. Non-scientific foresight can be ordinary, intuitive, religious. However, foresight in economic life should, as a rule, be scientific. Scientific foresight is an advanced reflection of reality, based on knowledge of the laws of nature, society and thinking.

Scientific foresight can take the form of: prediction, which is descriptive in nature, or the form of pre-instruction, when it is indicated that actions are necessary to achieve a goal. A form of prediction is a forecast, that is, scientific research aimed at determining the prospects for the development of a phenomenon.

Those phenomena are predicted that a person cannot influence or the influence is weak. For example, forecasts are developed for weather, harvest, fashion, demand for goods, birth rates, and deaths. It is clear that these phenomena cannot be predicted with high accuracy, much less planned.

Prediction, in contrast to prediction, is associated with solving a problem. Here there is necessarily a strong-willed decision of a person (group of people) to achieve the intended goal. Prediction may be in the form of a plan or program.

A plan is a decision on measures to achieve a goal. A program is a system of targets for the development of a phenomenon and planned ways to achieve them.

Forecast and plan, derivatives of economic foresight, have much in common in their nature, although the plan is considered as a more complex category. Let us note three features of the forecast and plan. The forecast is associated with the objective course of life and comes from its dialectical understanding, when necessity makes its way among contingencies, while the plan includes the decision, will and responsibility of the people who made it, with the goal of transforming reality. Forecasting is characterized by the probabilistic occurrence of an event; the plan treats this event as the goal of the activity. The forecast is characterized by alternative ways and timing of achieving the event; a plan is characterized by a decision on a system of measures providing for sequence, order, timing and means of achieving the desired event.

There is another relationship between forecast and plan. The fact is that for the scientific substantiation of the plan, as a rule, such methods are used as: analysis, that is, research and description of the phenomenon; explanation or diagnosis; prediction, including forecast. This means that the forecast is often used in the planning process.

The presence in the plan of a forecast that includes past trends usually increases the accuracy of the decision made, that is, the forecast becomes, as it were, part of the plan, the initial stage of its justification. As one author aptly put it, a plan without a forecast is an administrative action. Thus, the forecast and the plan, while having much in common, also have differences. The latter consist, firstly, in the way of handling information about the future: a forecast is a probability, a plan is a decision; secondly, in a quantitative assessment of the future: a forecast is a range (interval) of a value, a plan is a specific value; thirdly, in relation to freedom: a forecast is an optional action, a plan is a mandatory execution.

1.2 The essence of budget planning and forecasting and their role in organizing the budget process

Budget planning is the centralized distribution and redistribution of the value of the gross social product and national income between parts of the budget system on the basis of a national socio-economic program for the development of the country in the process of drawing up and executing budgets and extra-budgetary funds at various levels. Financial planning at the national and territorial level is ensured by a system of financial plans that are linked to material and labor balances in value terms. The system of financial plans includes long-term financial plans and consolidated financial balances (SFB), compiled at the national and territorial levels of government. The long-term financial plan is developed on the basis of forecast indicators for the economic and social development of the state. It contains data on the budget's capabilities to mobilize revenues and finance budget expenditure items. This plan is drawn up for three years based on aggregated budget indicators.

The plan is adjusted annually to reflect improvements in the forecast for the socio-economic development of the state. The consolidated financial balance is the balance of financial resources created and used in the state or in a certain territory. The consolidated financial balance covers funds from all budgets, extra-budgetary trust funds and enterprises located in the relevant territory. Drawing up a consolidated financial balance sheet is a preparatory stage in developing a targeted financial plan, i.e., a budget. Budget forecasting is closely related to consolidated financial planning. Budget forecasting is targeted and designed for the budget period, i.e. for no more than a year.

A forecast of budget development means a complex of probabilistic assessments of possible ways of developing its revenue and expenditure parts. The purpose of budget forecasting is to develop and justify optimal ways of budget development on the basis of current trends, specific socio-economic conditions and future estimates and, on this basis, make proposals for its strengthening.

When developing a budget development forecast, various methods can be used. Extrapolation method, i.e. drawing up a perspective based on the practice of previous periods. The method of expert assessments, i.e. a forecast based on estimates made and substantiated by competent specialists in certain branches of science and the national economy. Applying these two methods simultaneously; In this case, both objective development trends and expert opinions are used. The next stage of budget planning is the process of drafting a budget.

The role and place of budget forecasting and planning in the system of economic regulation are determined by their close interaction. After all, forecasting is the basis for developing, preparing and approving planning decisions. Forecasting determines the directions for the development of planning and the development of specific plans that take into account the characteristics of the situations in which they are developed: short-term, medium-term and long-term.

Budget forecasting is based on structural analysis and possible options for their development in the future, which fit within the framework of the current and strategic economic policy of the state.

The main task of developing a draft budget is to determine the volume of funds centralized in the budget for the purpose of financial support for the functions assigned to state authorities and local governments, and the activities provided for by the forecast of economic and social development of the state and territories. The main source of information for drawing up a draft budget is the forecast of socio-economic development of the state or territory, which in turn is developed on the basis of data on economic and social development for the reporting period, development trends for the planned year and other indicators. The development of the draft federal budget is based on the directions of the planned financial and budgetary policy defined in the Budget Message of the President of the Russian Federation to the Government of the Russian Federation, and the indicators of the forecast of socio-economic development of Russia for the planned year developed by the Ministry of Economy of the Russian Federation, the updated parameters of the medium-term forecast of socio-economic development of Russia, indicators of the consolidated financial balance.

Also used are indicators of the monetary program compiled by the Central Bank of the Russian Federation and indicators of long-term federal target programs, the list of which is determined by the Government of the Russian Federation on the basis of long-term and medium-term forecasts of the country's socio-economic development. At the first stage of the formation of the draft budget, federal executive authorities develop scenario conditions for economic and social development for the planned year, which reflects the main macroeconomic indicators and materials for clarifying the parameters of the medium-term forecast for the economic and social development of the country.

After the Government of the Russian Federation approves the scenario conditions, the Ministry of Finance of the Russian Federation develops the main characteristics of federal budget revenues and expenditures for the planned year and projects the amounts of basic federal budget revenues and expenditures for the medium term. Also, proposals on minimum wages and pensions, the procedure for indexing wages of public sector workers and pensions in the planned year and for the medium term are being considered. At the second stage of budget development, federal executive authorities distribute the maximum volumes of budget funds according to budget classification indicators, as well as the targeted distribution of financial resources between the main managers of budget funds.

