As a result, the enterprise retains a net profit that arises from the distribution of profits. It represents taxable profit minus income tax and tax on the excess of actual labor costs compared to the standard. At the same time, it includes the result of emergency circumstances, calculated as the difference between revenues and expenses associated with these circumstances. When forming net profit, transactions for the payment of fines, sanctions, penalties and other payments that were previously paid from the profit remaining at the disposal of the organization after taxation are taken into account.

Net profit is distributed in various areas. An enterprise of any form of ownership has the right to decide for what purposes and in what amounts to allocate the profit remaining after paying taxes to the budget and other obligatory payments and deductions. The distribution procedure depends on the specific organizational and legal form of the enterprise. As a result, after distribution, there remains unused profit or loss not covered by money.

In addition, there is also consolidated profit - this is profit consolidated according to the financial statements for the activities of the parent and subsidiaries.

You can also highlight excess profits. It occurs when enterprises operate in the most favorable conditions and their products have low costs. And excess profit is equal to the difference between the market price and the cost of production. Here, entrepreneurs receive the maximum rate of profit in their industry, but it, as a rule, is not permanent.

There is a monopoly profit within the excess profit. Monopolies set prices for their products themselves, they receive excess profits.

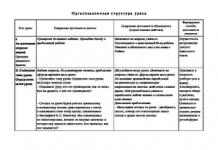

In a joint-stock company, the procedure for distributing profits is carried out on the basis of its charter. In general, the JSC's policy in the field of profit distribution is, as a rule, developed by the Board of Directors and approved at the general meeting of shareholders. The Board of Directors approves the regulations on profit distribution. A typical position form is given in the appendices

There are two approaches to distributing net profit. In the first approach, the constituent documents of the enterprise stipulate the procedure for creating special funds. These may be: an accumulation fund, which pools funds reserved for the production development of the enterprise and other similar activities to create new property; the social sector fund, which takes into account funds allocated to finance capital investments in the social sector; a consumption fund, which accumulates funds for the development of the social sphere, in addition to capital investments, material incentives for employees, one-time assistance, payment for vouchers to holiday homes, etc. The first approach facilitates the process of planning and monitoring the use of financial resources of the enterprise.

In the second approach, the profit remaining at the disposal of the enterprise is not distributed among funds, but forms a single multi-purpose fund, concentrating both profit, which is directed towards accumulation, and free funds, which can be directed towards both accumulation and consumption. With both approaches, enterprises independently determine the proportions of profit distribution in the main areas.

The typical approach to the distribution of profits in a joint-stock company is as follows: net profits are distributed to create funds.

A reserve fund is created in society. The procedure for its formation and use is determined by the charter of the joint-stock company. According to Article 35 of the Federal Law “On Joint-Stock Companies,” a reserve fund is created in the amount provided for by the company’s charter, but not less than 5 percent of its authorized capital. The formation and replenishment of the fund occurs through annual contributions until it reaches the size provided for by the charter of the company. Unforeseen commercial losses of the joint-stock company are covered from the reserve fund, and bonds are also repaid from it and shares of the company are repurchased in the absence of other funds. If there is a lack of net profit, funds are allocated from it: to pay dividends on shares (primarily on preferred shares; if there is insufficient profit to pay dividends, payment is made from the reserve fund), to pay taxes, pay the bank for a loan and other purposes. The use of the reserve fund for other purposes is prohibited. A JSC may also create an insurance fund, a guarantee fund, etc., which are intended to cover the losses of the JSC and are used if the profit of the reporting year is not enough to pay income on securities.

From the net profit, a special fund for the corporatization of the company's employees, provided for by the company's charter, can be formed. The fund's funds are spent only on the acquisition of shares of the company, sold by its shareholders, for subsequent distribution to its employees. The funds received from the paid sale of shares to the company's employees form the fund.

