It is very commendable when an organization decides to provide free meals to its employees. In fact, a full-time employee of the company spends a sufficient amount of money on all kinds of lunches, snacks, coffee, etc. If your salary is not too high, the cost of providing yourself with food can reach 10% of your average monthly income. Having saved this money, the employee will be more loyal to his superiors than if this had not happened. However, this is one side of the issue, and it in no way relates to the accounting that we want to tell you about. As part of our topic, we will talk about the types of free meals, which of them are mandatory and which are organized at the initiative of the employer, indicate the most popular transactions and touch a little on the topic of taxation.

Required or optional?

We have all heard at different times, and some know firsthand, that workers in hazardous industries are entitled to milk, as well as other food products within the limits regulated by Article 222 of the Labor Code of the Russian Federation. You can call it “nutrition” as such, but only with a very big stretch. We are talking here primarily about maintaining a healthy state of the body, rather than about a certain “fullness” that free lunches imply. By the way, such employees do not have to be given food products in kind: they can be replaced with monetary compensation at the request of the employee, but this is the topic of a completely different article. Here it is important for us to understand whether there is some kind of “obligation” of the employer to “feed” his subordinates or not? Having studied this issue, as well as interviewed our clients on the “” service, we come to the conclusion that there is no obligation as such, but there is a right. In addition to the specified article 222 of the Labor Code, we found article 108, which talks about a lunch break for employees. So far, this remains practically the only “legal” period of time intended for eating. How can an employer organize it to his benefit and taking into account the interests of his employees? In theory, the employer can charge additional amounts of money to compensate for food costs in proportion to the number of days worked in each month, or he has the right to open a small canteen, cafe, or even a restaurant, where any “bowl of soup” will be sold free of charge.

Documentation

At the same time, the desire to provide workers with the opportunity to have free lunch will not be enough. To do this, you need to perform a number of fairly simple but mandatory operations with documents:

If you have already decided to feed your subordinates, you must make a corresponding entry in the collective agreement, which must include approximately the following wording: “the employer undertakes to provide free food.” She will not allow her to abandon her obligations to her colleagues overnight;

It is necessary to issue an additional agreement to the employment contract with reference to the above note;

It is important to reflect information on the working time sheet about how many workers and on what days actually visited the canteen or received monetary compensation. This is necessary in order not to take into account in the calculation those who are on vacation, on sick leave or on a business trip;

It is important to create a document reflecting the daily menu with the signature of the general director and the seal of the organization. The menu must be compiled in such a way that the company’s management can actually ensure the preparation of exactly the dishes that are indicated on it. The ideal picture: management coordinates it with the team and makes adjustments to it, according to the preferences of the employees.

At this stage, the “paper” work ends and you can begin arranging the place where employees will have lunch. Accountants who have experience working in public catering or in a company with a similar “social package” know well how to distribute costs among accounts to correctly reflect the costs of purchasing food products.

Postings

The choice of the most optimal transactions will depend primarily on how exactly the company’s management organized free meals. There are cases when a company decides to organize a canteen, but does not involve professional chefs in the work, limiting itself to ordering ready-made dishes from third parties. Let's look at two options:

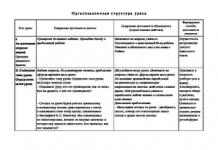

|

Method of catering |

Account correspondence | ||

|

Debit |

Credit |

||

|

Ordering food from specialized catering establishments |

Funds were transferred to the supplier for lunches |

||

|

Lunch provided |

|||

|

The cost of lunches provided is included in salary expenses |

|||

|

Compulsory insurance premiums charged |

|||

|

Personal income tax withheld from the cost of lunches |

|||

|

Meals in the employer's own canteen |

Reflection of expenses for preparing lunches |

||

|

Lunch included in wages |

|||

|

VAT on the cost of lunches |

|||

|

Writing off the cost of lunches |

|||

As we can see, each of the two accounting options is quite easy to learn, so there should be no difficulties in your work. Regarding the most optimal solution in the field of providing employees with free lunches, each company must decide for itself which one will be more suitable, based on its financial capabilities. Each of them has its own positive and negative sides. When ordering food from partners, it will certainly be of high quality, because... this is a highly competitive market. At the same time, by opening your own canteen, you can earn extra money by attracting third-party citizens as clients.

Taxation

Regardless of the way this issue is resolved, the accountant needs to correctly determine the tax base taking into account new expenses if the canteen has just begun to function. In particular:

Personal income tax

If we proceed from the definition that the lunch an employee receives is essentially income expressed in kind, then the personal income tax on its value will be calculated in proportion to how many servings the employee received per month. In fact, this means that personal income tax will be determined for each individual employee.

Regarding value added tax, the state and business disagree. For example, the Federal Tax Service considers lunches provided to employees as gratuitously issued inventory items, which by definition requires payment of VAT. In turn, companies for the most part do not agree with this belief, because regard lunches as a production activity prescribed in the collective agreement and agreements. Based on precisely this judgment, the need to pay VAT automatically disappears. However, tax experts recommend that you still pay VAT, as they say, “out of harm’s way,” and also for the reason that the company, when paying the tax, will be able to take into account the “input” VAT on the purchased products.

Income tax

Considering that the company purchases food raw materials and then donates it to employees in the form of ready-made meals, it does not receive any profit, but only bears expenses. However, when calculating income tax, a company has the right to take these expenses into account as expenses only when the employer’s obligation to provide free lunches is specified in the above-mentioned local acts, as well as when the employer has a personalized accounting of these costs. Otherwise, the tax base may be determined incorrectly.

In any case, know that by providing free food, you will not become poor, because there will be more gratitude than material costs.

Thank you for your attention and see you again!

Food Accounting Basics

Today there is only one specialized regulatory document that regulates the accounting of food products - Instruction No. 530. And although this Instructions quite outdated, but it continues to operate on the territory of Ukraine. Base - resolution No. 1545, according to which, until the adoption of the relevant acts of legislation of Ukraine, acts of legislation of the USSR on issues not regulated by the legislation of Ukraine are applied on its territory, provided that they do not contradict the Constitution and laws of Ukraine.