Chapter 2. Development of budget planning and forecasting methodology

1 Scientific foundations of financial forecasting and planning

The methodology of planning and forecasting is understood as a system of approaches, principles, indicators, techniques and methods for developing and justifying forecasts and planning decisions, as well as the logic of planning and forecasting.

The methodology is based on economic theory, which studies the patterns and laws of social development, the basic provisions and trends of reproductive processes, and develops and improves as economic theory itself develops. The planning and forecasting methodology must ensure the achievement of set goals and the solution of specific problems in the current economic situation. Indicators of plans and forecasts are a form of quantitative expression of the planned and forecast decisions made.

The methodology is a set of working methods and techniques used to carry out specific planned and forecast calculations and various indicators of the plan and forecast. It is of a private nature, is subordinate to the methodology of planning and forecasting and is included in it as an integral part.

Budget planning is the process of developing the overall structure and volumes of budget revenues and expenses for the next financial year and the future. The scheme of this process is established by the Budget Code of the Russian Federation, which regulates the basics of drawing up draft budgets at all levels.

Budget planning occupies a central place in the public finance management system. It connects all areas of public finance into a single whole: the provision of budget services, debt management, management of budget purchases, planning of budget investments, planning of interbudgetary relations, etc.

The budget planning system is a set of organization, methods and procedures for the formation of a draft budget. The budget planning system consists of annual budget planning and long-term (medium-term) financial planning.

The process of developing the annual budget is ensured by highlighting individual elements of the long-term financial plan related to the next budget year. However, the annual budget should be considered only as a more detailed and integral part of the long-term financial plan.

The results of the budget planning process are presented in the form of the following documents:

scenario conditions;

main directions of budget, tax and debt policy;

long-term financial plan;

the budget of a constituent entity of the Russian Federation (municipal entity) for the next year (in the case of a transition to a multi-year budget - for three years).

Budget planning is carried out in several stages:

the process of forming scenario conditions and main directions of budget, tax, debt and investment policies for the medium term;

the financial authority develops a long-term financial plan and target figures for the draft budget for the next year;

development of a draft budget of a constituent entity of the Russian Federation (municipal entity) based on the approved financial plan;

the draft budget, together with the administration’s action program and financial plan, is considered by the executive authority;

Taking into account the approved budget, clarification of socio-economic development forecast indicators and other factors, the long-term financial plan is clarified.

Budgetary forecasting (from the English budgetary forecasting) is a well-founded assumption, based on real calculations, about the directions of budget development, the possible states of its income and expenses in the future, the ways and timing of achieving these states. This is an integral part of the budget process, the basis of budget planning. The forecast is based on a thorough study of information about the state of the budget at the moment; determining, in accordance with the identified patterns, different options for achieving the expected budget indicators; finding, as a result of analysis, the best option for the development of budgetary relations.

Budget forecasting focuses on finding the optimal solution to problems and choosing the best possible option. In the process of budget forecasting, various options for the state's budget policy, different concepts of budget development are considered, taking into account a variety of economic and social objectives, objective and subjective factors operating at the state, regional and local levels. At the same time, the continuity of budget forecasting determines the systematic refinement of budget indicators as new data is generated.

The purpose of budget forecasting is to create scientific prerequisites, including scientific analysis of trends in the development of public funds, alternative forecasts of the upcoming development of revenue receipts and directions for using budget funds, assessment of the possible consequences of decisions made, justification of sources of income generation and directions for spending funds.

There are three types of forecasting:

Long-term - developed once every five years for a ten-year period. Long-term forecast data is used in developing concepts of socio-economic development, forecasts and programs for the medium term;

Medium-term - developed for a period of three to five years, subject to annual adjustments;

Short-term - compiled for the financial year.

The results of state forecasting of socio-economic development are used when making specific decisions in the field of socio-economic policy of the state.

Thus, having studied the scientific foundations of financial planning and forecasting, we can conclude that budget planning is intended to show real acceptable costs and justify a strategy for solving priority sectoral, regional and municipal problems. And the task of economic forecasting is, on the one hand, to find out the prospects for the near or more distant future in the area under study, and on the other hand, to help optimize current and long-term planning and regulation of the economy, based on the compiled forecast.

2 Budget planning methods

Budget planning is a component of financial planning that allows you to determine the volume, sources and targeted use of budget resources at each level of government: federal, regional, municipal.

Budget planning methods include:

economic analysis;

index,

balance,

normative,

program-targeted,

results-based budgeting, etc.

Economic analysis method

Economic analysis is an integral part and one of the main elements of the logic of forecasting and planning.

The essence of the method of economic analysis is that an economic process or phenomenon is divided into its component parts and the relationship and influence of these parts on each other and on the course of development of the entire process is revealed. Analysis allows us to reveal the essence of such a process, determine the patterns of its changes in the forecast (planning) period, and comprehensively assess the possibilities and ways to achieve the goals.

The process of economic analysis is divided into a number of stages: formulation of the problem, determination of goals and evaluation criteria; preparing information for analysis; study and analytical processing of information; developing recommendations on possible options for solving the problem and achieving goals; registration of analysis results.

In the process of economic analysis, methods of comparison, grouping, the index method are used, balance calculations are carried out, normative and economic-mathematical methods are used (method of correlation and regression analysis, etc.). The grouping method involves combining objects of economic analysis into qualitatively homogeneous groups, which makes it possible to study the patterns of their development, study the influence of individual factors that determine their dynamics, the nature of interaction, and identify development trends of this homogeneous group of economic phenomena and processes.

To determine the influence of each factor on the change in the general indicator, it is advisable to use the elimination method. The influence of factors is determined in the established sequence. It is assumed that when determining the influence of a given factor, the numerical values of the indicators of other factors remain unchanged. In the practice of economic analysis, elimination is known as the technique of chain substitutions.

Economic analysis involves a comprehensive study of the pace of economic development, the existing national economic proportions, and the structure of social production. Of particular importance is the identification of trends in changes in the most important indicators of production efficiency that characterize the quality of economic growth: material and energy intensity, capital productivity, labor productivity.

Normative method

The normative method is one of the main methods of budget planning. In modern conditions, it has begun to be given special importance in connection with the use of a number of norms and regulations as regulators of the economy. The essence of the normative method lies in the feasibility study of forecasts, plans, programs using norms and standards. With the help of norms and standards, the most important proportions are substantiated, the development of material production and non-production spheres is substantiated, and the economy is regulated.