The JSC creates an accumulation fund from net profit, depreciation charges and the sale of part of the property. This is part of the total social product used for expanded reproduction. The accumulation fund includes: growth of fixed production assets; increase in material working capital; increase in state material reserves; increase in stocks of agricultural products in personal subsidiary plots of the population

The accumulation fund funds are used for the development of production, including:

financing costs for re-equipment and expansion of production;

carrying out research work;

costs of issuing and distributing securities;

contributions to the creation of investment funds, joint ventures, associations;

write-off of costs, which, according to current regulations, are made from the profits remaining at the disposal of the enterprise;

increase in the authorized capital of the joint-stock company;

as a contribution to the authorized capital of a subsidiary, etc.

The consumption fund consists of two parts: the public consumption fund and the personal consumption fund, the relationship between which largely depends on the state structure, historically established national traditions and other political factors. It is intended for the social development of the enterprise and material incentives for personnel (providing financial assistance, paying for additional vacations, food, travel on transport), in some cases paying fines and penalties for violations due to the fault of the enterprise, and paying dividends. According to the method of education and socio-economic forms of use, the consumption fund is divided into: the wage and income fund, the public consumption fund, and the management apparatus maintenance fund.

Also, from the net profit, the entrepreneur receives personal business income for his activities to achieve the effective operation of the enterprise.

The formation and distribution of profit is presented in the diagram in Appendix 2.

At the end of each operating year, shareholders gather at a general meeting in order to calculate net profit and distribute it among all shareholders. Each shareholder receives dividends on their shares. The size of the dividend is not a fixed amount once and for all. On the contrary, it changes in one direction or the other depending on the overall profitability of the enterprise.

profit optimization tax

3. MAIN DIRECTIONS FOR INCREASING THE EFFICIENCY OF PROFIT USE IN MODERN CONDITIONS

The global financial crisis, which has been rapidly developing since August 2008, has significantly affected the profits of most companies in Russia. Many organizations could not bear the load and ceased their activities. Others continue their work, stay afloat, but experience a serious decrease in profits. The managers of such companies are concerned with the question of how to organize production and, in general, the economic activity of their company, how to prevent a further decline in profitability, how to increase the profit of their business and how to distribute it in the most effective way.

If an organization makes a profit during a crisis, then this is already an indicator of its effective performance. And the next main task, after receiving profit, is its effective distribution. Improving efficiency during a crisis is not at all easy. It is in this situation that all the abilities of managers come into play.

Organizations need to adapt to new conditions and learn to respond in a timely manner to changes in the external environment. To begin with, you should shift priorities from increasing profits towards preserving existing profits and preventing their further decline. It is necessary to audit the financial, production, and marketing activities of the company. Identify strengths and weaknesses, determine the supply of labor, production, and sales resources. Next, it is necessary to develop a number of anti-crisis measures and achieve efficiency in everything, including in the use of profits.

In a JSC, the Board of Directors decides on the distribution of net profit remaining at its disposal. The share of profit for the payment of interest on bonds is determined, deductions are made to the reserve fund, to the accumulation fund for the development of production, possible payments to employees of the joint-stock company in the form of cash remuneration or shares are calculated in accordance with a certain percentage provided for by the charter. The remaining net profit is used to pay dividends to shareholders.

In any joint stock company, the payment of dividends is important. If there are no dividends, then the shareholders will have no further interest in keeping their capital in this JSC. Dividends are primarily paid on preferred shares. The issue of payment of dividends on common shares is decided depending on the financial results of the company and taking into account the prospects for its development. If the net profit is not enough to pay them, then funds from the reserve capital are used for these purposes. But now JSC, like all other organizations, needs to adapt to modern conditions and develop further. When using and distributing the profits of a joint-stock company, it is quite important to calculate the amount of net profit allocated for the development of the company and the payment of dividends. It is quite natural that owners want to receive maximum dividends. But investment in production development is also necessary. The competitiveness of society, the expansion of markets for its products, and the profitability of sales depend on this. Therefore, financial services are obliged to constantly analyze calculation data in order to ensure financing of capital investments, the limiter of which is the interests of the owners. There is also a need to maintain at a certain level the compliance of fixed assets with new technological solutions, and this determines the amount of profit investment and thereby sets the minimum level of profitability. Therefore, the task of the capital manager of a joint-stock company is not only to ensure the presence of the company’s products (works and services) on the market, but also to satisfy the owner’s need to receive income in the form of dividends. Thus, the manager is faced with the task of distributing the profit between the owner and the investment in the most effective proportions. Information for making a decision on the quantitative expression of profit distribution is generated based on the results of a financial analysis of the balance sheet of the joint-stock company. When calculating, first of all, the size of the necessary capital increase for the development of the production process of the joint-stock company is determined. For this purpose, non-current assets and current assets, excluding cash, are studied. To determine the size and timing of dividend payments, the stability and liquidity of the joint-stock company are assessed. It is also necessary that the dividend policy pursued by the Board of Directors of the JSC be transparent.

