An equipment conservation act is a document drawn up by the commission in a free form, which confirms that all the objects listed in it are subject to suspension of operation for a certain period with the possibility of its resumption in the future.

FILES

Main reasons for conservation

There are three reasons why equipment is mothballed:

- Temporary cessation of commercial and non-commercial activities.

- Production volume began to decline.

- Inappropriate use of equipment.

Reasons for equipment conservation

Equipment conservation is carried out due to the following circumstances:

- man-made accidents, natural and man-made disasters that caused the cessation of equipment operation;

- non-use of equipment for more than three months in a row;

- inability to repurpose equipment due to its specific features;

- equipment cannot be rented out;

- equipment used seasonally in commercial and non-commercial activities.

Who decides to mothball equipment?

The fundamental decision to “freeze” rests with the director of the company. He also confirms with his signature the order of further actions. To create a list of equipment that is subject to conservation, you need to go through an inventory. For this purpose, the director, by order, appoints a commission responsible for the long-term preservation of the equipment. Then he issues a direct order on conservation.

Information that must be present in the document

The act must contain the following information:

- date of transfer of equipment for conservation;

- list of equipment that needs to be transferred;

- initial cost of equipment;

- reason for transfer;

- actions that were performed for the transfer;

- the amount of upcoming expenses;

- residual value if preservation is planned for more than three months;

- the amount of expenses already incurred;

- preservation period.

During inventory control, equipment that is intended for canning is allocated by the commission to a separate group. To account for it, the subaccount “Objects transferred for conservation” is used. Such equipment is registered in the act, indicating the manufacturer, model name and inventory number.

Who signs and why is the equipment conservation act needed?

The act is signed by all members of the commission and approved by the director of the organization. It is necessary for the director in order to:

- pay less income tax;

- suspend depreciation charges on equipment placed into storage for more than three months;

- exercise control over the outflow of financial assets during the conservation period.

Preservation period

By law, the minimum period for equipment preservation is three months, and the maximum is three years. Calculation begins from the date of approval of the document. If there is a need to extend the period, then the proposal for extension must be put forward no later than a month before the expiration of the conservation period. As for the re-preservation of equipment, the proposal is made no earlier than five months after re-preservation (resumption of operation of previously mothballed equipment).

Typical mistakes when filling out a document

Since the document does not have a single form, it is drawn up in any form. True, the practice of tax and audit audits shows that accountants, when filling out documents, systematically make mistakes. Here are the most basic ones:

- errors in writing words and numbers (in calculations);

- adding text;

- notes made in pencil;

- different ink colors;

- unspecified date of document preparation;

- the name of the organization is incorrectly indicated;

- the fact of economic or production activity has not been deciphered;

- signing a document by a person acting on someone else’s behalf without authority or in excess of the authority granted;

- conspicuous mechanical impact on the document (artificial aging, masking part of the text);

- the act was drawn up on sheets of varying quality.

Of course, all of the above errors cannot indicate the invalidity of the document. It is quite possible that such filling was due to objective reasons.

Important! The Federal Tax Service Inspectorate will always show interest in such documents, as it will consider them to be improperly executed. This means that the tax service will refuse to reimburse the organization for VAT and reduce the taxable base of the direct tax levied on the organization’s profits.

Error correction

If an accounting specialist notices an error in the act, he has the right to correct it. For example, if the amount was entered incorrectly in the document, it can be edited by crossing it out and indicating the correct value. However, do not forget that corrections in the document must be certified correctly. For this it is enough:

- put in the act the date when the correction was made;

- write “Corrected Believe”;

- sign the employee who is responsible for the correction;

- decipher this signature.

When filling out a document, it is unacceptable to use line corrections, blots, corrections and erasures.

Conclusion

So, today many firms, companies, enterprises are forced to suspend their work for various reasons and introduce conservation of equipment that is little used or not used at all. Firstly, this procedure allows you to ensure the best safety of the equipment, and secondly, the company will greatly save money associated with the transfer of tax fees. A properly drafted conservation act can help those firms, companies, and enterprises that do not plan to complete the current financial year with a profit.