In the practice of forecasting and planning, a system of norms and standards is used, including norms for the consumption of raw materials and fuel and energy resources; labor cost standards; norms and standards for the use of fixed production assets; standards for capital investments and capital construction; norms and standards characterizing the efficiency of social production; financial (depreciation rates, profitability standards, tax rates, etc.); social (minimum consumer budget, minimum wage, standards for consumption of food and non-food products per capita, standards for living space in urban and rural areas); environmental (standards for the release of harmful substances into the environment, standards for the content of harmful substances in water, etc.) norms and standards.

In current practice, norms and standards are determined by various methods. The most advanced is the calculation and analytical method, which involves the determination of norms and standards based on technical and economic calculations. For this purpose, technical documentation is used taking into account the latest achievements of science and technology, methods and instructions. The norms calculated by this method are called technically sound. They are the most progressive. In cases where it is not possible to use the calculation and analytical method, norms and standards are determined on the basis of reporting and statistical data for the past period or empirically - on the basis of experiences and experimental data, taking into account the best practices achieved and production reserves identified as a result of the analysis.

To improve the scientific level and quality of development of norms and regulations, it is necessary to improve the standardization, organization and technology for preparing norms and standards.

Balance sheet method

Using the balance method, the principle of balance and proportionality is implemented. It is used in the development of forecasts, plans and programs. Its essence lies in linking the country's needs for various types of products, material, labor and financial resources with production capabilities and sources of resources.

The balance method involves the development of balances, which are a system of indicators in which one part, characterizing resources by source of income, is equal to the other, showing the distribution (use) in all areas of their consumption. The results of balance sheet calculations serve as the basis for the formation of structural, social, fiscal and monetary policies, as well as employment and foreign economic activity policies. Balance sheets are also used to identify imbalances in the current period, reveal unused reserves and justify new proportions.

In the system of forecast and planned balances, one of the central places is occupied by material balances. With their help, the production and consumption of specific types of products are linked, and the production program of enterprises is justified. They are widely used to establish inter-industry proportions.

Developing a balance begins with determining the resource requirements for production and operational needs and capital construction, for which a number of methods can be used. The resource part of the balance is formed after determining needs. Resources are calculated for all sources of income. The final stage of developing a balance is the process of linking needs with resources.

The balance method is being improved in the following areas: improving the methodology for developing balance sheets, especially intersectoral ones; use of computers to carry out balance calculations; application of progressive norms and standards in the development of forecast and planned balances.

Program-target method

Compared to other methods, the program-target method (PTM) is relatively new and underdeveloped. It has become widespread only in recent years, although it has been known for a long time.

PCM is closely related to normative, balance sheet and economic-mathematical methods and involves the development of a plan starting with an assessment of final needs and based on the goals of economic development with the further search and determination of effective ways and means of achieving them and resource provision. Using this method, the principle of priority planning is implemented.

The essence of the PCM lies in the selection of the main goals of social, economic and scientific-technical development, the development of interrelated measures to achieve them within the scheduled time frame, with a balanced provision of resources, taking into account their effective use.

PCM is used in the development of targeted comprehensive programs, which are a document that reflects the goal and complex of research, social, production, organizational, economic and other tasks and activities, linked by resources, performers and implementation deadlines.

The development of targeted comprehensive programs is carried out in stages.

At the first stage, a list of the most important problems is formed, from which the problems that require a priority solution are then selected.

At the second stage, a task is given to develop a program to solve a specific problem. It reflects the program's goals, resource limits, participants, and program implementation timelines. At this stage, the parameters characterizing the goals of the program are specified and the tasks of its implementation for individual periods are determined. The general goal is broken down into subgoals.

At the third stage, tasks and activities necessary for the successful implementation of the program are developed. The composition of the main tasks of the program is established based on the constructed hierarchy of goals. For each task, stages of its implementation are developed.

The fourth stage involves calculating the main indicators and resource support for the program. The costs of material, labor, and financial resources necessary for its implementation are determined, and lists of material resources are generated indicating suppliers and recipients. At this stage, the effectiveness of the program is calculated.

The fifth stage is the final one. It is associated with the formation of program documents, coordination and, if necessary, approval of the program.

In terms of content, targeted comprehensive programs are divided into socio-economic, scientific and technical, production and economic, territorial, organizational and economic and environmental. Socio-economic programs provide for solving social problems and increasing the material standard of living of the people. Scientific and technical programs are aimed at solving scientific and technical problems, accelerating the introduction of scientific and technological achievements into production, allowing for a significant effect (economic, social and environmental) in the near future. The list of scientific and technical programs is formed based on certain priorities for economic development. Production and economic programs are designed to solve major intersectoral problems in the field of production, helping to increase its efficiency and develop new industries. Territorial programs are aimed at transforming regions, comprehensive development of new territories and solving other problems. Environmental programs are a set of environmental and nature-transforming measures. Organizational and economic programs are aimed at improving the organization of economic management.

A target program is a comprehensive document, the purpose of which is to solve a priority task for a given period. Depending on the complexity of the tasks, financial, organizational and technical capabilities, programs are accepted for a period of 2 to 5-8 years. As a rule, for 3-5 years.

Programs must be coordinated in terms of resources, performers and time. As a rule, they are advisory in nature. Separate programs for solving the most important scientific and technical problems may be approved. The implementation of programs is ensured through the government's economic program and plans and forecasts for the year.

Results-based budgeting.

Result-oriented budgeting is a system for organizing the budget process and state (municipal) management, in which expenditure planning is carried out in direct connection with the results achieved.

In the theory of management by goals and results, PB is considered the most complex way of using information about goals and results, since it includes the entire set of ways to use this information for making management decisions.

In its most general form, results-based budgeting is a system of budget formation (execution), reflecting the relationship between planned budget expenditures and expected (achieved) results. The purpose of this budgeting model is to monitor the compliance of the resources expended and the direct and social results obtained, to assess the significance and economic and social efficiency of certain types of activities financed from the budget.

Result-based budgeting ensures a continuous cycle of planning - output - result - planning.

The concept of reforming the budget process, focused on the implementation of budgetary budgeting, includes the following main tasks:

Bringing the budget classification of the Russian Federation closer to the requirements of international standards, introducing a budget accounting chart of accounts integrated with the budget classification, based on the accrual method and ensuring cost accounting by functions and programs.

Streamlining the procedures for drawing up and reviewing the budget, through the analytical separation of existing and newly accepted expenditure obligations. Existing obligations are subject to unconditional inclusion in the expenditure side of the budget, unless a decision is made to cancel or suspend them. New expenditure obligations should be established only if there are appropriate financial capabilities for the entire period of their validity and subject to a mandatory assessment of their expected effectiveness.