The board of directors decides on the distribution of net profit. Part of this profit can be directed to the production and social development of society. The share of profit to pay interest on bonds is determined. Contributions are made to the reserve fund. Possible payments to JSC employees in the form of cash remuneration or shares are calculated in accordance with a certain percentage provided for by the charter. The remaining net profit is used to pay dividends to shareholders.

The board of directors, based on the state of the company, the competitiveness of its products and development prospects, makes a decision on the specific ratio of net profit distributed in these areas. It is possible that in certain periods profits will not be used to pay dividends to shareholders, but will go in larger amounts to the production and social development of the workforce or other purposes.

The company's shares on its balance sheet are not taken into account when distributing profits among shareholders.

One of the indicators characterizing the financial condition of a joint-stock company, which in turn determines the process of profit distribution, is the share of profit calculated per share.

The amount of net profit per share makes it possible to realistically assess the efficiency of a joint-stock company and its financial position. This indicator is calculated using the formula:

A n = H n /N,

where A p is profit calculated per share; Ch p - net profit of the company; N is the number of issued shares. The growth of this indicator indicates the successful activity of the joint-stock company, guaranteeing high dividends and an increase in the actual value of shares. A decrease in profit per share leads to the conclusion that there is a problem in the use of share capital and entails the need for a detailed analysis of the activities of the joint-stock company.

The degree of “return” of share capital can be judged in relation to its net profit:

O = H n /TO,

where O is the return on equity capital;

K - share capital.

The return on equity capital characterizes the intensity of its use and, consequently, the increase or decrease in profits received from this capital.

2.3 Reserve fund of a joint stock company

In the process of distributing the net profit of a joint-stock company, a reserve fund is created, the value of which must be at least 10% of the authorized capital. The procedure for the formation and use of the reserve fund is determined by the charter of the joint-stock company. The specific amounts of deductions from profits to the reserve fund are established by the general meeting of shareholders, but not less than 5% of the company’s balance sheet profit. The formation and replenishment of the reserve fund occurs through annual contributions until the minimum required amount is formed. The reserve fund is intended to cover unexpected commercial losses of the JSC. If there is a lack of net profit, interest on bonds and dividends on preferred shares are paid from the reserve fund.

2.4 Payment of dividends

Shares are securities that give the right to receive dividends. The JSC has the right to make a decision on the payment of dividends on placed shares on a quarterly basis, once every six months or once a year. The joint-stock company pays dividends declared for each category and type of shares in cash, and in cases provided for by the company's charter - in other property.

Dividends are paid from net profit for the current year, and for certain types of preferred shares they can be paid from funds specially designated for this purpose.

The board of directors may decide to pay interim quarterly or semi-annual dividends. The decision on the payment of annual dividends, the amount of the dividend and the form of its payment for shares of each category and type is made by the general meeting of shareholders on the recommendation of the board of directors. The amount of annual dividends cannot be more than recommended by the board of directors and less than interim dividends paid. The General Meeting of Shareholders may decide not to pay dividends on shares of certain categories and types, as well as to pay partial dividends on preferred shares, the dividend amount for which is determined in the charter.

The date of payment of annual dividends is determined by the charter or a decision of the general meeting of shareholders on the payment of annual dividends. The date of payment of interim dividends is determined by a decision of the board of directors, but cannot be earlier than 30 days from the date of such decision.