I. GENERAL PROVISIONS

1.1. In accordance with the Rules (Resolution of the Government of the Russian Federation dated September 30, 2011 N 802), conservation means bringing an object and the territory used for its construction (construction site) into a state that ensures the strength, stability and safety of structures, equipment and materials, as well as safety object and construction site for the population and the environment.

1.2. According to clause 4 of Article 52 of the Civil Code of the Russian Federation, the developer (or customer) must ensure the conservation of a capital construction project, if necessary, stop work or temporarily suspend it for a period of more than six months.

1.3. Conservation procedure

1.3.1. In case of termination or suspension of construction work for more than six months, the developer (customer) makes a decision on the conservation of the object (except for a state-owned property) and on the source of funds to pay the costs associated with the conservation.

1.3.2. Such a decision must determine:

- list of works on conservation of the object;

- persons responsible for the safety and security of the facility (official or organization);

- deadlines for the development of technical documentation necessary for conservation work;

- timing of the work itself;

- the amount of funds for carrying out these works, determined on the basis of an act prepared by the contractor and approved by the developer (customer).

1.4. After making a decision on conservation, the developer (customer) ensures the preparation of technical documentation. Moreover, he independently determines its volume and content.

1.5. Based on this decision, the developer (customer), together with the contractor, carries out an inventory of the completed construction (reconstruction) of the facility in order to record the actual condition of the facility, the availability of design documentation, structures, materials and equipment.

1.6. Within ten calendar days after the decision is made, the developer (customer) is obliged to notify the contractor and the authority that issued the construction (reconstruction) permit about the conservation of the facility, as well as the state construction supervision body, if the construction (reconstruction) of the facility is subject to such supervision.

1.7. If conservation is not carried out, the developer may be brought to administrative liability on the basis of Part 1 of Article 9.4 of the Code of Administrative Offenses of the Russian Federation.

1.8. Capital construction projects, the construction of which is resumed after mothballing, are transferred by the customer to the contractor under an act indicating the technical condition on the day of transfer.

II. PRESERVATION PROCEDURE

2.1. The decision to terminate or suspend construction is made by the developer (customer and notifies the work performer (contractor) of the decision, the local government body, as well as the relevant body that issued the construction permit and the state construction supervision body, if such supervision is provided for by the Urban Planning Code for this type of construction .

2.2. The fact of termination or suspension of construction within three days must also be notified, if necessary, to the traffic police of internal affairs bodies, in order to cancel previously introduced restrictions on the movement of vehicles and pedestrians, as well as the owners of territories included in the territory of the construction site in accordance with the approved and, the agreed urban development plan of the land plot.

2.3. Construction, reconstruction, conservation and liquidation of enterprises, buildings, structures and other facilities, the operation of which is related to waste management, are permitted subject to a positive conclusion from the state environmental assessment.

2.4. The decision to carry out conservation and the procedure for conservation of capital construction projects is established and approved by the head of the developer’s (customer’s) organization. The standard form of the order “On the transfer to mothballing of capital construction projects” is given in Appendix No. 1.

2.5. Conservation of a capital construction project can be carried out at varying degrees of completion of construction.

The degree of completion of construction can be determined as follows:

2.5.1. Initial stage of construction

(from 0% to 15% of the volume of work) corresponds to the following level of organization of preparatory, construction and installation work:

- suppliers of equipment and materials have been identified;

- work was completed on temporary buildings and structures within the framework of the project.

2.5.2. Middle stage of construction

(over 15% to 50% of the scope of work) may correspond to the following level of organization of preparatory and construction work:

- survey and design work has been completed;

- work on the construction of walls and roof structure has begun and is almost completed;

- work has begun on the installation of technological equipment and internal systems.

2.5.3. High stage of construction

(over 50% to 75% of the scope of work) corresponds to the following level of organization of construction and installation work at the site:

- survey work has been completed;

- supplies of equipment and materials have begun and continue;

- work was completed on temporary buildings and structures within the framework of the project;

- installation work of technological equipment and internal systems was completed within (50-75)%;

- finishing work has begun.