Inclusion in the long-term financial plan of the distribution of allocations between the subjects of budget planning for a three-year period, which is shifted annually one year ahead.

Introducing into practice the budgetary process of forming departmental target programs, within the framework of which a significant part of budget expenditures carried out on an estimated basis should be included.

The transition to the distribution of budget resources between managers of budget funds and budget programs, depending on the planned level of achievement of the goals set for them, in accordance with the medium-term priorities of socio-economic policy and within the limits of the volumes of budget resources projected for the long term.

Expanding the scope of application of support mechanisms for regional and municipal budget reform programs selected on a competitive basis.

Thus, the most common methods of budget planning include the following methods: economic analysis, index, balance sheet, regulatory, program-targeted, result-oriented budgeting.

2.3 Budget forecasting methods

Budget forecasting is a reasonable assumption, based on real calculations, about the directions of budget development, the possible states of its income and expenses in the future, the ways and timing of achieving these states.

Forecasting methods should be understood as a set of techniques and ways of thinking that allow, on the basis of retrospective data from the external and internal connections of the forecasted object, as well as their measurements within the framework of the phenomenon or process under consideration, to derive definite and reliable judgments regarding the future state and development of the object.

Budget forecasting methods include:

method of expert assessments;

extrapolation method;

method of historical analogies.

Expert assessment methods

The essence of expert assessment methods is that the forecast is based on the opinion of a specialist or a team of specialists, based on professional, scientific and practical experience. There are individual and collective expert assessments. Individual expert assessments are based on the opinions of specialist experts in the relevant profile. Among individual expert assessments, the most widely used methods are interviews, analytical, and script writing.

The interview method involves a conversation between a forecaster and an expert using a question-answer pattern, during which the forecaster, in accordance with a pre-developed program, poses questions to the expert regarding the prospects for the development of the forecasted object.

The analytical method involves careful independent work by an expert to analyze trends, assess the state and development paths of the predicted object.

The expert can use all the information he needs about the forecast object. He draws up his conclusions in the form of a memorandum.

The most reliable are collective expert assessments. Methods of collective expert assessments involve determining the degree of consistency of expert opinions on promising areas of development of the forecast object, formulated by individual specialists. In modern conditions, mathematical and statistical tools are used to process the results of a survey of experts. budget planning forecasting Russian

To organize expert assessments, working groups are created whose functions include conducting a survey, processing materials and analyzing the results of a collective expert assessment. The working group appoints experts who provide answers to the questions raised regarding the prospects for the development of this facility. The number of experts involved in developing the forecast can vary from 10 to 150 people, depending on the complexity of the object. The purpose of the forecast is determined, questions for experts are developed. When conducting a survey, it is necessary to ensure the unambiguous understanding of individual issues and the independence of expert judgments. After the survey, the materials obtained as a result of collective expert assessment are processed. The final score can be determined as the average judgment or as the arithmetic mean of the scores of all experts.

Extrapolation methods

In methodological terms, the main tool of any forecast is the extrapolation scheme. The essence of extrapolation is to study the stable development trends of the forecast object that have developed in the past and present and transfer them to the future.

There are formal and predictive extrapolation. Formal extrapolation is based on the assumption that past and present trends in the development of the forecast object will be maintained in the future; with predictive extrapolation, actual development is linked to hypotheses about the dynamics of the process under study, taking into account changes in the influence of various factors in the future.

Extrapolation methods are the most common and well-developed. The basis of extrapolation methods is the study of empirical series. An empirical series is a set of observations obtained sequentially over time.

In economic forecasting, the method of mathematical extrapolation is widely used, which in a mathematical sense means the extension of the law of change of a function from the area of its observation to the area lying outside the observation segment.

Method of historical analogies

Methods of historical analogies should be used when predicting the development of new objects and processes for which there is no retrospective information. The essence of the method is to select an analog object for the forecast object, which in its development is ahead of the forecast object. The forecast will consist of comparing the available information on an analogue object with the specific features of the forecast object, on the basis of this a conclusion is made about the development of the forecast object in the future. However, despite all its attractiveness, this method has a number of limitations and difficulties in its application. Firstly, you should be very careful and careful in selecting analogue objects. Secondly, one should take into account all the specific features of the forecast object, as well as the actions of external factors.

So, forecasting methods should be understood as a set of techniques and ways of thinking that allow, on the basis of retrospective data of external and internal connections of the forecast object, as well as their measurements within the framework of the phenomenon or process under consideration, to derive definite and reliable judgments regarding the future state and development of the object. The most common methods of budget forecasting include: the method of expert assessments, the extrapolation method; method of historical analogies.

Chapter 3. System of budget forecasting and planning, ways to improve it

1 Organization of the budget forecasting and planning system of the Russian Federation

Financial planning at the national and territorial levels is ensured by a system of financial plans that are linked to material and labor balances in value terms. Each financial plan solves the problems of organizing and managing finances at a specific level of management.

The system of financial plans includes:

long-term financial plans;

consolidated financial balances compiled at the national and territorial levels of government.

Long-term financial planning at all levels of government is carried out in order to:

ensuring coordination of economic and social development and financial policies;

forecasting the volume of financial resources required to support planned activities;

forecasting the financial consequences of reforms and programs;

determining the possibility of implementing various measures in the field of finance.

All information on the system of financial plans represents a close relationship between various components, from collecting information to the possibility of implementing various programs provided by the methodology at all stages of development (Figure 1).

Figure 1. Scheme for compiling a forecast for the development of economic systems.

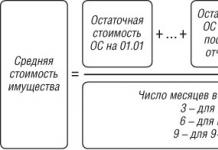

The long-term financial plan is developed on the basis of forecast indicators for economic and social development (Figure 2). It contains data on the budget's capabilities to mobilize revenues and finance budget expenditure items. This plan is drawn up for three years based on aggregated budget indicators. The plan is adjusted annually to the indicators of the updated socio-economic development forecast.

Figure 2. Mechanisms for connecting economic forecasting, the formation of concepts and programs for socio-economic development.

The consolidated financial balance is the balance of financial resources created and used in a certain territory. The consolidated financial balance covers funds from all budgets, extra-budgetary trust funds and enterprises located in the relevant territory.