For each dividend payment, the board of directors prepares a list of persons entitled to receive the dividend. This list includes shareholders and nominal holders of shares included in the register of shareholders of the JSC no later than 10 days before the date of the board of directors’ decision to pay dividends, and the list of persons entitled to receive annual dividends includes shareholders and nominal holders of shares entered into the register of shareholders of the company on the day of drawing up the list of persons entitled to participate in the annual general meeting of shareholders. There are legal restrictions on the payment of dividends (see Appendix 2).

A JSC does not have the right to make a decision on the payment of dividends on ordinary and preferred shares, the amount of the dividend for which is not determined, unless a decision has been made to pay the full amount of dividends on all types of preferred shares, the amount of the dividend for which is determined by the charter. A similar prohibition is established on the payment of dividends on preferred shares of a certain type, for which the dividend amount is determined by the charter, unless a decision is made on full payment of dividends on all types of preferred shares that provide priority in the order of receiving dividends over preferred shares of this type.

The Company's profit after paying taxes and other obligatory payments to the budget (net profit) remains at the disposal of the Company and is subject to distribution.

Distribution of profits and preparation of proposals submitted for consideration at the General Meeting of Shareholders is the function of the Board of Directors.

Profit can be directed to:

for payment of dividends on shares;

for material incentives for the Company's employees;

to finance planned short-term and long-term costs.

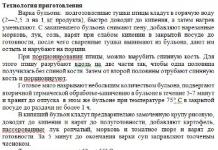

Profit distribution is carried out in stages:

preliminary distribution of profits;

collection of information on planned cost items;

final distribution of profit with clarification of its value.

At the first stage - the preliminary distribution of profit - the priority, mandatory in size, areas for using the profit and possible debatable areas for using the profit are considered.

Collection of information on planned cost items includes:

Drawing up estimates or financial calculations for each type of cost;

Consideration of proposals by types of costs;

Making a decision to include certain costs in the list of objects for financing from one or another fund;

Calculation of the total amount of funds required for inclusion in the list and determination of the size of the fund.

At the third stage, the size of funds is regulated within the limits of the total amount of distributed profit, the exclusion of funds in case of insufficient funds for individual cost items, and the adoption of the final version of profit distribution.

After clarifying the size of the dividend payment fund, the size of the dividend based on one share (preferred or ordinary) is calculated.

It is possible to develop several options for distribution of profits; the final choice of option may be left until a decision is made by the General Meeting of Shareholders.

43. The difference between a unitary enterprise and other forms of commercial organizations.

A distinctive feature of a unitary enterprise is the absence of ownership rights to the property assigned to it. The property of a unitary enterprise is indivisible and is not distributed among contributions or shares of employees. The owner of the property of an enterprise based on the right of economic management determines the subject and goals of its activities, exercises control over the use for its intended purpose and the safety of the property belonging to the enterprise. Part of the profit from the use of the property belongs to the owner.

Peculiarities:

1. Property is indivisible and is in state and municipal ownership.

2. The manager is appointed by the owner of the property.

3. The enterprise is liable for its obligations with all its property, but is not liable for the debts of the owner.

4. It may have the right of economic management and the right of operational management. On the right of economic management

1. You cannot sell real estate.

2.Cannot be rented out.

3. Contribute real estate as a contribution to the authorized capital of another enterprise. Based on operational management

State-owned federal enterprise.

The owner is the government of the Russian Federation. Peculiarities:

1. The owner has the right to seize excess property or property used for other purposes.

2. The enterprise does not have the right to dispose of property without the permission of the owner. 3. In case of insolvency, the government is responsible for the obligations of the enterprise.

"Accounting", 2008, N 14

The net profit received by the joint-stock company based on the results of the financial year can be used to develop production, repay losses from previous years, if any, remain in the organization as reserve capital, or pay dividends.

The net profit of an organization for the reporting year represents the final financial result of its activities for this period, identified on the basis of accounting for all business transactions.