There are no other specialized instructions for accounting for food products, so it can be taken as the basis for accounting not only in the healthcare sector, but also in other sectors of the public sector.

In addition, do not forget that food products are to the inventory category, the accounting of which is regulated Regulation No. 947. The unit of inventory accounting is their name or homogeneous group.

As a rule, financial responsibility for receiving, storing and using food products rests with the storekeeper. In the event that the position of storekeeper is not included in the staffing table of the institution, such responsibility is assigned to the employee elected by the manager. Directly at the catering unit, financial responsibility for food products lies with the production manager or chef, and in his absence in the staffing table, the cook.

Food products must be stored in specially equipped pantries and vegetable warehouses that ensure their safety and comply with sanitary standards and rules.

According to current legislation, catering services must be provided of appropriate quality, for which the head of the budgetary institution and the food supplier are responsible. Therefore, the supplier is obliged to provide, along with food products, documents confirming their quality: certificates of conformity, veterinary and quarantine permits.

Catering process

The process of organizing catering in a budgetary institution begins with the development of a weekly (two-week) cyclical menu based on food sets established by state regulations, which are introduced separately for different types of activities. A cyclic menu is developed within the approved budget institutions. It should be noted that at the moment the mentioned food sets, the monetary equivalents of which form the basis for calculating the planned budget allocations for food, are not linked to the lists of recommended dishes. Obviously, such a link is useful: it will facilitate work on the ground and will contribute to improving the quality of nutrition.

For example, in healthcare by order No. 931 The State Enterprise “State Research Center for Food Hygiene of the Ministry of Health of Ukraine” and other specialized institutions were instructed to develop technological food maps based on disease profiles, compile samples of weekly menus and scientifically based daily food sets. Today, to develop menus for institutions, their staffs have included the positions of a nutrition nurse and/or a dietician, along with a chef.

To compile a list of prepared dishes in practice, “ Collection of dish recipes and culinary products for public catering establishments", 1982, developed by NIIOP jointly with the Public Catering Directorate of the USSR Ministry of Trade. Among the publications that take into account the specifics of a particular industry, the following can be noted: “Collection of recipes for meals for schoolchildren.” M.: Ministry of Trade, 1985; Gubergrits A. Ya., Linevsky Yu. V. “Therapeutic nutrition.” K.: Higher School, 1989; Pokrovsky A. A., Samsonov M. A. “Handbook of Dietetics.” M.: Medicine, 1992, etc.

Selected according to a cyclical menu technological maps for dishes contain gross and net consumption standards for the products used, the yield of the finished portion, food preparation technology, its energy value and chemical composition. To calculate the cost of each portion based on technological maps, the accountant draws up calculation cards, which, in turn, contain gross standards, supplier prices for products and the yield of one serving. The accountant should check the ratio of gross, net and finished product yield standards according to technological maps from approved collections of recipes. If for the preparation of dishes they use raw materials that are similar, but different from those in the collection of recipes, or dispense dishes that are not contained in the collection, then the technological maps must be approved based on the results of control measurements by a commission appointed by order of the head of the institution. Please note: to “fit” into the approved budget of the institution, vary the list of dishes and the yield of finished products.

Accounting for food products in a warehouse

Accounting for food products in a warehouse must be carried out in such a way as to ensure the storage of food products during their receipt, storage and release.

Warehouses must have scales, measuring containers, refrigeration units, ventilation devices, tools and devices for opening containers.

Scales, weights, and measuring containers must undergo state verification or metrological certification performed by the State Standards Authority of Ukraine.

Products and containers in the warehouse must be placed by name, grade, in accessible places in sections, and within them - by individual types (on racks, in boxes, on shelves, etc.) in such a way that it is possible to ensure their quick admission, release and inspection.

When receiving supplies, the storekeeper must put his signature on the supplier’s document or the materials acceptance certificate indicating receipt of these valuables and accept them for safekeeping.

Quantitative and/or qualitative discrepancies with the data of suppliers’ documents identified upon receipt of material assets are documented in a report.

The storekeeper keeps quantitative records of products in Warehouse book.

IN Warehouse book(form No. З-9), the standard form of which has been approved by order No. 130, the receipt, consumption and remains of food products by name, quantity, item numbers and varieties are taken into account. The warehouse accounting book must be numbered and signed by the chief accountant. Each name of food product must be displayed on a separate page of the Book. Remains are displayed after each entry and issue of food products.

Based on the supplier's invoice data, records are made of the receipt of food products at the warehouse. Records of food products leaving the warehouse are made based on data menu-requirements for food distribution from warehouse(form No. З-4) and invoice (requirements)(form No. З-3).

At a frequency established by the chief accountant of the institution, the storekeeper (financially responsible person) provides to the accounting department, incoming and outgoing documents with a register, which is compiled in two copies. One copy of the register, after checking the correctness of the primary documents, is returned to the financially responsible person, and the second remains in the accounting department. At the end of the Warehouse Book, entries are made at least once a quarter about its verification by the accounting department.

Accounting for food products in the catering department

Accounting for food products at the catering unit has its own characteristics.

Food preparation and distribution are carried out based on the actual number of people eating, which is recorded by authorized employees at the beginning of each day.

Thus, senior nurses of inpatient departments of medical and preventive healthcare institutions must submit daily data on the actual presence of patients in the hospital as of 9:00 am, indicating the distribution of patients among diet tables according to the medical cards of inpatients.

The number of patients in the departments is compared with the data from the emergency department.

Based on these data, the nutritionist of the food department compiles summary data regarding patients who receive food in the hospital as a whole. Also, the nutritionist must reconcile this data with the statistical data of the hospital and the data of the emergency department.

In educational institutions, data on the actual availability of meals is provided by the persons responsible for such information.

Based on the summary data regarding the patients who are eating, the nutritionist, with the participation of the chef and the accounting employee and with the help of the nutritionist, draw up a menu layout for the patients’ meals. If the number of diet tables is insignificant, then a menu requirement is drawn up.