The need to develop territorial consolidated financial balances is due to a number of factors:

) development of programs that provide for the unification of efforts of territorial authorities and enterprises located on their territory for economic and social development;

) significant financial costs for the implementation of such programs. To provide financial resources for the activities planned by these programs, coordination and concentration of funds from the budget system, funds from departments and enterprises are necessary. This, in turn, requires the development of a consolidated financial balance sheet for the region;

) the need to bring together different types of financial plans: financial plans of economic enterprises and organizations, territorial budget, extra-budgetary funds, etc., reflecting individual aspects and stages of distribution and redistribution of national income created and used in a given territory. This allows you to have a complete picture of the formation and use of all financial resources of the administrative-territorial unit;

The main task of the territorial consolidated financial balance is to determine the volume of financial resources created, received and used in the region (both centralized, accumulated and redistributed by territorial budgets, and decentralized, i.e. resources of enterprises, organizations and extra-budgetary funds).

Planning of financial resources is accompanied by an analysis of the achieved level of mobilization and use of financial resources in the region, identifying the degree to which this level corresponds to the development needs of the region.

The information base for developing the consolidated financial balance of the region is: data from territorial economic, financial, statistical bodies, functional divisions of territorial authorities, economic standards and limits on the main indicators of regional development, indicators of draft plans for economic and social development of the territory, data from the territorial budget, extra-budgetary funds , balances of income and expenses of all enterprises and organizations located on the territory, regardless of their departmental subordination.

Drawing up a territorial consolidated financial balance allows you to:

· achieve unity in the economic and social development of the territory;

· more accurately determine the volumes of financial resources available in the region and necessary to implement the activities provided for by the territorial program;

· balance the material and financial resources used in the region;

· improve the quality of budget planning;

· coordinate the use of financial resources of both territorial bodies and enterprises located in the region;

· concentrate financial resources on the most important areas of economic and social development of the territory in each specific period;

· find intraregional reserves to finance the activities planned by territorial programs;

· make the most effective use of funds allocated by the state for the development of production, social and industrial infrastructure in the region;

· exercise effective control over the mobilization and use of financial resources;

· more actively influence the formation of all sections of the territorial program;

· achieve a combination of territorial and departmental interests.

Coordination and concentration of funds in the region, increasing the efficiency of their use have a positive effect on financial planning and help reduce the need for financial resources allocated from the budget.

Budget forecasting is closely related to consolidated financial planning.

The most important condition for successful farming is the constant improvement of management methods. To manage means to foresee. In this regard, the role of long-term planning, and therefore scientific forecasting, is increasing. Forecasting the parameters of natural indicators must be accompanied by a forecast of financial resources, since it is impossible to qualitatively forecast the development of the economy without taking into account the prospects for the growth of these resources.

Unlike consolidated financial planning, which is carried out, as a rule, for a longer period, budget forecasting is targeted and designed for the budget period, i.e., no more than a year. But since the overwhelming majority of the indicators of the consolidated financial balance include a number of budget indicators, when drawing up a long-term consolidated financial balance it is necessary to carry out forecast calculations of the main budget indicators.

A forecast of budget development means a complex of probabilistic assessments of possible ways of developing its revenue and expenditure parts.

The purpose of budget forecasting is to develop and justify optimal ways of budget development on the basis of current trends, specific socio-economic conditions and future estimates and, on this basis, make proposals for its strengthening. Timely consideration of the results of such forecasting is an important condition for taking the most effective measures in the financial policy of the region.

The calculation of projected budget indicators is based on different methodological approaches than the calculation of annual budget indicators. If annual and quarterly budget indicators are determined on the basis of direct calculations of economic and financial parameters, then when determining forecast budget indicators, as a rule, this is not possible due to the lack of necessary statistical and reporting data.

Forecasting the development of territorial budgets is based on a number of indicators. Since population growth and changes in its structure have a direct impact on the development of all sectors of the local economy, and, consequently, on the development of territorial budgets, much attention in forecasting is paid to the analysis of the prospects for demographic changes.

Demographic forecasting makes it possible to determine the directions for using funds, that is, to identify priorities in financing local economic sectors.

) The functional dependence of the volume of territorial budgets on population growth is described by the equations:

y = a0 + a1 x ; y = ax3,

where y is the volume of territorial budgets;

x is the population of the administrative-territorial unit.

In the first case, a linear model was used, in the second - a parabolic one. The correlation coefficients of these equations showed greater closeness in the relationships being studied. Since the size of expenditures of territorial budgets depends primarily on the size of the population for which these expenditures are intended.

With the help of these economic and mathematical models, it is possible to calculate not only the amount of total expenditures of territorial budgets, but also expenditures on the national economy and socio-cultural events.

) You can also predict the amount of spending on education and health care. For these purposes, a multifactor linear model is used:

y = ax1 + ax2,

where y - expenses for social and cultural events; - expenses for education;

x2 - healthcare costs.

A similar model can be used when calculating forecast indicators of costs for the maintenance of secondary schools, hospitals, etc.

In the future, the economic-mathematical method in combination with long-term state minimum social standards and norms can find wide application in budget forecasting, providing it with a more objective, scientifically developed basis.

2 Modernization of the budget forecasting and planning system

It is necessary to increase the accuracy and reliability of the forecast of the parameters of macroeconomic indicators of the socio-economic development of the Russian Federation, which are the starting points for drawing up the draft federal budget.

The most pressing in this regard are the problems of information support for management processes and the creation of a formalized system of indicators characterizing the financial potential of the territorial or local budget.

In this regard, authorities should develop various programs and methodological recommendations to improve information and analytical activities and create an information system for the formation of financial resources of industries, development of the potential of tax and other budget revenues.

Also, such developments are intended to solve problems of creating a system of information on the results of activities of business entities, analyzing the financial condition of enterprises in various sectors of the economy, financial control, assessing the tax base and the state of fulfillment of obligations to the budget. Systematized information will ensure the improvement of planning and forecasting methods, performing analytical calculations, as well as the development of sound measures that will help increase the potential of tax and other budget revenues.

The main goal of creating an information system is to develop uniform procedures at all stages of forecasting the development of the potential of financial resources in the region.

In this regard, planning is considered as a continuous process, which involves obtaining reliable data on the indicators of production, economic and financial activities of enterprises, conducting a detailed analysis on their basis in order to ensure management processes and making informed decisions, control and monitoring of ongoing changes, regular review decisions and measures to achieve the planned indicators, as well as adjusting the forecast parameters of socio-economic and budget planning.

Carrying out systematic observations of indicators reflecting the results of the activities of economic entities is organized by sectoral ministries and other executive authorities of the region that coordinate and regulate activities in sectors of the economy. Systematic observations are carried out in relation to enterprises included in the lists of economically and socially significant economic entities in various sectors of the territory’s economy.