If a positive financial result is achieved at the end of the year, then we are talking about retained earnings, if negative - about an uncovered loss. The amount of net profit of the reporting year, formed in the manner established by regulatory documents for accounting on account 99 "Profits and losses", is written off with the final turnover of December to the credit of account 84 "Retained earnings (uncovered loss)", and the amount of net loss - to the debit of the specified accounts.

Analytical accounting for account 84 is organized in such a way as to ensure the generation of information on the areas of use of funds. At the same time, in analytical accounting, funds of retained earnings used as financial support for the production development of the organization and other similar activities for the acquisition (creation) of new property and not yet used can be divided.

By virtue of paragraphs. 11 clause 1 art. 48 of the Law on Joint Stock Companies, approval of the annual financial statements of a joint stock company, as well as the distribution of profits (covering losses) of the company and the announcement of dividends based on the results of the financial year fall within the competence of the general meeting of shareholders held from March 1 to June 30 of the year following the reporting year.

In accordance with current Russian legislation, net profit received as a result of financial and economic activities can be directed to:

- formation of the organization's reserve capital;

- covering losses from previous years;

- production development of the organization;

- payment of dividends (income);

- other purposes (payment of remuneration to managers of the organization, financial assistance to employees, charity, etc.).

Formation of reserve capital

The reserve fund (capital) of a joint-stock company is intended to cover its losses, as well as to repay the company's bonds and repurchase the company's shares in the absence of other funds. It cannot be used for other purposes.

The size of the fund is approved in the company's charter and must be at least 5% of the company's authorized capital. The reserve fund of a joint stock company is formed through mandatory annual contributions. Their size is provided for by the company's charter and, until the size established by the company's charter is reached, cannot be less than 5% of net profit (example 1).

Example 1. In accordance with the decision of the general meeting of shareholders based on the results of the approved annual reporting for 2007 and in accordance with the charter, CJSC Mercury allocated 200,000 rubles. for the formation of reserve capital.

The following entry is made in accounting:

K-t sch. 82 "Reserve capital"

deductions to the reserve fund are reflected.

Coverage of losses from previous years

Covering the losses of previous years at the expense of the profit of the reporting year is reflected by the entry: debit of account 84 credit of account 84. If the amount of profit is sufficient to cover the losses of previous years, then the balance of account 84 shows the amount of retained earnings, if insufficient - the amount of uncovered losses.

If, at the end of the reporting year, an organization identifies a loss, its write-off from the balance sheet is reflected in the credit of account 84 in correspondence with the accounts (example 2):

- 84 “Retained earnings (uncovered loss)” - when retained earnings from previous years are used to pay off the loss;

- 82 “Reserve capital” - when reserve capital funds are used to cover a loss;

- 80 “Authorized capital” - if, on the basis of a decision of the general meeting, the amount of the authorized capital is brought to the value of the organization’s net assets;

- 75 “Settlements with founders” - covering the loss of a simple partnership is repaid from targeted contributions of its participants.

Example 2. The amount of net loss of Pluton OJSC from financial and economic activities at the end of the reporting year amounted to 2,500,000 rubles, including under the joint activity agreement - 500,000 rubles.

Based on the decision of the general meeting of shareholders, repayment of losses is carried out as follows:

- RUB 1,400,000 - at the expense of reserve capital;

- 600,000 rub. - by bringing the amount of the authorized capital to the amount of net assets;

- 500,000 rub. - through targeted contributions from shareholders.

Reflection in accounting:

Dt sch. 82 "Reserve capital"

RUB 1,400,000

reserve capital funds were used to pay off the loss;

Dt sch. 80 "Authorized capital"

K-t sch. 84 "Retained earnings (uncovered loss)"

the amount of the authorized capital is brought to the value of net assets (the entry is made after the corresponding changes in the constituent documents are registered);

Dt sch. 75 "Settlements with founders"

K-t sch. 84 "Retained earnings (uncovered loss)"

the loss under the simple partnership agreement was repaid at the expense of targeted contributions from shareholders.

The general meeting of shareholders may decide not to pay off the loss of the reporting year, but to leave it on the organization’s balance sheet.