If the number of patients changes by more than 3 people compared to the number of patients as of 9:00 am, the nutritionist of the catering department makes a calculation of the change in food needs. When the need for food products increases, an invoice (demand) is issued to the warehouse (pantry), and when the need decreases, the remaining food products are returned to the warehouse.

Accounting for food products in accounting

Food credited to balance at original cost, which, in the case of their delivery for cash, is the supplier’s cost excluding VAT. Transport costs for delivery do not increase the cost of inventories, and, like VAT, are immediately charged to actual expenses.

In accounting, food products are recorded in quantitative and total terms, in the context of financially responsible persons.

Analytical accounting food products in accounting are maintained by name, quantity, cost and financially responsible persons in the turnover sheets, in which turnover is calculated monthly and balances at the beginning of the month are determined. In case of manual accounting form entries in the turnover sheets are made on the basis of data from accumulative sheets for the receipt and consumption of food products, the standard forms of which are approved by order No. 130.

Standard form Cumulative statement of food receipts(form No. 3-12) for the month is, firstly, a register of incoming documents by supplier, indicating the date, number and total amount of each document. Secondly, the form contains a list of all names of received products, indicating the unit of measurement, quantity and amount for each date for each item and each document, as well as the total amount for all items and all documents (suppliers). Standard form Accumulative statement of food consumption(form No. 3-13) for the month is a list of all items of products used, indicating the unit of measurement, quantity for each working date of the month, price and amount for the month for each item, as well as the total amount for all items. The document provides the actual number of people eating on each date and the total number of menu requirements for which it was compiled. Analytical accounting data must coincide with synthetic accounting data which leads to subaccount 232“Food products” using memorial orders, the standard form of which has been approved Instruction No. 68.

Memorial order No. 11 “Cumulative statement of receipt of food products” is a decoding of the debit turnover of subaccount 232 in correspondence with the credit of subaccount 361 “Settlements with suppliers” in the form of a register of the amounts of incoming documents by suppliers.

Memorial order No. 12 “Cumulative statement of food consumption” is a breakdown of the credit turnover of subaccount 232 in correspondence with the debit of other subaccounts.

Let us remind you that entries in memorial orders are made for each primary document. If there are several financially responsible persons in an institution, then separate accumulative statements and a summary of the institution are compiled for them.

Write-off of food products

Write-off food products for the supplied meals are carried out according to weighted average price.The latter is determined for each item by dividing the total value of the remaining inventory at the beginning of the reporting period and the value of the inventory received in the reporting month by the total amount of inventory at the beginning of the reporting period and the inventory received in the reporting period (see example below). Number of products used of each item for their write-off is determined as the sum for all names of dishes of the products of the gross norm of products per dish according to the calculation card and the number of identical dishes issued according to the intake sheets (see example below). Checksum write-offs for all types of products are equal to the product of the approved monetary limit per 1 consumer per day by the actual number of consumers and the number of days of service provision (without charity).

The amount of used products calculated as described above is periodically compared by the accountant with the data in the warehouse accounting book maintained by the financially responsible person.

With greater frequency, but at least once a quarter, they carry out inventory in accordance p.p. 9 clause 1.5 of Instruction No. 90- i.e., they compare balances according to accounting data with the actual availability of products in the pantry. If discrepancies are identified, the reasons for them will need to be clarified. In the event of an actual shortage and after offset of the shortage with surplus by re-grading, a write-off is made taking into account natural loss of products according to Standards No. 88.

Note that natural decline- these are the costs of drying and spraying liquid and powdery products, crumbling when cutting meat, etc. The amount of such costs is calculated for each product separately as the product of the norm, expressed as a percentage, by the quantity (amount) of goods sold for the period between inventories (see .example below). The established norms of natural loss are limiting: products are written off in actual amounts, but not more than those calculated according to the norms. The standards apply regardless of the shelf life of food in the pantry. Ukraine is the first trade zone. Whether a pantry belongs to the 1st or 2nd group is determined according to Clause 3 of Appendix No. 7 To Standard No. 88.

We also draw attention to the fact that when writing off perishable food products, you must comply with the requirements of sanitary and hygienic and sanitary and anti-epidemic rules and regulations ( SanPiN 42-123-4117-86 “Conditions and shelf life of food products, especially perishables”). It is prohibited to write off perishable food products after their specified shelf life. According to Art. 46 of Law No. 4004 the cost of sold food products with expired shelf life is subject to reimbursement in the amount of 100% of their value.

Example.We summarize the initial data and calculations in tables. We also take into account that food inventories were carried out in the canteen on June 1 and 5, and, according to the latter, the actual balance of poultry meat is 20.685 kg. The pantry belongs to the second group. The rate of natural loss of chilled poultry meat is 0.15%.

|

Technological map no. |

Calculation of disposal of raw materials for poultry meat (kg) |

||

|

Name of dish (yield in g) |

Chicken cutlet (50 g) |

Boiled chicken (50 g) | |

|

Gross norm for poultry meat (kg per 100 servings) | |||

| 18,060 = 6,2: 100 X 280 + 7,0: 100 x 10 |

|||

| 19,870 = 6,2: 100 x 10 + 7,0: 100 x 275 |

|||

| 17,804 = 6,2: 100 x 277 + 7,0: 100 x 9 |

|

Received |

Remaining at the end |

||||||||

|

Quantity, kg |

Price, UAH |

Amount, UAH. |

Quantity, kg |

Price*, UAH |

Amount, UAH. |

Quantity, kg |

Price, UAH |

Amount, UAH. |

|

|

Total before inventory | |||||||||

|

Natural decline (fact)** | |||||||||

* Disposals are calculated using weighted average prices, namely:

06/01/14: 24.59 = (384.00 + 575.00) : (16,000 + 23,000),

06/02/14: 24.59 (the price did not change, since there was no receipt),

06/04/14: 25.96 = (26.31 + 975.00) : (1.070 + 37.500).

** The limit for natural loss is 0.084 kg (55.734 x 0.15%).

*** Data for the balance sheet for the corresponding period (analytical accounting).

The actual loss (20.766 - 20.685 = 0.081 kg) is less than the marginal loss (0.084 kg), so we write off all this loss as expenses of the corresponding budget.