In order to obtain initial information about business entities identified as economically or socially significant, industry departments enter into cooperation agreements and (or) send requests for information on financial and economic performance indicators and the amounts of accrued and paid taxes:

to the address of an economic entity;

to the state statistics authorities at the place of state registration (location), as well as, in some cases, if necessary, to the tax authorities.

When implementing a set of monitoring activities, a system of standard selected indicators is used, which, when conducting systematic research, are the basis for assessing the potential of financial and tax resources both for individual enterprises and at an industry level.

When assessing the financial condition, as well as the potential of tax and other financial obligations to the budget of business entities, the following data is used:

financial statements;

tax accounting, reporting and tax returns on the base of taxation and fees, the amount of accrued and paid payments to the budget, the status of debt and other indicators;

federal statistical observation forms No. P-1 "Information on the production of goods and services", No. P-3 "Information on the financial condition of the organization", No. PM "Information on the main indicators of the activities of a small enterprise", No. 1-IP (industrial) "Information on the industrial activities of an individual entrepreneur" and other forms of statistical reporting approved by the State Statistics Committee of Russia as tools for organizing federal state statistical observation.

It is advisable to summarize the initial information, depending on the timing and sources of its receipt, and form it into summary tables:

"Information on the main financial and economic indicators of activity";

"Information on the formation of tax and other financial resources of the budget";

"Forecast of indicators."

Information on financial and economic performance indicators is intended to summarize data characterizing the activities of individual economic entities and sectors of the regional economy.

Information on the formation of tax and other financial resources of the regional budget is intended to assess, by enterprise and industry, the tax base and fees for a representative group of taxes and other payments to the budget.

The forecast of indicators is intended to determine the main parameters necessary for forecasting budget resources in accordance with production development programs.

When filling out information, comparability of the data of the reporting period with the indicators for the same period of the previous year must be ensured. If in the reporting year there was a reorganization, change in the structure or methodology for calculating indicators, then the data for the previous year are presented based on the new structure and methodology.

If necessary, data is adjusted and recalculated in accordance with established rules and methodology adopted in the reporting period. If the indicators are not comparable and adjustment is not possible, explanations are provided.

When considering the problems of forecasting, two components should be distinguished: methodological, which implies the choice of a forecasting algorithm as a tool for describing the state of the phenomenon and solving problems in future periods, and managerial, which involves the use of the obtained information for making management decisions. The methodological aspect requires improvement of existing approaches when forecasting cash gaps. When forecasting temporary cash gaps, preference should be given to economic and mathematical modeling methods based on financial and statistical analysis and probabilistic assessment of the occurrence of these events. Only on the basis of assessing the reliability of the results obtained are management actions aimed at preventing predicted cash gaps determined, including by finding internal reserves and improving the quality of regional budget revenue planning. The quality of forecasting and planning of revenues of the budget system of the Russian Federation should be an integral part of the system of indicators aimed at determining the efficiency and effectiveness of the activities of the bodies that implement the budget.

There are certain difficulties in administering revenues by budget levels. Thanks to the close interaction of the Treasury with the financial and tax authorities of the region, it was possible to systematize the administration of non-tax revenues and identify administrators for non-tax revenues of local budgets. Despite active actions on the part of federal and regional executive authorities, newly formed revenue administrators cannot always competently explain to taxpayers the procedure for issuing payment documents for payment of payments.

Conclusion

Based on the study, the following conclusions and suggestions can be made:

A forecast is understood as a system of scientifically based ideas about the possible states of an object in the future, about alternative ways of its development. The forecast expresses foresight at the level of a specific applied theory, at the same time the forecast is ambiguous and has a probabilistic and multivariate nature. The process of developing a forecast is called forecasting.

Forecasting is broader in scope than planning, since it includes not only the performance indicators of an economic entity, but also takes into account the changing parameters of the external environment to a greater extent. At the same time, the forecast and plan complement each other. The forms of combination of forecast and plan can be very different: a forecast can precede the development of a plan (in most cases), follow it (forecasting the consequences of a decision made in a plan), be carried out in the process of developing a plan, independently play the role of a plan, especially in large-scale large-scale economic systems (region, state), when it is impossible to ensure an accurate determination of indicators, i.e. the plan becomes probabilistic in nature and practically turns into a forecast. Planning is aimed at justifying the adoption and practical implementation of control decisions. The purpose of forecasting is primarily to create scientific prerequisites for their implementation.

The most important component of the planning and forecasting methodology are methodological principles, which are understood as starting points, fundamental rules for the formation and justification of plans and forecasts. They provide purposefulness, integrity, a certain structure and logic to the plans and forecasts being developed.

Methods of planning and forecasting are the methods and techniques by which the development and justification of plans and forecasts is ensured.

The quality of forecasting and planning of revenues of the budget system of the Russian Federation should be an integral part of the system of indicators aimed at determining the efficiency and effectiveness of the activities of the bodies that implement the budget.

List of sources used

Regulations

Constitution of the Russian Federation: [adopted by popular vote on December 12, 1993] (taking into account the amendments made by the Law of the Russian Federation on Amendments to the Constitution of the Russian Federation dated December 30, 2008 No. 6-FKZ, dated December 30, 2008 No. 7-FKZ) // Russian newspaper. - 1993. - December 25.

Budget Code of the Russian Federation dated July 31, 1998 No. 145-FZ (as amended on December 30, 2011 No. 310-FZ) // SZ RF-2009, No. 1

On the financial foundations of local self-government in the Russian Federation: Law dated September 25, 1997 No. 126-FZ (as amended on October 6, 2008 No. 131-FZ) // Consultant+.

On state forecasting and programs for social and economic development of the Russian Federation: Federal Law dated July 20, 2000 No. 115-FZ (as amended from July 9, 2010 No. 159-FZ) // Consultant+.

On the development of a long-term financial plan for the Russian Federation and a draft federal law on the federal budget for the next financial year: Regulations dated March 6, 2005 No. 118 // Consultant+.

Scientific and educational literature

Avetisyan I.A. On the effectiveness of the state budget and budget expenditures: textbook / I.A. Avetisyan. - M.: INFRA-M, 2008.

Baldina S.V. Budget accounting in the Russian Federation: a textbook for universities / S.V. Baldina. - M.: MCFR, 2009.