2.5.4.Final stage of construction

(over 75% to 99% of the volume of work) corresponds to the following level of organization of construction and installation work at the site:

- survey and design work has been completed;

- supplies of equipment and materials have been completed;

- work on the construction of walls and roof structure has been completed;

- work was completed on temporary buildings and structures within the framework of the project;

- work on the installation of technological equipment and internal systems is being completed;

- finishing work at the site was completed within (50-99)%;

- commissioning work has begun at the site.

2.6. The developer (customer) and the performer of the work, no later than a month after the decision to terminate or suspend construction, draws up:

2.6.1. Certificate of acceptance of the completed part of the object

with a description of the condition of the facility, indicating the volume and cost of work performed, and attaching a statement of equipment, materials and structures used (installed) at the facility. In this case, the unified form N KS-2 “Act on acceptance of completed work” is used (Approved by the Resolution of the State Statistics Committee of Russia dated November 11, 1999, N 100 “On approval of unified forms of primary accounting documentation for accounting of work in capital construction and repair and construction work”) .

The act is drawn up based on the data Logbook for completed work

(Form N KS-6a) in the required number of copies.

The actual volumes of construction and installation work performed must be compared with estimates, as well as accounting data for the relevant services of the customer and contractor, including through control measurements.

The act is signed by authorized representatives of the parties having the right to sign (the work contractor and the developer (customer).

Acceptance certificates for subcontracted work must include the certification signatures and seal of the general contracting enterprise that accepted the work.

Based on the data from the Work Acceptance Certificate, fill in Help about

cost of work performed and expenses

(form N KS-3).

2.7. List of unused and subject to conservation (storage) equipment, materials and structures.

The standard form of the Statement is given in Appendix 2.

2.8. List of works and costs necessary to ensure the safety of mothballed buildings (structures) or their structural elements

. The specified List is compiled with the participation of the design organization. The standard form of the List is given in Appendix 3.

2.9. Based List of works and costs

, necessary to ensure the safety of mothballed buildings (structures) or their structural elements, by the design organization, on behalf of the customer, within 2 months after the decision to mothball the construction is made estimate

and, if necessary, working drawings for the conservation of a capital construction project, as well as estimates for measures to ensure their safety.

Estimate for conservation work

after agreeing with the contractor, the estimate for measures to ensure the safety of the mothballed enterprise (facility) is approved by the developer (customer).

The development of working drawings and the preparation of estimates for conservation work and measures to ensure the safety of the mothballed enterprise (object) is carried out under an additional agreement concluded between the customer and the design organization.

2.10. The customer is obliged, within 2 months from the date of the decision to mothball the construction of enterprises (facilities), to make payments to the contractor for the volumes of construction and installation work completed before the decision on mothballing, to compensate for the losses the contractor incurred in connection with the termination or modification of contracts for the supply of materials and structures, as well as to pay the costs of transporting building materials and equipment to other construction sites (if any).

2.11. After agreeing on the estimate for conservation work and the estimate for measures to ensure the safety of the mothballed enterprise (facility), the customer and contractor must draw up Act on suspension of construction

. In this case, the unified form N KS-17 is used, approved by the Decree of the State Statistics Committee of the Russian Federation of November 11, 1999, N 100 “On approval of unified forms of primary accounting documentation for accounting for work in capital construction and repair and construction work.” The act must indicate the following data (on objects, work and costs suspended by construction):

- estimated cost - the total cost under the contract and the cost of actually completed construction and installation work;

- actual costs as of the date of conservation;

- funds necessary for settlements with the contractor;

- the cost of work and expenses required for conservation (including costs of compensating losses to suppliers and contractors).

The act is drawn up in the required number of copies for each construction site, indicating separately the work suspended by construction. One copy is transferred to the contractor, the second - to the customer (developer). The third is presented at the request of the investor.

2.12. The construction and installation work provided for in the estimate for conservation work is carried out by the contractor under an additional agreement to the general contract for capital construction. The additional agreement stipulates the deadlines for completing the work and handing over the mothballed enterprises (facilities) and structural elements to the customer.

Payments for completed construction and installation work for the conservation of enterprises (facilities) are made on the basis acceptance certificates for completed construction and installation work, drawn up according to Form N KS-2.