Acquisition of property

One of the sources of financing capital investments aimed at financial support for the production development of an organization is funds from retained earnings.

When making capital investments, the organization's current assets gradually become part of non-current assets. At the same time, when the fact of acquisition of fixed assets is reflected in accounting, only the asset of the balance sheet changes. The source of financing itself, reflected in the liabilities side of the balance sheet, does not decrease.

Thus, despite the fact that the organization’s profit aimed at purchasing fixed assets will actually be spent, this fact will not be reflected in the balance sheet liabilities.

It is advisable to reflect the amounts of retained earnings from previous years aimed at acquiring new property of the organization in the accounting records as internal correspondence in the subaccounts of account 84.

Internal records for account 84 will allow the organization to obtain information about the amounts of profit spent on the acquisition of fixed assets.

In order to effectively control the status and use of funds for financing capital investments for analytical accounting in account 84, it is advisable to open the following two sub-accounts:

- "The balance of retained earnings from previous years";

- "Retained earnings from previous years aimed at purchasing fixed assets."

As profits are used to purchase fixed assets and make other capital investments, simultaneously with the correspondence of accounts on the debit of account 01 “Fixed assets” and the credit of account 08 “Investments in non-current assets”, internal correspondence is applied to the specified sub-accounts.

When, after the next accounting entry for these internal sub-accounts, the balance of the sub-account “Remaining Retained Earnings of Previous Years” becomes debit, we can say that the organization uses working capital as a source of financing capital investments aimed at ensuring the production development of the enterprise.

Many experts recommend that information about how much profit the organization used for capital investments be reflected in the explanatory note to the balance sheet. The fact is that users of reporting have the right to receive additional data that is not on the balance sheet, but without which it is impossible to assess the real financial results of the organization’s activities (clause 24 of PBU 4/99).

Payment of dividends

A dividend is any income received by a shareholder from an organization when distributing profits remaining after taxation (including in the form of interest on preferred shares) on shares owned by the shareholder in proportion to the shareholders’ shares in the authorized capital of this company.

The allocation of part of the profit of the reporting year to the payment of income to the founders of the organization based on the results of approval of the annual financial statements is reflected in the debit of account 84 “Retained earnings (uncovered loss)” and the credit of accounts 75 “Settlements with founders” and 70 “Settlements with personnel for wages”. The choice of account depends on the status of the company’s shareholder (example 3).

Example 3. In accordance with the decision of the shareholders meeting based on the results of the approved annual reporting, RUB 1,000,000. directed by Neptune OJSC to pay dividends, including:

- 450,000 rub. - shareholders who are employees of the organization;

- 550,000 rub. - shareholders who are not employees of the organization.

The following entries are made in accounting:

Dt sch. 84 "Retained earnings (uncovered loss)"

K-t sch. 70 "Settlements with personnel for wages"

the accrual of dividends to shareholders who are employees of the organization is reflected;

Dt sch. 84 "Retained earnings (uncovered loss)"

K-t sch. 75 "Settlements with founders", subaccount. 2 "Calculations for payment of income",

accrual of dividends to other shareholders is reflected.

Dividends may not always be paid. So, for example, a joint stock company, by virtue of clause 1 of Art. 43 of Law N 208-FZ does not have the right to make a decision (announce) on the payment of dividends on shares, in particular:

- until full payment of the entire authorized capital of the company;

- before the repurchase of all shares that must be repurchased;

- if on the day such a decision is made the company meets the signs of insolvency (bankruptcy) in accordance with the legislation of the Russian Federation on insolvency (bankruptcy) or if the specified signs appear in the company as a result of the payment of dividends;

- if on the day such a decision is made, the value of the company's net assets is less than its authorized capital, and the reserve fund, and the excess of the liquidation value of the placed preferred shares over the par value determined by the charter, or becomes less than their size as a result of such a decision.

Use for other purposes

A joint stock company can also spend net profit on:

- payment of remunerations (bonuses) to managers of the organization based on the results of work for the year;

- payment of financial assistance to employees;

- charitable purposes;

- organization of recreation, cultural and sports events.