Primary documents and consolidated registers for food accounting

Mandatory requirements for the preparation of primary documents are formulated in Law No. 996. Primary documents are compiled on a continuous basis from the moment of registration of a legal entity until its liquidation in order to record all business transactions. They must contain: the name of the document, the name of the organization on whose behalf the document was drawn up, the date and place of its preparation, the content, volume and unit of measurement of the business transaction, the position of the person responsible for carrying out and processing the operation, the signature and position of the person directly involved in the transaction its completion. To optimize accounting for organizations given the right to independently develop forms of primary documents in compliance with the above requirements, standard forms can be used.

Due to the high labor intensity of public catering services, the entire process is divided, as mentioned above, into several stages (operations), at each of which certain primary documents (consolidated registers), and several departments are involved.

For clarity, we provide information on the distribution of powers between the pantry, catering department and accounting department in the table:

| Operation (composing unit) | Documents | Document storage location |

||

| pantry | catering department | accounting |

||

| Reception, storage and delivery of products storekeeper | Supplier's invoice (with register for the period) | + | ||

| Supplier quality certificate (with register for the period) | + | |||

| Warehouse book | ||||

| Cooking food department | The menu is cyclical and daily | |||

| Technological maps | ||||

| Sales of dishes food department | Daily information about the number of people eating | |||

| Fence sheet for release of finished products | ||||

| Calculations and systematization of information accounting | Calculation cards | |||

| Menu-requirement and invoice-requirement (with register for the period) | + | |||

| Analytical balance sheets for food products | ||||

| Memorial Warrants No. 6, 11 and 12 | ||||

| Inventory lists | ||||

Correspondence of subaccounts for food accounting

In conclusion, we present the correspondence of accounting subaccounts in accordance with by order No. 611 indicating memorial orders, which must be executed in accordance with Instructions No. 68, for an institution financed from the local budget. Let us remind you that entries in memorial orders are made for each primary document.

| Subaccount correspondence | Memorial warrant |

|||

| Food products were capitalized without VAT, VAT was written off as expenses | 1550,00 | |||

| Funding has been received to the registration account in the Treasury | ||||

| Payment was made to the supplier for food products | ||||

| Products transferred for processing | ||||

| Raw materials written off for sold catering products | ||||

Regulatory documents

HKU- Economic Code of Ukraine dated January 16, 2004 No. 436-IV.

Law No. 996 - Law of Ukraine “On Accounting and Financial Reporting in Ukraine” dated July 16, 1999 No. 996-XIV.

Law No. 4004- Law of Ukraine “On ensuring the sanitary and epidemiological well-being of the population” dated February 24, 1994 No. 4004-XII.

Resolution No. 1545- Resolution of the Verkhovna Rada of Ukraine “On the procedure for temporary validity on the territory of Ukraine of certain acts of legislation of the USSR” dated September 12, 1991 No. 1545-XII.

Instruction No. 530- Instructions for recording food products in medical and preventive and other healthcare institutions financed by the State Budget of the USSR, approved by order of the USSR Ministry of Health dated 05.05.83 No. 530.

Order No. 130- order of the State Treasury of Ukraine “On approval of standard forms for accounting and write-off of inventories of budgetary institutions and instructions on their preparation” dated December 18, 2000 No. 130.

Regulation No. 947 - Regulations on accounting of inventories of budgetary institutions, approved by Order of the Ministry of Finance dated November 14, 2013 No. 947.

Order No. 931 - Procedure and Instructions for organizing a medical nutrition system for patients in healthcare institutions, approved by Order of the Ministry of Health dated October 29, 2013 No. 931.

Instruction No. 90 - Instructions for inventory of material assets, calculations and other balance sheet items of budgetary institutions, approved by Order of the Ministry of Finance dated October 30, 1998 No. 90.

Standards No. 88 - Norms for the natural loss of food products during storage and distribution at small wholesale bases and in pantries of public catering establishments and Instructions for their use, approved by order of the USSR Ministry of Trade dated April 2, 1987 No. 88 (Appendices 6 and 7).

Order No. 611 - Chart of accounts for accounting of budgetary institutions, approved by order of the Ministry of Finance dated June 26, 2013 No. 611.

Instruction No. 68 - Instructions on the forms of memorial orders of budgetary institutions and the procedure for their preparation, approved by order of the State Treasury dated July 27, 2000 No. 68.

The main objective of the program:Automation of calculations when creating daily menu requirements in the DDU and obtaining all necessary reporting documents. Additionally, you can plan a menu for a future period and receive data on compliance with standards for the previous period.

Features implemented by the program Nutrition accounting in kindergarten:

- Maintaining an unlimited number of ready-made 10-day menus

Maintaining up to 10 categories of beneficiaries in one document. Additional menus and returns.- Quick menu creation:

- from the directory of cyclic 10-day menus

- using the food guide

- copying previous menus

- Reports:

- Menu-requirement

- Request-invoice

- Menu for parents

- Menu layout

- TTK for any dish

- Storekeeper's expense sheet

- Service functions:

- rounding the total number of products

- selection for a given number of products

- possibility of separate write-off of products by funding sources

- Maintaining cyclic 10-day menus

Built-in menus, the ability to create your own menus with calculation of compliance with standards and approximate costs. Ability to exchange cyclic menus between users.- Reports:

- List of cyclic menus

- Calculation of compliance with standards using a cyclic menu

- Menu layout by cyclic menu

- Accounting for the movement of products according to DDU

Accounting for the receipt of products using the “Receipt invoice” documents. Storing all information on the movement of products in the balance register. Automatic write-off of products using “Menu-requirement” documents. Reconciliation of results using the “Inventory” document.- Reports:

- Wealth accounting card

- Receipt accumulative statement

- Detailed receipt statement

- Turnover sheet by product

- Product consumption sheet

- Inventory sheet

- Receiving specialized reporting on compliance with standards

- Reports:

- Cumulative statement for products

- Cumulative calorie sheet

- Compliance with nutritional standards

- Compliance with product standards

- Meeting calorie standards

- Keeping logs related to catering

Logbook for rejecting finished products, logbook for rejecting raw products, logbook for rejecting perishable products, logbook for vitaminization, logbook for waste.- Reports:

- Printable forms of sheets of relevant magazines

- Accounting for contracts with suppliers

Maintaining a log of contracts with suppliers, with the ability to fill out specifications. Automatic control of contract fulfillment. Price control according to contract specifications, filling out invoices according to specifications.- Reports:

- Printable specification form

- Detailed report on the implementation of the contract

- Planning food expenses for the future period

The ability to calculate an institution’s need for products for a period based on a cyclic menu or real consumption for the previous period, taking into account balances.- Reports:

- Calculation of product consumption planning

- Usability of dishes

- Exchange of information with external programs

It is possible to upload and download documents Menu-requirement and Receipt invoice into the 1C8-BGU and Parus programs. - Additional features:

- Automatic archiving of program databases

- Possibility of accounting for DDU groups

- Possibility of accounting for transactions by budget sources

- Flexible customization of printed forms to suit user needs

- - work using Cloud technology, without installing a program on your computer from any device with Internet access;

- - program rental.

In both options, the payment will be 350 rubles/month. In this case, you do not pay for updates and use technical support on a general basis.

What regulatory documents should be followed when organizing catering? What are the requirements for the nutrition itself? How is catering organized and reflected in records?

In accordance with paragraph 1 of Art. 37 of the Law on Education, educational organizations are charged with organizing meals for students. What norms and requirements should be observed in this case, as well as what is the procedure for recording various operations related to catering, we will consider in this article.

The organization of meals should be handled by an educational institution. At the same time, regulatory regulation of the provision of meals to students is within the competence of state authorities of the constituent entities of the Russian Federation and local governments (clause 4 of Article 37 of the Law on Education). They determine the cost of meals, sources and rules for financing them, preferential categories of students who are exempt from paying for meals in whole or in part, and other general organizational issues.

In addition, at the federal level, the joint Order of the Ministry of Health and Social Development of the Russian Federation No. 213n, the Ministry of Education and Science of the Russian Federation No. 178 dated March 11, 2012, approved Methodological Recommendations for organizing meals for students and pupils in educational institutions (hereinafter referred to as the Recommendations). They list technical regulations, SanPiNs and federal laws that educational organizations must comply with. It should be noted that some of the documents named in the regulations have been changed or lost force, while the regulations themselves have not lost their relevance. Let's consider its main provisions.

Nutritional requirements.

Nutrition can be monitored by parent committees, guardianship councils and other public organizations.

a) compliance of the energy value of daily food rations with the energy expenditure of students and pupils;

b) balance and maximum variety of diet;

c) optimal diet;

d) ensuring in the process of technological and culinary processing of food products their high taste qualities and preservation of the original nutritional value;

e) taking into account the individual characteristics of students and pupils (the need for dietary nutrition, food allergies, etc.);

f) ensuring sanitary and hygienic food safety;

h) compliance of raw materials and products used in food with the hygienic requirements for quality and food safety provided for by the technical regulations on food safety, technical regulations for juice products from fruits and vegetables, technical regulations for fat and oil products, Uniform requirements approved by the Decision of the Commission Customs Union dated May 28, 2010 No. 299, SanPiN 2.3.2.1940-05, SanPiN 2.3.2.1078-01.

It is recommended to provide students and pupils of educational institutions with average daily food sets (rations) in accordance with current sanitary rules and regulations (clause 7 of the Recommendations):

The menu for each type of educational institution must be developed on the basis of approved nutritional sets (rations) that ensure the satisfaction of the needs of students and pupils of different age groups for basic nutrients and the energy value of nutrients, taking into account the duration of their stay in the educational institution and the educational load.

When developing menus and catering, you should also be guided by the Methodological Recommendations “MR 2.4.5.0107-15. 2.4.5. Hygiene. Hygiene of children and adolescents. Baby food. Organization of nutrition for children of preschool and school age in organized groups”, approved by the Chief State Sanitary Doctor of the Russian Federation on November 12, 2015. They set out the basic principles and recommendations for organizing nutrition for preschool and school-age children in organized groups, as well as for using a range of food products in children’s nutrition.

Institutions also need to provide for a centralized supply of drinking water that meets the hygienic requirements for the water quality of centralized drinking water supply systems (clause 12 of the Recommendations).

Water can be provided in stationary drinking fountains or in containers.

The range of food products that form the basis of nutrition for students and pupils of educational institutions is recommended to be compiled in accordance with the requirements of SanPiN 2.4.1.3049-13 and SanPiN 2.4.5.2409-08 (clause 14 of the Recommendations).

Two hot meals a day (breakfast and lunch) must be provided. The intervals between meals should not exceed three to four hours. For students and pupils attending an extended day group in general education institutions, it is additionally recommended to organize an afternoon snack (clause 15 of the Recommendations).

In educational institutions (except preschools), food products can be traded using vending machines.

The assortment list of food products permitted for trade in this way is given in paragraph 16 of the Recommendations.

Catering.

Catering in educational institutions can be carried out using industrial methods of food production and the production of culinary products directly in the catering units of educational institutions in accordance with sanitary and epidemiological requirements (clause 17 of the Recommendations).

Industrial methods of food production for educational institutions are recommended to ensure the industrial production of semi-finished products and ready-made dishes with prolonged (extended) shelf life at food production complexes using modern technologies that ensure large-scale production of food sets (rations), with their subsequent distribution by pre-preparation and distribution canteens of educational institutions (Clause 18 of the Recommendations).

Food service workers must undergo advanced training courses (clause 19 of the Recommendations).

The development of programs and implementation of activities aimed at training, retraining and specialists, ensuring the improvement of catering in educational institutions, the formation of a culture of healthy nutrition among students and pupils of educational institutions, can be carried out on the basis of regional internship sites, the structure of which may include specialized educational institutions of professional education, educational institutions, scientific organizations (clause 20 of the Recommendations).

Documentation and accounting.