Construction and installation work performed by the contractor before mothballing, and construction and installation work for the mothballing of enterprises (facilities) are included in the scope of construction and installation work.

2.13. The mothballed object and construction site are transferred to the developer (customer) according to the act. The act is accompanied by as-built documentation, a work log, as well as documents on surveys, inspections, control tests, measurements carried out during construction, documents from suppliers confirming the compliance of materials, work, structures, technological equipment and engineering systems of the facility with the project and the requirements of regulatory documents.

2.14. The possibility of resuming the construction of facilities after a long break should be established by specialized design and research organizations through a thorough examination of structures, determining their actual strength, the level of corrosion damage to structural elements and issuing (extension) of a construction permit with the authorized bodies.

2.15. Work on the re-preservation of capital construction projects, including restoration work, is carried out by the contractor according to the estimate approved in the manner established by clause 2.9 of these Regulations for estimates for conservation work.

Annex 1

|

(name of company) |

Appendix 1. ORDER

|

_____ _____ _____ |

|||||||

|

(place of compilation) |

|||||||

|

On the transfer to mothballing of capital construction projects |

|||||||

|

Due to |

|||||||

|

indicate the reasons for the transfer |

|||||||

|

transfer the following capital construction projects to mothballing: |

|||||||

|

Name of capital construction projects |

Cadastral number of the land plot and inventory number of the capital construction project |

Construction completion level*) |

Preservation periods |

Objects of fixed assets are transferred to conservation when they are not used in the activities of educational institutions and cannot be used for transfer for a fee for temporary use.

When determining fixed assets to be preserved, it is advisable to conduct an inventory. In its process, the feasibility of transferring fixed assets to conservation is analyzed. At the same time, the inventory commission of the institution carries out an examination of mothballed objects, an economic justification for transferring to conservation (re-preservation); draws up appropriate cost estimates, including for the maintenance of mothballed objects, and draws up an act, which is signed by the members of the commission and approved by the institution.

In the conservation act, it is advisable to provide a list of mothballed fixed assets indicating their inventory numbers, initial and residual values, amounts of accrued depreciation, useful life and conservation periods.

There is no unified form of this document, so the institution should develop it taking into account the specifics of its activities and accounting

It is also necessary to develop an internal local document of the institution - a procedure that will determine the composition of measures for the conservation (reconservation) of objects and the sequence of their implementation.

Fixed assets are transferred to conservation for a period of more than three months based on an order from the head of the institution. It is also advisable to indicate in the order the reason for the conservation of the object, the date of transfer, the period of conservation, and the residual value of the object.

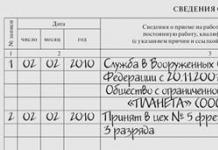

In the inventory cards of fixed assets (f. 0504031, 0504032), a note should be made about their transfer to conservation. Since a special column is not provided for this, information about conservation can be indicated in section 4 “Information on acceptance, internal movements, disposal (write-off) of fixed assets” of the card.

During the conservation process, fixed assets do not physically wear out. This is the reason for excluding the corresponding objects from depreciable property in accounting, but only in the case when the conservation period exceeds three months.

Additionally, we note that hazardous production facilities are transferred to mothballing in compliance with Federal norms and regulations in the field of industrial safety (approved by order of Rostechnadzor dated March 11, 2013 No. 96). In particular, it is necessary to prepare a justification for the safety of conservation in accordance with the order of Rostechnadzor dated July 15, 2013 No. 306.

Accounting

To account for transactions with material objects related to fixed assets, account 0 101 00 000 “Fixed assets” is intended. This is established by paragraph 38 of the Instructions, approved by order No. 157n dated December 1, 2010. An object of fixed assets that is under conservation continues to be listed on the balance sheet of the institution as an object of fixed assets (clause 11 of the Instructions, approved by order of the Ministry of Finance of Russia dated December 16, 2010 No. 174n).

In addition, the mothballing of an object of fixed assets for a period of more than three months is reflected in the debit of the corresponding analytical accounts of account 0 101 00 000 “Fixed Assets”, while simultaneously making an entry in the inventory card about the mothballing (re-mothballing) of the object.

According to paragraph 85 of Instruction No. 157n, the institution keeping records of a fixed asset calculates depreciation on it using the straight-line method. Depreciation begins on the 1st day of the month following the month the object was accepted for accounting, and is carried out until the cost of this object is fully repaid or this object is written off from accounting. During the year, depreciation on fixed assets is accrued monthly in the amount of 1/12 of the annual amount.

When transferring a fixed asset item to conservation for a period of more than three months, depreciation is suspended. Let's look at the conservation of an object and the calculation of depreciation using an example.

Example

Based on the order of the head of the educational budgetary institution, on May 31, 2015, a fixed asset item - production equipment - was mothballed with an initial cost of 120,000 rubles, with a depreciation amount of 80,000 rubles, for a period of six months. This object was purchased through a subsidy for the implementation of a state (municipal) task. The amount of accrued monthly depreciation is 1200 rubles. On November 25, 2015, the facility was reopened.

These transactions are reflected in accounting as follows:

|

Debit |

Credit |

Amount, rub. |

|

|

Depreciation accrued for May |

4 109 60 271 |

4 104 24 410 |

|

|

The fixed assets object was transferred to conservation |

4 101 24 310 |

4 101 24 310 |

|

|

Fixed asset facility reactivated |

4 101 24 310 |

4 101 24 310 |

|

|

Depreciation accrued for November |

4 10960 271 |

4 10424 410 |

|

Tax accounting

There is no need to restore the value added tax previously accepted for deduction on a mothballed or simply idle fixed asset. VAT on the costs of conservation (re-preservation) and maintenance of this property can be deducted, although the tax authorities are against this. However, the courts do not agree with them, citing the fact that any operation with property (including its liquidation) is related to production activities and is aimed at generating income (resolution of the Federal Antimonopoly Service of the North-Western District dated June 11, 2013 in case No. A56- 42644/2012).

For profit tax purposes, mothballed fixed assets are excluded from depreciable property when the mothballing period exceeds three months. At the same time, depreciation charges are reduced and the tax base is increased. It must be borne in mind that what matters is the actual, and not the expected, conservation period, as this may affect the calculation of depreciation.

For property tax purposes, conservation is not a basis for excluding property from fixed assets; therefore, these objects continue to be taken into account on the balance sheet and are listed, albeit separately, as part of fixed assets. And according to paragraph 1 of Article 374 of the Tax Code of the Russian Federation, this is a condition for calculating property tax.

A. Opalskaya,

Professor of the Department of Accounting and Auditing, Institute of Economics and Management, Ministry of Economic Development of Russia

Every enterprise sooner or later faces the fact that some fixed assets (fixed assets) are not in use for a long time. They may not be used for months or even years, and the reason for this can be anything from seasonality, completion of work on a project or its freezing, to the fact that the volume of work being performed is simply reduced.

If such a situation arises, the best way out of it would be conservation of the object. What is it, how is it carried out and how is accounting and taxation carried out?

Conservation is mandatory procedure for those enterprises that have a strategic purpose, influencing the economic situation of the state, and also responsible for its security. This operation is also carried out in institutions that are the property of the state.

Conservation is mandatory procedure for those enterprises that have a strategic purpose, influencing the economic situation of the state, and also responsible for its security. This operation is also carried out in institutions that are the property of the state.

It is worth noting that in this case there is no need to clarify the share of state ownership in the capital of the enterprise. Preservation procedure specified in the provisions. They must be taken into account when carrying out this operation, especially if state funds are involved. And also if the procedure is carried out at the expense of other sources. Thus, it does not matter what form of ownership the enterprise has.

In this matter only the source of funding is important. It is necessary to focus on how conservation issues are resolved and what this procedure is all about.

The exact definition of what conservation is is indicated in one of the provisions. In your own words, this concept can be expressed as follows: conservation of OS objects is a whole range of measures that are aimed at storing OS for a long period with the possibility of resuming functioning if production activities are stopped.

That is, in the case when fixed assets are temporarily impossible to use, they can be mothballed. Preservation is possible for up to three years. When the conservation period expires, it is necessary to carry out the reverse procedure - re-opening, and also decide how to continue to use fixed assets or completely liquidate them. Enterprises that are not affected by the provisions can mothball the OS for a longer period.

It is worth noting that this procedure is performed on the basis of the documents specified in the regulations. If the company does not fall under the criteria, which are also specified in the regulations, then this operation is carried out according to their personal decision.

This decision must be formalized as an order from the manager; it is adopted at the general meeting of shareholders. It all depends on the rules to which the entire enterprise is subject. Before performing this procedure, it is necessary to draw up a project. Such a project may be based on recommendations made by a special commission.

The conservation procedure takes place in a certain sequence. First of all, a decision is made to carry out this procedure by the body of the enterprise that has all the necessary powers for this.

The conservation procedure takes place in a certain sequence. First of all, a decision is made to carry out this procedure by the body of the enterprise that has all the necessary powers for this.

After the decision has been made, an order is issued that it is necessary to create a commission that deals with conservation issues. The head of this commission should be the head of the enterprise. After the order is issued, it is necessary to create a report stating that the use of fixed assets is impossible. The creation of a report must be approached from a technical and economic perspective.

At the end it is created Act, which indicates that fixed assets are temporarily removed from circulation and it is advisable to mothball them. The creation of a commission and the preparation of all documents are optional procedures. In this case, it will be sufficient to provide a decision on conservation.

Fixed assets that have undergone conservation cannot be used by the enterprise. Compliance with this rule is mandatory. It is not recommended to violate it, because the funds that have been preserved are not ready for use. If you ignore this rule, then there is a risk of causing damage to these products by subjecting them to breakage.

If an enterprise has decided to sell or transfer objects that have been mothballed, then in this case it is not necessary to re-mothball them. That is, they can be sold or transferred in the form in which they are located.

If fixed assets are mothballed, then the depreciation process will be suspended. Since depreciation is calculated every month, in case of conservation, the depreciation process will be suspended starting from the new month.

If fixed assets are mothballed, then the depreciation process will be suspended. Since depreciation is calculated every month, in case of conservation, the depreciation process will be suspended starting from the new month.

But if depreciation is calculated using the enterprise's own method, then this is exceptional situation. This means that it will stop accruing the next day after the objects are mothballed.

The original cost of objects that were mothballed, as well as the amount of accrued depreciation are indicated in the general balance sheet. It is also necessary to additionally indicate information about the residual value of fixed assets that have undergone conservation.

To make it much easier to indicate this information, it is recommended to consider the original cost of the fixed asset and depreciation separately. In this way, additional accounts are created and you can get by with separate accounting. The cost of conservation and re-preservation costs, as well as the maintenance of objects that have undergone this procedure, must be taken into account differently, depending on the type of activity of the enterprise, objects, as well as the timing and reasons for this operation.

It is worth considering a specific case using the example of an enterprise that organizes leisure activities during a certain season. Such enterprises can be summer cafes, attractions, boat rentals or ski resorts, and so on. For such enterprises, the OS conservation operation is part of the activity or production technology.

The need for this operation and the reverse procedure must be foreseen in advance. It is obvious that these operations should be included in the cost of the goods or services provided.

In the case where conservation occurs due to the fact that the volume of production is reduced or a certain type of activity at the enterprise is temporarily stopped, this event can be considered within the framework of normal activities that will not be related to production as a whole. The costs of these operations must be reflected in accounting, just like others.

It is also worth noting that the conservation process may occur due to an emergency. Such situations may include a fire or natural disaster that caused severe damage to the warehouse. If we consider one of these scenarios, we can assume that the enterprise does not have the means to recover, however in the plans do it in a year or two. Then conservation of funds will be appropriate and, perhaps, the only right decision. In this case, conservation costs are indicated as extraordinary.

After the objects are re-opened, it is necessary to resume depreciation. To do this, an order is issued by the manager, and depreciation will begin to accrue from the new month. If there is a need to mothball fixed assets, then the following should be remembered:

- This procedure is carried out for three years.

- When preserving fixed assets, depreciation is not charged.

- This issue is approved by the head in the presence of the commission.

- It is necessary to conclude an act, which is proof of the procedure.

A tutorial on preserving and moving the OS in 1C Accounting is presented below.