Vladimirova L.P. Forecasting and planning in market conditions. M.: Dashkov and Co., 2005

Godin A.M. Budget and budget system of the Russian Federation / A.M. Godin. - M.: Dashkov and Co. , 2007

Matskulyak I.D. State and municipal finances / I.D. Matskulyak. - M.: Yurait, 2007.

Krivosheeva M.Yu. Strategy for the socio-economic development of the region based on program-targeted management methods: textbook / M.Yu. Krivosheeva. - M.: INFRA-M, 2007.

Logunova S.T. Public finance: textbook. manual for universities / S.T. Logunova. - M.: MAX Press, 2010.

Borisevich V.I. Forecasting and economic planning: V.I. Borisevich. - Mn.: IVF, 2007

Raizberg B.A. Program-target planning and management: educational and practical. allowance / B.A. Raizberg, A.G. Pubically. - M: Infra-M, 2009

Romanovsky M.V. Finance and credit: Textbook / M.V. Romanovsky, N.N. Nazarov, M.I. Popova and others; Ed. M.V. Romanovsky, G.N. Beloglazova. - M.: Yurayt-izdat, 2010.

Fedorov G.S. Organization of the budget process as a factor in ensuring financial security / G.S. Fedorov. - Cheboksary, 2010

Budget forecasting is closely related to consolidated financial planning.

The most important condition for successful farming is the constant improvement of management methods. To manage means to foresee. Therefore, the role of long-term planning, and, consequently, scientific forecasting, is increasing. Forecasting the parameters of natural indicators must be accompanied by a forecast of financial resources, since it is impossible to qualitatively forecast the development of the economy without taking into account the prospects for the growth of these resources.

Unlike consolidated financial planning, which is carried out over a longer period, budget forecasting is targeted and is designed for the budget period, i.e. for no more than a year. At the same time, the overwhelming majority of the consolidated financial balance sheet indicators include a number of budget indicators. Therefore, when drawing up a forward-looking consolidated financial balance, it is necessary to carry out forecast calculations of the main budget indicators.

Under budget development forecast implies a complex of probabilistic assessments of possible ways of developing its revenue and expenditure parts. The purpose of budget forecasting is to develop and justify optimal ways of budget development on the basis of current trends, specific socio-economic conditions and future estimates and, on this basis, make proposals for its strengthening. Timely consideration of the results of such forecasting is an important condition for taking the most effective measures in the financial policy of the state and region.

The calculation of projected budget indicators is based on different methodological approaches than the calculation of annual budget indicators. If annual and quarterly budget indicators are determined on the basis of direct calculations of economic and financial parameters, then when determining forecast budget indicators, as a rule, this is not possible due to the lack of necessary statistical and reporting data.

Financial and budgetary forecasting is a relatively young branch of financial science, the development of which was associated with the need to compile consolidated financial balances for the future. A significant contribution to the development of methods for prospective financial calculations was made by A.M. Volkov, V.A. Galanov, L.P. Evstigneeva, B.S. Pavlov, G.B. Polyak, T.Ya. Shakhova.

Methods used to forecast budget development. When developing a budget development forecast, various methods can be used. One of them - extrapolation method those. drawing up a perspective based on the practice of the previous period. However, this method is suitable for forecasting only some items of budget expenditures and revenues that are more or less stable.

Also used method of expert assessments, those. a forecast based on estimates made and substantiated by competent specialists in certain branches of science and the national economy. But this method also has disadvantages, since it contains an element of subjectivity.

You can apply both of these methods simultaneously, using both objective development trends and expert opinions.

One way to extrapolate basic financial patterns could be regression lines, the reliability of which increases when constructing multi-step correlation models that make predicted budget indicators dependent on several variables. Therefore, work on the budget forecast should begin with identifying and studying the factors (variables) influencing the formation of the budget. These factors include: the development of the country’s productive forces and the availability of national financial resources, demographic changes, the development of economic sectors, etc.

To calculate the main indicators of the federal budget for the future, they can be used correlations between the volume of federal budget revenues And two variables: produced national income and gross output of industry and agriculture, as well as the relationship between these indicators and income tax. Correlation coefficients show great closeness in the relationships being studied, since budget revenues are formed primarily from national income, and the connection between income tax and profit itself is obvious.

When forecasting the volume of budget resources for the future, you should use deep economic And statistical analysis of current trends, allowing, on average, with a certain degree of probability, to neutralize the influence of many factors, to identify the most common in a set of trends. Qualitative analysis showed that the statistical models used to determine federal budget resources provided well-consistent data regarding its volume in the near future. Regression equations with the above two variables have a linear form:

When developing these models, an independent problem is finding the values of independent variables (national income and manufactured products) in the forecast period. To determine them, forecast calculations of the specified general economic indicators are used. Economic analysis is supplemented by studying the rates of development of the studied indicators, their mutual relationships, calculations of the average annual rates of the studied phenomena by year, comparison of their development with the rates of other economic quantities (industrial fixed assets, population, etc.). Such an analysis is necessary because the federal budget is connected with real economic situations and therefore quickly responds to changes in any sector of the national economy, with policies in the field of social protection of the population, with changes in the procedure for financing basic state expenditures, etc.

Forecasting the development of territorial budgets. Budget forecasting, and primarily forecasting of territorial budgets, is associated with the spread in the 70s of the practice of developing long-term comprehensive plans for the economic and social development of territories, in which it was necessary to make forecast calculations of budget indicators as the basis for planning financial support for the activities provided for in these plans. The methodology for forecasting territorial budgets was first developed and tested in our country in 1976 by G. B. Polyak during the preparation and implementation of comprehensive plans for the economic and social development of administrative-territorial units. The problems of territorial budget forecasting are also reflected in the works of S.K. Bito/owl, KM. Dementieva, T. T. Tulebaeva.

Due to the fact that population growth and changes in its structure have a direct impact on the development of all sectors of the local economy, and, consequently, on the development of territorial budgets, much attention in forecasting is paid to the analysis of the prospects for demographic changes. Demographic forecasting allows you to determine the directions for using funds, i.e. identify priorities in financing local economic sectors.

The functional dependence of the volume of territorial budgets on population growth is described by the equations:

In the first case, a linear model is taken, in the second - a parabolic one. The correlation coefficients of these equations showed greater closeness in the relationships being studied. And this is quite understandable, since the size of expenditures of territorial budgets depends primarily on the size of the population for which these expenditures are intended.

With the help of these economic and mathematical models, it is possible to calculate not only the amount of total expenditures of territorial budgets, but also expenditures on the national economy and socio-cultural events.