Within the framework of catering, the following main areas of accounting are affected:

food accounting;

accounting of ready meals;

accounting for food charges.

Food accounting. In accordance with clause 118 of Instruction No. 157n, food products are recorded on account 0 105 02 000 “Food products” (most often on account 0 105 32 000 “Food products - other movable property of the institution”). Food products are classified as inventories, and their acquisition in accordance with Instructions No. 65n is carried out under Article 340 “Increase in the cost of inventories” of KOSGU under expense type code 244 “Other purchase of goods, works and services to meet state (municipal) needs.”

When organizing the purchase of food products, institutions are guided by the Law on the Contract System. When purchasing for public catering services and (or) supply of food products purchased for organizations engaged in educational activities, the customer has the right to conduct either an electronic auction, a closed auction, a request for quotations, a request for proposals, a purchase from a single supplier (contractor, performer) without presentation requirements for procurement participants to have relevant experience, or a competition with limited participation with requirements for procurement participants to have experience in accordance with the standards established by Appendix 2 to Decree of the Government of the Russian Federation dated 04.02.2015 No. 99 (hereinafter referred to as Decree No. 99).

This conclusion was made based on the fact that the provision of public catering services and (or) the supply of food products purchased for organizations conducting educational activities, organizations for children’s recreation and their health (if the initial (maximum) contract price (lot price) exceeds 500 thousand rubles) refers to cases of procurement of goods, works, services, which, due to their technical and (or) technological complexity, innovative, high-tech or specialized nature, can only be supplied, performed, provided by suppliers (contractors, performers) who have the necessary level of qualification (clause 6 of Appendix 2 to Resolution No. 99).

At the same time, when choosing a method for determining a supplier (contractor, performer), the customer must avoid unreasonable procurement from a single supplier (performer, contractor), as this may entail a violation of the principle of ensuring competition, which is one of the basic principles of the contract system in the field of procurement . Similar explanations are given in letters of the Ministry of Economic Development of the Russian Federation dated February 18, 2016 No. OG-D28-2109, dated June 6, 2016 No. D28i-1474, dated September 19, 2016 No. D28i-2577.

Analytical accounting of food products is maintained in the turnover sheet for non-financial assets (f. 0504035). Entries in this document are made on the basis of data from the accumulative sheet for food receipts (f. 0504037) and the accumulative sheet for food consumption (f. 0504038). Every month, in the turnover sheet (f. 0504035), turnover is calculated and balances at the end of the month are displayed (clause 119 of Instruction No. 157n).

An accumulative statement (f. 0504037) is compiled for each financially responsible person, indicating suppliers (manufacturers), by name and (if necessary) by code of food products.

Entries in the accumulation sheet (f. 0504038) are made daily based on the menu requirements (f. 0504202) and other documents attached to it.

At the end of the month, the totals are calculated in the accumulative sheet (f. 0504038), the cost of the products consumed is determined and at the same time it is checked against the number of those receiving food. This document is compiled for each financially responsible person by name and (if necessary) by code of food products.

The menu-requirement for the distribution of food products (f. 0504202) is used to formalize the supply of food products and is compiled daily in accordance with the standards for the distribution of food products and data on the number of people receiving food.

The menu requirement (f. 0504202), certified by the signatures of persons responsible for receiving (issuing, using) food products, is approved by the head of the institution and transferred to the accounting department within the time limits established within the accounting policy by the rules of document flow and technology for processing accounting information.

All of the above document forms are approved by Order No. 52n.

Operations for the receipt and disposal of food products are formalized as follows:

|

State institution |

Budgetary institution |

Autonomous institution |

|||

|---|---|---|---|---|---|

|

Receipt of materials from supplier |

|||||

|

0700 0000000000 000 |

0700 0000000000 000 |

0700 0000000000 000 |

|||

|

Payment to the supplier for food costs |

|||||

|

0700 0000000000 244 |

0700 0000000000 000 |

0700 0000000000 000 |

|||

|

Advance payment to the supplier for the cost of food products |

|||||

|

0700 0000000000 244 |

0700 0000000000 000 |

0700 0000000000 000 |

|||

|

Offset of advance payment when settling with the supplier |

|||||

|

0700 0000000000 244 |

0700 0000000000 244 |

0700 0000000000 244 |

|||

|

Transfer of food products for cooking |

|||||

|

0700 0000000000 000 |

0700 0000000000 000 |

0700 0000000000 000 |

|||

* Instructions for the use of the Chart of Accounts for Budget Accounting, approved by Order of the Ministry of Finance of the Russian Federation dated December 6, 2010 No. 162n.

** Instructions for the use of the Chart of Accounts for accounting of budgetary institutions, approved by Order of the Ministry of Finance of the Russian Federation dated December 16, 2010 No. 174n.

*** Instructions for the application of the Chart of Accounts for accounting of autonomous institutions, approved by Order of the Ministry of Finance of the Russian Federation dated December 23, 2010 No. 183n.

Accounting for ready meals. To correctly reflect ready-made meals in accounting, let us turn to the explanations given in Letter of the Ministry of Finance of the Russian Federation dated April 22, 2016 No. 02-07-05/23495. It states, in particular, that in accordance with clause 121 of Instruction No. 157n, products manufactured in an institution for the purpose of sale are reflected in account 0 105 37 000 “Finished products - other movable property of the institution.”

In this case, finished products are accepted for accounting at planned (normative-planned) cost (clause 122 of Instruction No. 157n).

For each product of own production, the selling price is calculated. The selling prices of dishes are determined by the calculation method based on the standards for laying raw materials specified in the collections of recipes.

Based on the fact that a state institution is recognized as a non-profit organization, the sales price of a product of its own production determined by the calculation method is the standard planned cost.

Unified forms of primary accounting documentation for recording operations in public catering were approved by Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132 (hereinafter referred to as Resolution No. 132).

Calculation of sales prices for dishes and products by public catering establishments (canteens) is carried out in calculation cards (form No. OP-1), the release of all dishes for a specific day is based on the menu plan (form No. OP-2).

The actual cost of finished products is determined at the end of the month.

At the same time, the actual cost of finished products in the institution’s canteen is formed taking into account direct, overhead and general expenses using account 0 109 00 000 “Costs for the production of finished products, performance of work, services” (clause 134 of Instruction No. 157n).

Paragraphs 134 and 135 of Instruction No. 157n provide for several options for the distribution of overhead and general business expenses of an institution incurred per month.

In this case, the chosen method of distributing these expenses to the institution must be provided for as part of the formation of accounting policies.

Please note that when organizing meals in general education and preschool institutions, in most cases it is paid for by parents. In such canteens, the cost of ready-made meals does not include expenses for staff wages, utilities and property maintenance (clause 3, clause 1, article 8, clause 5, clause 1, article 9, clause 4, article 65, clause 9 Article 66 of the Law on Education). Thus, their cost will consist only of the cost of the products or semi-finished products used.

Acceptance of ready-made dishes into accounting and their sales are reflected as follows:

|

State institution |

Budgetary institution |

Autonomous institution |

|||

|---|---|---|---|---|---|

|

Acceptance of ready meals |

|||||

|

0700 0000000000 000 |

0700 0000000000 000 |

||||

|

Sales of ready meals |

|||||

|

0700 0000000000 000 |

0700 0000000000 000 |

||||

* If finished products are sold for a fee.

** If the finished products are spent on the needs of the institution (no fee is charged for food). In state-owned educational institutions, which include boarding schools, orphanages, special (correctional) schools, etc., meals for students are organized at the expense of budget funds.

In educational organizations (and these are mainly budgetary and autonomous institutions), the income received from the sale of ready-made meals is the institution’s own income, and all calculations should be reflected according to KVFO 2. In accordance with Instructions No. 65n, income is included in Article 130 “Income from the provision of paid services (works)" KOSGU.

Accounting for food charges. Payment can be made through the cash desk or transferred to the institution’s personal account. Accrual of income and payment of fees for food in budgetary and autonomous institutions are reflected as follows:

|

Budgetary institution |

Autonomous institution |

|||

|---|---|---|---|---|

|

Accrued income from the sale of ready-made dishes |

||||

|

Income has been received at the cash desk (to the personal account) |

||||

State institutions that are not administrators of revenues coming to the budget make the following entries:

Educational institutions are responsible for the health of students and pupils. When organizing catering, they must comply with the requirements of sanitary and epidemiological rules and regulations, as well as apply modern catering technologies. Meals are organized by the institution itself or through third-party specialized organizations. In the first case, the institution organizes accounting of food products, finished products and food charges. In the second, records are kept of settlements with the institution providing services.

Federal Law of December 29, 2012 No. 273-FZ “On Education in the Russian Federation.”

Approved by the Chief State Sanitary Doctor of the Russian Federation on January 17, 2005. Put into effect by Resolution of the Chief State Sanitary Doctor of the Russian Federation dated January 19, 2005 No. 3.

Approved by the Chief State Sanitary Doctor of the Russian Federation on November 6, 2001. Put into effect by Decree of the Chief State Sanitary Doctor of the Russian Federation dated November 14, 2001 No. 36.

Approved by Resolution of the Chief State Sanitary Doctor of the Russian Federation dated May 15, 2013 No. 26.

Approved by Resolution of the Chief State Sanitary Doctor of the Russian Federation dated July 23, 2008 No. 45.

Approved by Resolution of the Chief State Sanitary Doctor of the Russian Federation dated 02/09/2015 No. 8.

Instructions for the application of the Unified Chart of Accounts for public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state academies of sciences, state (municipal) institutions, approved. By Order of the Ministry of Finance of the Russian Federation dated December 1, 2010 No. 157n.

Instructions on the procedure for applying the budget classification of the Russian Federation, approved. By Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n.

Federal Law of April 5, 2013 No. 44-FZ “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs.”

Order of the Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n “On approval of forms of primary accounting documents and accounting registers used by public authorities (state bodies), local governments, management bodies of state extra-budgetary funds, state (municipal) institutions, and Methodological guidelines for their application."

It is no secret that today the most important tool for stimulating employees, along with wages, is the provision of a social package, including the organization of free meals at the enterprise. But which option to choose so that both employees are satisfied and the company incurs the least costs? The answer is in the article.You can organize free meals for employees in a variety of ways: order lunch for each employee, open your own canteen, or even organize a buffet. At the same time, food can be provided on the basis of an order from the manager, or the corresponding clause can be included in the employment contract. Let us consider, using specific examples, the dependence of the tax burden on an enterprise for various options for organizing free meals for employees. Order on the side Of course, the undoubted “advantage” of ordering lunches for employees from third-party organizations is convenience for the enterprise itself. An agreement is concluded, and ready-made lunches are delivered to the office. Thus, the company only needs to pay them and correctly calculate all taxes. In accordance with paragraph 1 of Article 210 of the Tax Code, when determining the tax base for personal income tax, all income of the taxpayer received both in cash and in kind is taken into account. Thus, the cost of free meals provided to employees is subject to personal income tax. Paragraph 1 of Article 211 of the Tax Code establishes that for income received by employees in kind, the tax base is determined as the cost of goods received (work, services, other property), which is calculated based on market prices and includes the corresponding amounts of VAT. According to paragraph 25 of Article 270 of the Tax Code, when determining the tax base for income tax, expenses in the form of free meals provided are not taken into account (with the exception of special meals for certain categories of employees in cases provided for by current legislation, and with the exception of cases where free or reduced-price meals provided for in labor agreements (contracts) and (or) collective agreements). In addition, UST is also charged on these amounts. According to paragraph 1 of Article 237 of the Tax Code, when determining the tax base for the Unified Social Tax, any payments and remuneration are taken into account (except for the amounts specified in Article 238 of the Code) regardless of the form in which these payments are made.

Example 1Basis - order The situation discussed above will change somewhat if free food is provided on the basis of an order from the manager, and the source of financing is net profit. At the same time, the clause on providing free meals to employees is not included in employment contracts. In this case, these payments cannot reduce the tax base for income tax and are not subject to UST. In addition, employers who decide not to include a clause on free meals in their employment contract should take into account that, according to the tax authorities, input VAT cannot be deducted. Arbitration practice on this issue is quite contradictory (resolution of the Federal Antimonopoly Service of the North-Western District dated August 31, 2004 in case No. A56-50026/03, dated January 31, 2006 in case No. A56-11756/2005, resolution of the FAS Ural District dated 18 August 2004 in case No. F09-3352/04-AK).The Vesna company orders lunches for employees externally. The cost of one lunch is 118 rubles, including VAT, the number of employees is 50 people, lunches are purchased 20 days a month. A clause providing free meals to employees is included in employment contracts.

VAT deductible – 18,000 rubles. (RUB 118,000) 18: 118);

UST – RUB 30,680. (RUB 118,000) 26%));

Personal income tax – 15,340 rubles. (RUB 118,000) 13%).

Thus, the total tax burden (savings) will be –3343 rubles. (–18,000 rub. + 30,680 rub. + + 15,340 rub. + (–31,363 rub.)). But it is necessary to take into account that 15,340 rubles. the company transfers it as a tax agent (NDFL). That is, your own tax savings will be -18,683 rubles.

Example 2Own dining room Some businesses decide to open their own canteen and prepare lunches themselves. But do not forget that in this case, the transfer of free food to employees will be considered as its sale. Opening a canteen is considered as an additional activity of the enterprise. And here a contradiction appears between the opinions of financiers and the judiciary. According to the Ministry of Finance of Russia, if the area of the visitor service hall is no more than 150 square meters, or there is no service hall in the dining room, then this activity in accordance with paragraph 2 of Article 346.26 of the Tax Code should be subject to UTII (letters dated March 17, 2006 No. 03-11 -04/3/141 and dated March 2, 2006 No. 03-11-04/3/101). The judges believe that if lunches are provided free of charge to members of the work collective, then the activity is not of an entrepreneurial nature and, accordingly, is not transferred to UTII (resolution of the Federal Antimonopoly Service of the Central District of April 13, 2007 in case No. A09-6535/06-15). The provision of free meals in the form of a “buffet” is recognized as subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation). Accordingly, the organization has an obligation to calculate and pay taxes to the budget. However, VAT can then be claimed for deduction. The enterprise must also accrue unified social tax and personal income tax from the cost of lunches. The cost of meals and unified social tax will reduce taxable profit. Thus, the option of having your own canteen is very labor-intensive, problematic and, from a tax optimization point of view, not the most advantageous. It is worth choosing only if the production cost is an order of magnitude lower than the cost of purchased lunches, which can only be achieved in large enterprises. "Buffet" Instead of organizing your own canteen or delivering ready-made lunches to the office, an enterprise can purchase food vouchers for its employees from a third-party organization, including in the form of a buffet. When organizing meals for company employees in the form of a buffet, it is impossible to determine exactly the portion eaten by each employee and its cost. Accordingly, it is impossible to establish exactly what amount of income (payment) was received by each specific employee. In this case, the enterprise does not have the obligation to calculate and pay personal income tax due to the absence of an object of taxation (these taxes are considered personalized), since it is not possible to record the income of individuals received in kind. Thus, paragraph 8 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated June 21, 1999 No. 42 emphasizes that income tax is a personalized tax: it is calculated individually for each employee and cannot be determined impersonally by calculation. Considering that personal income tax is calculated on the same principle as income tax, in our opinion, the conclusions presented in this document have not lost their relevance today. But the tax authorities believe that, in accordance with the Tax Code, it is necessary to keep individual records of payments, and personal income tax must be accrued. Article 120 of the Tax Code provides for a fine of 5,000 rubles for violation of accounting for taxable items. If the violation lasts more than one tax period, the fine may amount to 15,000 rubles. In addition, the tax inspectorate may impose a fine for the fact that the organization has not fulfilled the tax agent’s obligations to withhold personal income tax (20 percent of the amount that had to be withheld and paid to the budget). According to tax authorities, in this case, regardless of whether the provision of free food is included in the labor (collective) agreement or not, taxable profit cannot be reduced. Based on this principle, then the UST is not automatically calculated.Let's take the conditions of example 1. But the clause on providing free meals to employees is not included in employment contracts, free meals are provided based on the order of the manager, the source of financing is net profit.

The cost of lunches is 118,000 rubles. (50 people)) 118 rub.) 20 days);

The Vesna enterprise cannot deduct VAT. The income tax base is not reduced, there is no unified social tax.

The company is only obliged to transfer personal income tax for employees in the amount of 15,340 rubles. (RUB 118,000)) 13%).

Example 3Thus, the most profitable, at first glance, option in terms of tax burden is the buffet option without taking into account possible fines. Therefore, if the company has a well-organized legal service that is ready to defend its position in court, we can recommend this option. At the same time, to reduce risks, it is better not to reduce taxable profit by the amount of expenses. But, since the buffet option is the most risky from the point of view of possible claims from the tax authorities, we can recommend ordering meals externally with the inclusion of a clause on the provision of free meals in employment contracts.For employees, the Vesna enterprise purchases food vouchers externally in the form of a buffet. The amount indicated in the invoice is RUB 118,000, including VAT. A clause providing free meals to employees is included in employment contracts.

The cost of lunch, including VAT, is 118,000 rubles.

VAT deductible – 18,000 rubles. If the company does not reduce taxable profit, then this amount will constitute tax savings.

If the Vesna enterprise decides to reduce the income tax base for the cost of lunches, then it will be necessary to make the following charges.

UST – RUB 30,680. (RUB 118,000) 26%).

Costs for lunches (excluding VAT) in the amount of unified social tax reduce the tax base for income tax in the amount of 130,680 rubles. ((RUB 118,000 – RUB 18,000) + RUB 30,680).

The income tax savings will amount to RUB 31,363. (RUB 130,680) 24%).

Thus, the total tax burden (savings) will be -18,683 rubles. (–18,000 rub. + 30,680 rub. + + (–31,363 rub.)).

N. Pokrovskaya, Deputy General Director of ZAO Business Audit