Any decision on spending net profit is made by shareholders at a general meeting. In accounting, the implementation of any expenses at the expense of net profit is reflected after the approval of the decision of the meeting of shareholders in the debit of account 84 and the credit of a specially opened sub-account to this account. At the same time, for account 84 it is necessary to organize analytical accounting in such a way as to ensure the generation of information on the areas of use of funds.

* * *

The decision of the owners to distribute profits or cover losses of the reporting year is a fact of the organization’s economic activity that takes place not in the reporting year, but in the next year. Therefore, these transactions must be reflected in the accounting records in the next reporting period.

In the event that the general meeting of shareholders, for example, in open joint-stock companies due to a large number of shareholders, takes place later than the deadline for submitting annual financial statements to the tax authorities, the distribution of net profit will no longer be an event after the reporting date.

After the general meeting, the accountant, in the usual manner, based on the minutes of the meeting, must reflect in the accounting records the use of net profit for the formation of reserves, payment of dividends, etc.

The needs of expanded reproduction based on establishing an optimal ratio between funds allocated for consumption and accumulation.

When distributing profits and determining the main directions for its use, it is primarily taken into account state of the competitive environment, which may dictate the need to significantly expand and update the production potential of the enterprise. In accordance with this, the scale of deductions from profits to production development funds is determined, the resources of which are intended to finance capital investments, increase working capital, support research activities, introduce new technologies, transition to progressive labor methods, etc. General scheme of enterprise profit distribution shown in Fig. 20.4.

Rice. 20.4. Main directions of profit distribution

An important aspect of profit distribution is the determination of the proportion of division of profit into capitalized and consumed parts, which is established in accordance with the constituent documents, the interests of the founders, and is also determined depending on the business development strategy.

For each organizational and legal form of an enterprise, an appropriate mechanism for the distribution of profits remaining at the disposal of the enterprise is legally established, based on the peculiarities of the internal structure and regulation of the activities of enterprises of the corresponding forms of ownership.

At any enterprise, the object of distribution is the balance sheet profit of the enterprise. All distribution means the direction of profit to the budget and by items of use in the enterprise. The distribution of profits is regulated by law in that part of it that goes to the budgets of various levels in the form of taxes and other obligatory payments. Determining the directions for spending the profits remaining at the disposal of the enterprise, the structure of the funds being formed, and the process of their use are within the competence of the enterprise itself.

The state does not establish any standards for the distribution of profits, but through the procedure for providing tax incentives, it stimulates the direction of profits for innovation, capital investments of a production and non-production nature, for charitable purposes, financing environmental protection measures, expenses for the maintenance of objects and institutions in the non-production sphere, etc. Legislation limits the size of an enterprise's reserve fund and regulates the procedure for forming a reserve for doubtful debts.

The procedure for distributing and using the profit of an enterprise is fixed in its constituent documents and is determined by regulations, which are developed by the relevant divisions of economic and financial services and approved by the governing body of the enterprise.

Distribution of profits at enterprises of various organizational forms

Subdistribution of profit is understood as the order and directions of its use, determined by legislation, the goals and objectives of the enterprise, and the interests of the founders - owners of the enterprise. Profit distribution is based on the following principles:

- fulfillment of obligations to the state;

- ensuring the material interest of employees in achieving the highest results at the lowest cost;

- accumulation of own capital, ensuring the process of continuous business development;

- fulfillment of obligations to founders, investors, creditors, etc.

The main directions of profit distribution are presented in Fig. 20.4.

Profit of a general partnership distributed among the participants in accordance with the constituent agreement, which determines the shares of its participants.

The procedure for distributing profits depends on the period for which the partnership was created. If a partnership is created for a specific period, in order to implement a specific project, then the net profit is distributed among the participants in accordance with their shares in the share capital.

In the case where a partnership is created for a long or indefinite period, various funds can be formed from profits (Fig. 20.5).

Rice. 20.5. Distribution of partnership profits

IN limited partnership From the balance sheet profit, various fees and income tax, calculated in accordance with the procedure established for legal entities, are first paid into the budget. Then, from the net profit, income is paid to investors (limited partners), since they made their contributions to the joint capital, but do not participate in the current activities of the partnership and do not bear full responsibility for the results. Then the funds necessary for the development of the enterprise are formed. Profit used to pay the participants of the partnership is divided in accordance with their share in the share capital. The remainder of the profit is distributed among full members (general partners).

If the profit is not received or is received in a smaller volume than expected, then the following options are possible:

- in case of negative financial results, full members are obliged to give investors their share of the profits by selling the property of the partnership;

- If there are insufficient funds, a decision may be made not to pay profit to shareholders.

Profit of a limited liability company taxed and distributed in accordance with the general procedure established for legal entities. Net profit can be distributed to a reserve fund, which, in accordance with the law on limited liability companies, is recommended to be formed for the timely fulfillment of obligations to founders leaving their membership, and also divided into two parts - an accumulation fund and a consumption fund. The accumulation fund includes those funds that, by decision of the founders, are used for the development of the enterprise and investment projects. The consumption fund may consist of a social development fund, material incentives and the part that goes to pay the founders (it is distributed in proportion to their shares in the authorized capital).

The most difficult thing is the order of distribution profits of joint stock companies. The general mechanisms for distribution of profits and the procedure for paying dividends are fixed in the company's charter.

To determine the dividend rate, it is necessary to calculate the potential amount of profit that can be paid to shareholders without damaging the activities of the joint-stock company.

The general procedure for distribution of JSC profits is shown in Fig. 20.6.

The JSC's profit distribution policy is usually developed by the board of directors and is subject to approval at the general meeting of shareholders.

When planning the distribution of net profit of a joint-stock company, it is necessary to take into account the types of shares issued. Thus, preferred shares provide for mandatory payment of dividends at approved rates. The issue of payment of dividends on ordinary shares is decided depending on the financial results of the company and taking into account the prospects for its development. In order to develop the enterprise, if there is insufficient profit, a decision may be made to reinvest dividends on ordinary shares and not pay income to their owners in the current year. The distribution of profit to the capitalized part and dividends is the most important point in financial planning, since the development of the joint-stock company and its ability to pay dividends in the future depend on it. Dividends that are too high can lead to capital consumption and slow down business development. At the same time, non-payment of dividends reduces the market price of the company's shares and creates difficulties when placing the next issue of shares, and infringes on the interests of the owner-shareholders.

Rice. 20.6. Distribution of joint stock company profits

State-owned enterprises operating on the territory of the Russian Federation can carry out their activities as unitary enterprises with the right of economic management or with the right of operational management (federal state enterprise). The distribution of profits of these economic entities has its own specifics.

(UP) is a state or municipal enterprise that is not vested with the right of ownership to the property assigned to it by the owner (the property is indivisible and cannot be distributed among deposits).

Unitary enterprises with the right of economic management are created by decision of the authorized state (municipal) body. It owns, uses and disposes of property. The owner decides on the issues of creation, reorganization and liquidation of the enterprise; determining the subject and goals of the activity; control over the use and safety of property. The owner has the right to receive a portion of the profit. He is not responsible for the obligations of the enterprise.

The unitary enterprise, with the right of operational management (federal government enterprise), owns and uses property in accordance with the goals of its activities. It can dispose of property only with the consent of the owner. The owner (Russian Federation) bears subsidiary liability for the obligations of the state-owned enterprise.

Distribution order profits from state-owned enterprises regulated by the Model Charter of a state-owned plant (factory, farm) and the Procedure for planning and financing the activities of state-owned plants, approved by the Government of the Russian Federation.

In accordance with these documents, profit from the sale of products (works, services) produced in accordance with the order plan and as a result of the independent economic activity permitted to it is directed to finance activities that ensure the implementation of the order plan, plant development plan and for other production purposes , as well as for social development according to standards established annually by the authorized body. The procedure for establishing such standards is approved by the Ministry of Finance of the Russian Federation. The free balance of profit remaining after it has been directed to these purposes is subject to withdrawal to the federal budget.