You can also predict the amount of spending on education and health care. For these purposes, a multifactor linear model is used:

A similar model can be used when calculating forecast indicators of costs for the maintenance of secondary schools, hospitals, etc.

In the future, the economic-mathematical method in combination with long-term state minimum social standards and norms can find wide application in budget forecasting, providing it with a more objective, scientifically developed basis.

Long-term budget planning is carried out by forming a budget forecast of the Russian Federation for a long-term period, a budget forecast of a constituent entity of the Russian Federation for a long-term period, as well as a budget forecast of a municipal entity in the long-term period if the representative body of a municipal entity has decided to form it in accordance with the requirements of the budget code. A long-term budget forecast is understood as a document containing a forecast of the main characteristics of the corresponding budgets (consolidated budgets) of the budget system of the Russian Federation, indicators of financial support for state and municipal programs for the period of their operation, other indicators characterizing budgets (consolidated budgets of the budget system), and also containing the main approaches to the formation of budget policy for the long term.

The budget forecast of the Russian Federation, a subject of the Russian Federation for the long term, is developed every 6 years for 12 years or more based on the forecast of socio-economic development.

The long-term budget forecast of the municipality is developed every 3 years for 6 years based on the forecast of the socio-economic development of the municipality.

The budget forecast may be changed taking into account changes in the forecast of social and economic development. The procedure for development and approval, period of validity, as well as requirements for composition and content are established by the government of the Russian Federation at the federal level, the highest executive body of the state. power subject of the Russian Federation, local administration at the local level.

State and municipal programs are also plans, state. municipal programs are approved by the government of the Russian Federation, the highest executive body of the state. authorities, constituent entities of the Russian Federation, local municipal administrations.

The timing of the implementation of these programs will be determined by them. The procedure for making decisions on the development of state and municipal programs, the formation and implementation of these programs, are established in accordance with regulatory legal acts, the government of the Russian Federation, the highest executive body of the state. authorities, constituent entities of the Russian Federation and local administration of the municipality.

State municipal programs must be brought into compliance with the law (decision) on the budget no later than 3 months from the date it comes into force. For each state municipal program, the effectiveness of its implementation is assessed annually. Based on the results of the assessment, a decision may be made on the need to terminate or change, starting from the next financial year, previously approved by the state. municipal program, including the need to change the volume of budgetary allocations for financial support for the implementation of state. municipal program.

Financial resources of the corporation: Own and attracted.

Own funds - Depreciation, own funds, profit.

Attracted financial resources - loans, subsidies. loans.

The organization’s financial instruments are divided into 3 groups:

1. Financing tools - where to get money from

2. Investment instruments - where to invest temporarily free money (stocks, bonds, precious metals, deposits, etc.)

3. and others. - insurance and leasing.

Corporations may enter into financial relationships with:

1. State (taxes, subsidies)

2. Other corporations, organizations

3. With physical persons (for example payment of dividends)

Budget forecasting refers to reasonable assumptions based on real calculations about the directions of budget development, its possible states in the future and alternative ways and timing of achieving these states. The forecast is the basis of budget planning and is based on an analysis of the current state of the budget and the dynamics preceding it.

During budget forecasting, various approaches to the formation of the state's budget policy, different concepts of budget development are considered based on taking into account the system of economic and social factors operating at the federal, regional and local levels.

- 1. calculation of the volume of financial resources for the country as a whole;

- 2. determining the size of the possible withdrawal of financial resources to the state income;

- 3. identifying the most effective forms and methods of withdrawing funds from the budget;

- 4. research into the possibilities of influencing the development of production and services through the taxation system;

- 5. determination of optimal proportions for the distribution of income between budgets of different levels - federal, regional and local.

The information base for forecasting budget revenues is: plan-forecast of the country's socio-economic development for the forecast period; plans and forecasts of line ministries and departments; forecast estimates of production volumes and sales of products, services, profits; income of non-state commercial and non-profit structures; volume of property of legal entities and individuals; the amount of income of the population, etc.

Federal Budget Project

Pre-developed financial forecasts and plans play a significant role in drafting the budget.

The procedure for drawing up the draft federal budget is defined in Art. 184 BC RF. The drafting of the federal budget is carried out by the Government of the Russian Federation and begins no later than 10 months before the start of the next financial year; it also determines the procedure and timing for drawing up the draft federal budget. The authorized executive body organizes the development of a forecast of the socio-economic development of the Russian Federation for the next financial year and clarification of the parameters of the medium-term forecast of the socio-economic development of the Russian Federation, which forms the basis of the long-term financial plan.

The Ministry of Finance of the Russian Federation organizes the development of: projections of the main indicators of the federal budget for the medium term; draft Federal Law on the Federal Budget for the next financial year.

Projections of the main indicators of the federal budget for the medium term are developed simultaneously with the draft federal budget for the next financial year on the basis of the medium-term program of the Government of the Russian Federation, the medium-term forecast of the socio-economic development of the Russian Federation and the forecast of the Consolidated Financial Balance Sheet for the territory of the Russian Federation (see Lecture 5).

The preparation of regional budgets is based on: Budget message of the President of the Russian Federation; forecast of socio-economic development of the relevant territories for the next financial year; the main directions of the budget and tax policy of the relevant territory for the next financial year; forecast of the consolidated financial balance for the relevant territory for the next financial year; development plan of the state or municipal sector of the economy of the relevant territory for the next financial year.

The first stage of the formation of the federal budget is the development by federal executive authorities and the selection by the Government of the Russian Federation of a plan-forecast for the functioning of the Russian economy for the next financial year, containing the main macroeconomic indicators characterizing the state of the economy. The second stage of the formation of the federal budget is the distribution by federal executive bodies of the maximum volumes of budget financing for the next financial year in accordance with the functional and economic classifications of expenditures of the budgets of the Russian Federation and by recipients of budget funds, as well as the development by these bodies of proposals for carrying out structural and organizational reforms in sectors of the economy and the social sphere, on the repeal of regulatory legal acts, the implementation of which entails the expenditure of budget funds that are not provided by real sources of financing in the next financial year, on the suspension of the validity of these regulatory legal acts or on their phased introduction.

At the same time, the authorized executive body creates a list of federal target programs to be financed from the federal budget in the next financial year, and agrees on the volumes of their financing in the coming year and for the medium term. The federal executive bodies are developing and agreeing on the indicators of the draft federal budget for the next financial year, bills on the minimum wage, on the minimum amount of state pensions, on the procedure for indexing wages of public sector workers and state pensions in the next financial year: