Under a leasing agreement, property can be recorded on the balance sheet of the lessor or lessee. The second option is the most complex and often raises questions among accountants, since accounting and tax accounting data do not coincide and differences arise. In the 1C: Accounting 8 program, edition 3.0, starting with release 3.0.40, basic operations with leased property are automated, which are recorded on the lessee’s balance sheet without taking into account the redemption value.

New accounts in 1C:Accounting 8 (rev. 3.0) to automate leasing accounting

The main regulatory legal acts that must be followed when concluding a leasing agreement are the Federal Law of October 29, 1998 No. 164-FZ “On Financial Lease (Leasing)” and Part Two of the Civil Code of the Russian Federation - in Chapter 34 “Lease” paragraph 6 is devoted to leasing.

Under a leasing agreement, the lessee must accept the property purchased for him by the lessor from the seller, pay the lessor lease payments, the procedure and terms of payment of which are determined by the agreement, and at the end of the lease agreement, return this property or buy it back into his own ownership.

The agreement specifies the amount of lease payments, methods and frequency of their transfer to the lessor.

The tax consequences for the parties to the transaction depend on the terms of the agreement and the structure of the lease payment.

IS 1C:ITS

In the reference book “Agreements: conditions, forms, taxes” in the “Legal support” section, read more about what is important for the lessor and lessee to know when concluding a leasing agreement.

When reflected leasing operations in accounting they are guided by the “Instructions on the reflection in accounting of transactions under a leasing agreement”, approved. by order of the Ministry of Finance of Russia dated February 17, 1997 No. 15 (hereinafter referred to as Instructions No. 15).

The lessee, if the leasing object is accounted for on its balance sheet, upon receipt of the fixed asset (FPE), must generate transactions (paragraph 2, clause 8 of Instructions No. 15):

Debit 08 “Investments in non-current assets”

Credit 76 “Settlements with various debtors and creditors” subaccount “Rental obligations”

After accepting the leased property, the following entry is made into the OS:

Debit 01 “Fixed assets” subaccount “Leased property”

Loan 08 “Investments in non-current assets”

If the leased property is accounted for on the lessee’s balance sheet, then the accrual of lease payments to the lessor in the lessee’s accounting records is reflected in the following entries (paragraph 2, clause 9 of Instructions No. 15):

When accounting for the leased asset on the lessee's balance sheet, the property is accounted for as depreciable (clause 9 of Instructions No. 15, paragraph 3 of clause 50 of the Methodological Instructions for Accounting of Fixed Assets, approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

The amounts of depreciation charges are reflected in the debit of the accounts for accounting for production (circulation) costs in correspondence with account 02 “Depreciation of fixed assets”, subaccount “Depreciation of leased property”. In this case, it is allowed to use an accelerated depreciation mechanism by a factor not higher than 3 (paragraph 3, clause 9 of Instructions No. 15).

Leasing payments due to the lessor are reflected by the lessee by postings (paragraph 2, clause 9 of Instructions No. 15):

Debit 76 “Settlements with various debtors and creditors” subaccount “Rental obligations”

Credit 76 “Settlements with various debtors and creditors” subaccount “Debt on leasing payments”

At the end of the contract, the leased property must be returned by the lessee or acquired into ownership (Clause 5, Article 15 of Law No. 164-FZ).

In accordance with the Tax Code, the lessee has the right to deduct VAT on the entire amount of lease payments, which is indicated in the invoice (subclause 1, clause 2, article 171, paragraph 2, clause 1, article 172 of the Tax Code of the Russian Federation).

For the purpose of calculating income tax, the leased asset is taken into account as part of depreciable property at its original cost - the amount of the lessor's expenses for the acquisition, construction, delivery, production and bringing it to a state in which it is suitable for use, excluding the amount of taxes subject to deduction or taken into account in composition of expenses (clause 1 of article 257 of the Tax Code of the Russian Federation).

According to paragraph 10 of Article 258 of the Tax Code of the Russian Federation, property leased is included in the appropriate depreciation group (subgroup) by the party for whom this property should be accounted for in accordance with the terms of the leasing agreement.

Leasing payments for the use of leased property recorded on the balance sheet of the lessee are considered other expenses associated with production and (or) sales, less depreciation amounts accrued on this fixed asset (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation).

If the leased asset is taken into account on the balance sheet of the lessee as a fixed asset, then in respect of it it is necessary to pay corporate property tax (letter of the Ministry of Finance of Russia dated January 20, 2012 No. 03-05-05-01/04, clause 3 of the Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 11/17/2011 No. 148).

The lessee must pay transport tax, if the vehicles that are the subject of leasing are registered in his name (Article 357 of the Tax Code of the Russian Federation).

IS 1C:ITS

For more information about the tax consequences arising for the lessee, read the reference book “Contracts: conditions, forms, taxes” in the “Legal Support” section.

Note that initial cost of the leased asset, depreciation costs and the procedure for including lease payments in expenses are different in accounting and tax accounting, so temporary differences arise. They are accounted for in accordance with PBU 18/02 “Accounting for calculations of corporate income tax”, approved. by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n.

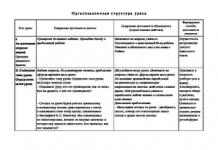

In the 1C: Accounting 8 program, starting with release 3.0.40, subaccounts have been added to account for transactions with leased property, including when accounting for transactions in foreign currency and in conventional units (cu) (see Table 1) .

|

Subaccount in "1C: Accounting 8" (rev. 3.0) starting from version 3.0.40 |

What is it for? |

|

76.07.1 “Rental obligations” |

To summarize information on long-term financial obligations under lease agreements in Russian currency |

|

76.07.2 “Debt on leasing payments” |

To summarize information about current payments under a leasing agreement in Russian currency |

|

76.27.1 “Lease obligations (in foreign currency)” |

To summarize information on long-term financial obligations under lease agreements in foreign currencies |

|

76.27.2 “Debt on leasing payments (in foreign currency)” |

To summarize information about current payments under a leasing agreement in foreign currencies |

|

76.37.1 “Rental obligations (in monetary units)” |

To summarize information on long-term financial obligations under lease agreements, payments for which are actually carried out in rubles, but are accounted for in conventional units. Account balances and turnover are simultaneously formed in rubles and in cu. Any currency from the directory can be used as a conventional unit Currencies programs |

|

76.37.2 “Debt on leasing payments (in cu)” |

To summarize information about current payments under a leasing agreement, payments for which are actually carried out in rubles, but are taken into account in conventional units. Account balances and turnover are simultaneously formed in rubles and in cu. Any currency from the directory can be used as a conventional unit Currencies programs |

|

01.03 “Leased property” |

To summarize information about the availability and movement of fixed assets of an organization that are leased until their disposal |

|

02.03 “Depreciation of leased property” |

To summarize information about depreciation of leased property |

|

76.07.9 “VAT on rental obligations” |

The amounts of value added tax due to be paid by the organization related to the acquisition of fixed assets under lease agreements in Russian currency are taken into account. |

|

76.37.9 “VAT on rental obligations in (cu)” |

The amounts of value added tax due to be paid by the organization related to the acquisition of fixed assets under lease agreements are taken into account, the calculations for which are actually carried out in rubles, but are taken into account in conventional units. Account balances and turnover are simultaneously formed in rubles and in cu. Any currency from the directory can be used as a conventional unit Currencies programs. |

Let’s look at how “1C: Accounting 8” edition 3.0 reflects the main leasing accounting operations if the property is listed on the lessee’s balance sheet without taking into account the redemption value.

Receipt of fixed assets for leasing and acceptance of the leased object for accounting by the lessee

The receipt of leased property is reflected in a new program document Entry into leasing(chapter OS and intangible assets group Receipt of fixed assets).

The document indicates the initial cost of leased fixed assets in accounting (AC) and tax accounting (TA).

To put a fixed asset object into operation, a document is created Acceptance of fixed assets for accounting(chapter OS and intangible assets group Receipt of fixed assets) - see Figure 1.

Bookmarks are filled in the document:

- Non-current asset;

- Fixed assets;

- Accounting;

- Tax accounting;

- Depreciation bonus.

To document Acceptance of fixed assets for accounting added a new method of admission According to the leasing agreement, which allows you to specify the lessor and the method of reflecting the costs of leasing payments in tax accounting.

When choosing an admission method According to the leasing agreement additionally required fields are displayed:

- Counterparty and Agreement on the Non-current asset tab;

- The method for reflecting expenses in tax accounting on the Tax Accounting tab in the Leasing payments group of details.

Since the property is listed on the balance sheet of the lessee, then on the tab Tax accounting in the field The procedure for including costs in expenses indicated Depreciation calculation, and the flag is set Calculate depreciation.

In the field Special coefficient the increasing or decreasing coefficient is indicated (if it is not equal to 1).

Reflection of the monthly lease payment

Starting from release 3.0.40 in 1C:Accounting 8, leasing payments are calculated using the document Receipt (act, invoice), to which the operation is added Leasing services(Fig. 2).

To accept VAT for deduction, you must register and post the document Invoice received.

A document has been added to the program Change in the reflection of expenses on lease payments of fixed assets. It is intended to change the method of reflecting expenses on lease payments after accepting leased property for accounting (section OS and intangible assets group Depreciation of fixed assets hyperlink OS depreciation parameters).

Depreciation and recognition of lease payments in tax accounting

Since the property is accounted for on the balance sheet of the lessee, its value is repaid through depreciation charges over the term beneficial use.

To perform operations to calculate the amount of depreciation for a month for accounting and tax accounting, recognize leasing payments in tax accounting, as well as to reflect taxable temporary differences (TDT) and recognize deferred tax liability (DTL), it is necessary to use processing Closing the month(chapter Operations group Closing the period hyperlink Closing the month), which contains a list of necessary regulatory operations.

Before processing Closing the month it is necessary to restore the sequence of documents.

To do this, click on the hyperlink Retransfer of documents per month, press the button Perform operation, then button Perform month end closing, after which all scheduled operations will be performed in a list, including:

- Depreciation and depreciation of fixed assets;

- Recognition of leasing payments in NU;

- Calculation of income tax.

In a program when performing a routine operation the difference between the lease payments reflected in the document is determined Receipt (act, invoice), and accrued depreciation in tax accounting. If the monthly lease payment exceeds the amount of accrued depreciation, the difference is reflected in tax accounting expenses. If the accrued depreciation exceeds the amount of the lease payment, then the depreciation amount is reversed by this difference.

Create a printed form Statement of depreciation of fixed assets maybe from the group Reports of the OS and intangible assets section.

In processing Closing the month from the document form Regular operation -> Recognition of leasing payments in NU or from the context menu you can generate a help calculation Recognition of expenses on fixed assets received under lease.

The report is intended to illustrate the reflection of the amounts of leasing payments in the accounting and tax accounting of the lessee.

How can a lessee reflect leasing payments for the use of property in accounting and taxation? How can the lessee reflect lease payments in accounting and taxation in relation to the redemption value? The answers are in the article.

Question: Accounting and tax accounting of leasing operations from the lessee (accounting for advance lease payment, accounting for VAT, depreciation and redemption value)?

In accounting, reflect leasing payments monthly as expenses in correspondence with settlement accounts (,). Determine the nature of expenses depending on the direction of use of the leased asset. If the leased asset is used in the production and sale of goods (works, services), use expense accounts for ordinary activities. In other cases, reflect other expenses:*

– a leasing payment has been accrued for the property used by the organization;

Debit 19 Credit 60 (76) subaccount “Payments for the use of the leased asset”

– input VAT on leasing services is taken into account.

Upon receipt of an invoice from the lessor and other necessary conditions are met:

– submitted for deduction of input VAT on leasing services.

When repaying the debt to the lessor, make the following entry:

Debit 60 (76) subaccount “Payments for the use of the leased asset” Credit 51

– lease payment has been paid.

Clauses , , , and PBU 10/99 and Instructions for the chart of accounts (accounts , , , , , , , ).

Recognize expenses regardless of the fact of transfer of funds to the lessor in the amount of the cost of services for each current month established by the lease payment schedule. This is due to the fact that costs are accepted in accounting in monetary terms equal to the amount of their payment and (or) accounts payable to the lessor. The amount of payment and (or) accounts payable is determined based on the price and conditions established by the agreement (clause and 6.1 of PBU 10/99).

The parties may agree that the leased asset is recorded on the lessee’s balance sheet.

Then, starting from the month following the one in which the property was accepted for accounting as part of fixed assets on account 01, begin calculating depreciation.

This procedure follows from the provisions of paragraph 21 of PBU 6/01, paragraphs and instructions approved.

Establish the useful life of the leased property in the general manner. When determining the useful life, take into account all the factors provided for in paragraph 20 of PBU 6/01. That is:*

- expected lifespan according to performance and power;

- expected physical wear, depending on the operating mode, natural conditions and the influence of an aggressive environment;

- regulatory and other restrictions on use (for example, lease term).

If the terms of the agreement do not provide for the repurchase of the property, the lessee has the right to determine the depreciation period based on the duration of the leasing agreement. This method is directly provided international standard financial statements (IAS) 17 “Lease”, put into effect by order of the Ministry of Finance of Russia dated November 25, 2011 No. 160n. It states that if there is no reasonable certainty that the subject of the financial lease will become the property of the lessee at the end of the contract, then the asset must be fully depreciated over the lease term. Therefore, the useful life can be set equal to the lease term.

This follows from the provisions of paragraphs and PBU 6/01, paragraph 7 of PBU 1/2008, paragraph 59 of the instructions approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and is indirectly confirmed by letters of the Ministry of Finance of Russia dated December 6, 2011 No. 03- 05-05-01/94 and dated November 11, 2008 No. 03-05-05-01/66.

Situation: How can a lessee reflect in accounting payments and depreciation on leased property, which is recorded on its balance sheet*

The lessee must calculate depreciation on the leased property. Moreover, only leasing payments should be reflected in expenses. This is explained as follows.

Leasing payments include the lessor’s income, as well as reimbursement of its costs associated with the acquisition, transfer of property to the lessee and other services provided for in the contract (Clause 1, Article 28 of the Law of October 29, 1998 No. 164-FZ). At the same time, the lessee's expenses in the form of leasing payments meet all the conditions for recognition of expenses in accounting established in paragraph 16 of PBU 10/99.

Depreciation of fixed assets is a way to pay off their cost, and it should be accrued by the organization on whose balance sheet this fixed asset is listed (clause 17 of PBU 6/01). At the same time, depreciation charges can be recognized as expenses if they reimburse the cost of the fixed asset (). In this situation, this condition is not met.

The lessee does not bear the costs of acquiring the property, since these are the costs of the lessor. The lessee only reimburses them to the lessor in the amount of lease payments. Therefore, the lessee cannot recognize depreciation as an expense.

Therefore, write off depreciation to reduce the liabilities reflected when receiving the property on lease: on account 76, the subaccount “Cost of the leased asset.”

Thus, you can reflect the accrual of lease payments and depreciation for the current month in accounting using the following entries:

Debit 20 (25, 26, 44, 91-2...) Credit 60 (76) subaccount “Payments for the use of the leased asset”

– the lease payment for the current month has been accrued;

– depreciation has been accrued for the current month on property received under lease to reduce the debt of the lessee to the lessor for the property received under lease.

An example of how lease payments are reflected in the lessee's accounting. Leased property is recorded on the balance sheet of the lessee*

LLC "Production Company "Master"" in January 2009 received production equipment under a lease agreement without the right to buy for a period of 5 years (60 months). Under the terms of the agreement, the equipment is listed on the balance sheet of the lessee. The cost of the property is 967,000 rubles. (including VAT – RUB 147,508). The total amount of leasing payments under the agreement is RUB 1,300,000. (including VAT – RUB 198,305). The monthly leasing payment amount according to the schedule is RUB 21,667. (including VAT - 3305 rubles). The first payment is due in January 2009.

The Master's accountant determined the useful life based on the contract term - 5 years (60 months). In accounting, an organization calculates depreciation using the straight-line method.

In January, the following entries were made in the organization's accounting records.

Debit 08 subaccount “Property received under lease” Credit 76 subaccount “Cost of the leased asset”

– 819,492 rub. (967,000 rubles – 147,508 rubles) – the cost of the property received is reflected on the balance sheet;

Debit 01 sub-account “Fixed assets received on lease” Credit 08 sub-account “Property received on lease”

– 819,492 rub. – equipment leased was put into operation.

Monthly starting from January 2009 until the end of payments according to the payment schedule:

– 18,362 rub. (RUB 21,667 – RUB 3,305) – lease payment accrued for the current month;

– 3305 rub. – input VAT on the amount of the lease payment for the current month is taken into account;

Debit 68 subaccount “VAT calculations” Credit 19

– 3305 rub. – submitted for deduction of input VAT on leasing services;

– 21,667 rub. – the lease payment for the current month has been paid.

Every month from February until the property is returned:

Debit 76 subaccount “Cost of the leased asset” Credit 02 subaccount “Depreciation of property received under lease”

– 13,658 rub. (RUB 819,492: 60 months) – depreciation was accrued to reduce the amount of liabilities for the cost of property received for temporary use.

When calculating depreciation, the lessee can apply an accelerated depreciation coefficient of no higher than 3 (paragraph 3, paragraph 9 of the instructions approved by order of the Ministry of Finance of Russia dated February 17, 1997 No. 15).

But the application of increasing factors to the depreciation rate is provided for in accounting only when calculating depreciation using the reducing balance method. This follows from the provisions of paragraph 19 of PBU 6/01, paragraph 54 of the instructions approved by order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n, and is confirmed by the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 5, 2011 No. 2346/11.

An example of depreciation calculation in accounting for a leased asset using the reducing balance method with an acceleration factor of 3*

LLC "Production Company "Master"" received leased property under a contract without redemption in January and put it into operation. The cost of the property received is RUB 967,000. (including VAT – RUB 147,508). The equipment is accounted for on the lessee's balance sheet.

The useful life of the equipment is 6 years (72 months).

In accounting, depreciation for this equipment is calculated based on the declining balance method with an acceleration factor of 3.

The annual depreciation rate is:

1: 6 years? 100% = 16.6667%.

The annual depreciation amount for 2013 was:

RUB 409,747 ((967,000 rub. - 147,508 rub.) ? 3 ? 16.6667%).

Starting from February 2013, “Master” accrues monthly depreciation of equipment in the amount of 34,146 rubles. (RUB 409,747: 12 months).

The residual value of the equipment at the end of 2013 will be:

RUB 443,886 (967,000 rub. – 147,508 rub. – (34,146 rub. ? 11 months).

In 2014 (and subsequent years), the accountant recalculates the annual depreciation amount based on the residual value of the equipment.

The annual depreciation amount for 2014 will be:

RUB 221,943 (RUB 443,886 ? 3 ? 16.6667%).

Starting from January 2014, “Master” accrues monthly depreciation on equipment in the amount of 18,495 rubles. (RUB 221,943: 12 months).

Advance payments

The lessee can make payments under the agreement in advance. Reflect the listed prepayment on a separate sub-account to account 60 “Calculations for advances issued” as follows:*

– the leasing payment is transferred in advance.

During the period of provision of the service for which the prepayment is transferred, make the following entries in your accounting:*

Debit 20 (23, 25, 29, 44, 91-2...) Credit 60 (76) subaccount “Payments for the use of the leased asset”

– leasing payment accrued;

Debit 60 (76) subaccount “Settlements for the use of the leased asset” Credit 60 (76) subaccount “Settlements for advances issued”

– the transferred advance (part of it) is offset against the debt to the lessor.

This procedure is based on the provisions of paragraph 3 of PBU 10/99 and the Instructions for the chart of accounts (accounts,).

An example of how the lessee's accounting records the payment of advances under a leasing agreement. The organization uses the accrual method*

LLC "Production Company "Master"" received leased property under a contract without redemption in January 2014. The contract term is 5 years (60 months). The total amount of leasing payments for the entire leasing period is RUB 1,300,000. (including VAT – RUB 198,305). The cost of monthly leasing services according to the schedule is RUB 21,667. (RUB 1,300,000: 60 months), including VAT in the amount of RUB 3,305. (RUB 198,305: 60 months). The cost of one year of leasing in January must be transferred in advance in the amount of 260,004 rubles. (RUB 21,667 ? 12 months).

To account for settlements with the lessor, the accountant uses sub-accounts opened for account 60 - “Settlements for advances issued” and “Settlements for the use of the leased asset”.

In January, the following entries were made in the organization’s accounting records.

Debit 60 subaccount “Settlements on advances issued” Credit 51

– 260,004 rub. – advance payment to the lessor;

Debit 68 subaccount “Calculations for VAT” Credit 76 subaccount “Calculations for VAT from advances issued”

– 39,662 rub. (RUB 260,004 ? 18: 118) – submitted for deduction of VAT on the advance payment.

Starting from January until the advance is completely written off:

Debit 20 Credit 60 subaccount “Payments for the use of the leased asset”

– 18,362 rub. – leasing payment accrued;

Debit 19 Credit 60 subaccount “Payments for the use of the leased asset”

– 3305 rub. – input VAT on leasing payments for the use of the leased asset is taken into account;

Debit 76 subaccount “Calculations for VAT on advances issued” Credit 68 subaccount “Calculations for VAT”

– 3305 rub. – VAT, previously accepted for deduction from the advance payment, has been restored;

Debit 68 subaccount “VAT calculations” Credit 19

– 3305 rub. – submitted for deduction of VAT from the leasing payment for the use of the leased asset;

Debit 60 subaccount “Settlements for the use of the leased asset” Credit 60 subaccount “Settlements for advances issued”

– 21,667 rub. – part of the advance issued is offset against debt repayment

lessor.

Income tax

When calculating income tax, accounting for leasing payments depends on whose balance sheet the leased asset is listed on - on the balance sheet of the lessor or on the balance sheet of the lessee.

Since the recognition of leasing payments under the accrual method does not depend on the fact of payment, the advance payment transferred to the lessor does not need to be included in tax expenses (clause 1 of Article 272 of the Tax Code of the Russian Federation). Include in expenses that part of the advance payment that relates to the service already provided.

If the organization uses the cash method, then lease payments must be reflected in that reporting period, which actually lists the payment for services rendered (clause 3 of Article 273 of the Tax Code of the Russian Federation). If an advance payment is made against leasing payments, it is impossible to reduce the taxable profit on it (clause 3 of Article 273 of the Tax Code of the Russian Federation, letter of the Department of Tax Administration of Russia for Moscow dated December 15, 2003 No. 23-10/4/69784).

Due to differences in the rules for recognizing lease payments as expenses in accounting and tax accounting, temporary differences may arise. For example, when using the cash method in tax accounting. This follows from paragraph 8 of PBU 18/02.

Consider the costs of leasing the property of service industries and farms separately (). Do not take into account the costs of leasing non-production objects when calculating income tax. This is due to the fact that all expenses that reduce the tax base must be economically justified (clause 1 of Article 252 of the Tax Code of the Russian Federation). That is, they are related to the production activities of the organization.*

Property on the balance sheet of the lessee

If the property is transferred to the balance of the lessee, then take into account each lease payment minus the amount of accrued depreciation. The fact is that property received on the balance sheet is recognized as depreciable (Clause 10, Article 258 of the Tax Code of the Russian Federation).

By including depreciation as an expense, the lessee already takes into account a certain part of the lease payment in its costs. Therefore, when calculating income tax on other expenses, you need to write off only the remaining part of the leasing fee (minus the amount of accrued depreciation) (). Otherwise, the tax cost may be unlawfully doubled (clause 5 of Article 252 of the Tax Code of the Russian Federation).

An exception is provided for organizations that use the cash method of tax accounting. They do not need to adjust the amount of lease payments for accrued depreciation.

The fact is that with the cash method, depreciation is allowed only for paid property received into ownership (subclause 2, clause 3, article 273 of the Tax Code of the Russian Federation). And since leased property can become the property of the lessee only if its redemption is envisaged, it is impossible to depreciate the received object until this moment (letter of the Ministry of Finance of Russia dated November 15, 2006 No. 03-03-04/1/761). Consequently, regardless of whose balance sheet the leased asset is recorded on, under the cash method all lease payments are included in other expenses as they are paid ().*

Services for the transfer of property under leasing are subject to VAT (subclause 1, clause 1, article 146 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated August 3, 2011 No. 03-07-08/247). Accordingly, input VAT presented by the lessor can be deducted if there is an invoice and relevant primary documents (in addition, other conditions necessary for applying the deduction must be met) (and clause 1 of Article 172 of the Tax Code of the Russian Federation).*

How can a lessee reflect lease payments in accounting and taxation regarding the redemption value?

Payment of redemption price

Payments for the redemption of leased property should not be included in expenses until the transfer of ownership. They are not subject to the procedure for accounting for leasing payments for the temporary use of property.

Reflect settlements for the repurchase of leased property in the debit of account 60 (), opening a subaccount for it “Calculations for the repurchase of the leased asset”. When payment of the redemption price is provided at the end of the contract, reflect this operation in accounting as follows:*

Debit 60 (76) subaccount “Calculations for the repurchase of the leased asset” Credit 51 (50...)

– the redemption price of the leased asset has been paid.

If you transfer the redemption value during the term of the contract, then apply these amounts to advances. Do this until ownership of the leased item passes from the lessor to your organization. For convenience, use a separate subaccount “Calculations for advances issued” to account 60 ():

Debit 60 (76) subaccount “Settlements on advances issued” Credit 51

– an advance is transferred towards the redemption value of the property received under lease.

Don't forget to reflect VAT on the advance:

Debit 19 Credit 76 subaccount “Calculations for VAT on advances issued”

– VAT paid as part of the advance payment is taken into account;

Debit 68 subaccount “VAT calculations” Credit 19

– submitted for deduction of input VAT upon receipt of an invoice for the advance payment.

And at the moment of transfer of ownership, make the following entries:

Debit 60 (76) subaccount “Settlements for the repurchase of the leased asset” Debit 60 (76) subaccount “Settlements for advances issued”

– the advance is credited towards repayment of the redemption value of the leased asset;

Debit 19 Credit 68 subaccount “VAT calculations”

– VAT previously claimed for deduction on advances has been restored;

Debit 76 subaccount “Calculations for VAT on advances issued” Credit 19

– the restored amount of VAT is written off.

This procedure follows from the provisions of paragraph 1 of Article 19 of the Law of October 29, 1998 No. 164-FZ, articles and the Civil Code of the Russian Federation, paragraphs, PBU 10/99 and the Instructions for the chart of accounts (accounts , , , , , ).*

Property on the balance sheet of the lessee

If the leased asset was accounted for on the balance sheet of the lessee (i.e., your organization) in account 01, then first reflect its disposal in the following order:*

– the amount of accrued depreciation on the leased asset is written off;

– the residual value of the leased property is written off (if it is not yet fully depreciated at the time of redemption).

This accounting procedure follows from paragraphs, PBU 6/01, Instructions for the chart of accounts (accounts, , ,).

After ownership of the property has transferred to your organization, record the property as newly acquired.

An example of a lessee reflecting in accounting calculations under a leasing agreement with the right to buy. The agreement provides for payment of the redemption price upon expiration of its validity period. Leased property is recorded on the lessee's balance sheet. The contract term is less than the useful life*

In April 2008, OJSC “Production Company “Master”” received equipment under a leasing agreement for five years (60 months). Upon expiration of the agreement, “Master” buys the leased item. The useful life of the property is six years (72 months). The cost of the property is 967,000 rubles. (including VAT – RUB 147,508).

The total amount of leasing payments for the entire leasing period is RUB 1,300,000. (including VAT – RUB 198,305). The distribution of payments by type of expense is as follows:

- the redemption price payable upon termination of the contract is RUB 216,667. (including VAT – RUB 33,051);

- cost of using property (financial lease) – RUB 1,083,333. (including VAT – RUB 165,254).

The amount of the monthly lease payment for the use of the property according to the schedule is RUB 18,056. (RUB 1,083,333: 60 months), including VAT – RUB 2,754.

In the agreement, the parties agreed that leasing payments begin to accrue from the month following the month of transfer of the equipment to the “Master”. The property is transferred to the balance of the lessee.

In April 2008, Master’s accountant recorded the following entries in the accounting books:

Debit 08 Credit 76 subaccount “Cost of the leased asset”

– 819,492 rub. (967,000 rubles – 147,508 rubles) – reflects the cost of the leased asset transferred to the Master’s balance sheet;

Debit 01 Credit 08

– 819,492 rub. – equipment is included in fixed assets.

Monthly from May 2008 until the end of the contract in April 2013:

Debit 76 subaccount “Cost of the leased asset” Credit 02 subaccount “Depreciation of leased property”

– 11,382 rub. (RUB 819,492: 72 months) – depreciation was accrued for the current month to reduce the amount of liabilities for the cost of property received for temporary use;

Debit 20 Credit 60 subaccount “Payments for the use of the leased asset”

– 15,302 rub. (RUB 18,056 – RUB 2,754) – leasing payment for the use of equipment has been accrued;

Debit 19 Credit 60 subaccount “Payments for the use of the leased asset”

– 2754 rub. – input VAT on the leasing payment is taken into account;

Debit 68 subaccount “VAT calculations” Credit 19

– 2754 rub. – submitted for deduction of input VAT on leasing services;

Debit 60 subaccount “Payments for the use of the leased asset” Credit 51

– 18,056 rub. – the leasing payment is transferred.

In April 2013:

Debit 02 subaccount “Depreciation of leased property” Credit 01 subaccount “Fixed assets received on lease”

– 682,920 rub. (RUB 11,382 ? 60 months) – at the end of the contract, accrued depreciation is written off

subject of leasing;

Debit 76 subaccount “Cost of the leased asset” Credit 01 subaccount “Fixed assets received under lease”

– 136,572 rub. (RUB 819,492 – RUB 682,920) – leased property is written off from accounting at its residual value;

Debit 08 Credit 60 subaccount “Calculations for the repurchase of the leased asset”

– 183,616 rub. (216,667 rubles – 33,051 rubles) – the acquisition of equipment is reflected;

Debit 19 Credit 60 subaccount “Calculations for the repurchase of the leased asset”

– 33,051 rub. – VAT is taken into account on the redemption price of the leased asset;

Debit 60 subaccount “Calculations for the repurchase of the leased asset” Credit 51

– 216,667 rub. – the redemption value of the property is transferred to the lessor;

Debit 68 subaccount “VAT calculations” Credit 19

– 33,051 rub. – submitted for deduction of input VAT from the cost of purchased equipment;

Debit 01 Credit 08

– 183,616 rub. – purchased equipment is accepted for accounting.

From the next month after the equipment was registered, the accountant began calculating depreciation.

Receipt of redeemed property

Accept the purchased property for accounting as an object of your own fixed assets, inventories or goods - depending on the cost at which your organization ultimately purchased this object and for what purposes it will be used in the future. Based on this, use the corresponding accounting accounts ( , , ...):

Debit 08 (10, 41...) Credit 60 (76) subaccount “Calculations for the repurchase of the leased asset”

– the acquisition of the former leased asset is reflected;

Debit 19 Credit 60 (76) subaccount “Calculations for the repurchase of the leased asset”

– VAT is taken into account on the redemption price of the leased asset;

Debit 68 subaccount “VAT calculations” Credit 19

– submitted for deduction of input VAT upon receipt of the invoice.

Accept property for accounting at the acquisition price, that is, at the redemption value, but taking into account other costs associated with the transfer of ownership (for example, state duties).

Do not include inseparable improvements to the leased property in the initial cost of the purchased property. They have already been taken into account as a separate inventory item before the transfer of ownership.

By taking into account the purchased property as part of fixed assets on account 01 (PBU 6/01,).

Income tax

In tax accounting, costs in the amount of leasing payments for the use of property reduce the base for calculating income tax. The procedure for recognizing such costs depends on the method of determining income and expenses and on whose balance sheet the leased asset is listed.

But for the recognition of expenses in the form of redemption value, it does not matter which party accounted for the leased property on its balance sheet before its redemption. The redemption value of the leased asset is a payment for the acquisition of ownership of the property, and not for the use and possession of it. Consequently, such expenses can be recognized after the end of the leasing agreement in the usual manner established for the recognition of costs for the acquisition of a new object. That is, depending on whether such property is recognized as depreciable or not. In addition, the cost recognition procedure will be different for property that will be used in production and intended for sale.

In the initial cost of such property, in addition to the redemption price, also include the costs associated with the transfer of ownership. As a general rule, do not take VAT and excise taxes into account in the initial cost.

Determine the depreciation rate for such property based on its useful life. However, do not forget to reduce this period for the period of its operation before redemption. That is, the period provided for the depreciation group to which the property belongs can be reduced by the period of time during which it was leased. In this case, it does not matter on whose balance sheet the object was listed. This possibility is provided for in paragraph 7 of Article 258 of the Tax Code of the Russian Federation. In addition, part of the redemption costs can be recognized at a time by applying and).

Article 273 and the Tax Code of the Russian Federation.

Purchase price in advance

Leasing payments towards the redemption value transferred during the term of the contract are an advance. When calculating income tax, the amounts of advances issued do not reduce taxable profit. This rule applies both when using the accrual method and when using the cash method.

This follows from the provisions of paragraph 14 of Article 270, paragraph 3 of the mandatory conditions for this. That is, the property has been accepted for accounting and a correctly executed invoice has been received from the lessor.*

Situation: when can the amount of input VAT be deducted from the redemption value of the leased property, which was paid during the term of the leasing agreement?

Deduct input VAT in the general manner for advances.

Do this if all necessary conditions are met. After ownership of the leased asset is transferred to you from the lessor and an invoice is received, the amount of VAT previously accepted for deduction on part of the redemption price will have to be restored. And then again deduct the tax imposed by the lessor, but this time on the value of the asset received into ownership.

This procedure is established in paragraph 1 of Article 154 of the Tax Code of the Russian Federation.

Leasing is a popular form of financing capital investments. After all, without incurring significant one-time costs compared to the value of the property, the lessee, having concluded a leasing agreement with the lessor and paying lease payments, will receive the necessary property for temporary possession and use (Article 2 of the Federal Law of October 29, 1998 No. 164-FZ).

We will show you with examples in our consultation how to keep accounting records for the lessee if the object is accounted for on the balance sheet of one or the other party to the agreement.

Leasing transactions if the property is on the lessor’s balance sheet: example

Let's imagine typical leasing transactions with the lessee, if the object is listed on the lessor's balance sheet, using the following example.

In accordance with the leasing agreement, the fixed asset object is transferred to the lessee for a period of 5 years. The total amount of leasing payments for this period is 3,540,000 rubles, incl. VAT 20%. Payments under the agreement are made monthly.

The leasing agreement also stipulates that at the end of its validity period the object is purchased by the lessee at the redemption price of 34,220 rubles, incl. VAT 20%.

| Operation | Account debit | Account credit | Amount, rub. |

|---|---|---|---|

| Leased property is registered off balance sheet | 001 “Leased fixed assets” | 3 540 000 | |

| Monthly lease payment transferred (3 540 000 / 60) | 76 “Settlements with various debtors and creditors”, subaccount “Debt on leasing payments” | 51 “Current accounts” | 59 000 |

| Monthly lease payment taken into account (59 000 * 100/120) | 20 “Main production”, 26 “General business expenses”, 44 “Sales expenses”, etc. | 49 166,67 | |

| VAT included in the leasing payment (59 000 * 20/120) | 19 “VAT on purchased assets” | 76, subaccount “Debt on leasing payments” | 9 833,33 |

| Accepted for deduction of VAT on leasing payment | 19 | 9 833,34 | |

| ………… | |||

| Leased property was written off off-balance sheet due to the expiration of the leasing agreement | 001 “Fixed assets” | 3 540 000 | |

| 60 “Settlements with suppliers and contractors” | 51 | 34 220 | |

| Leased property was accepted for accounting at redemption value as part of inventory | 10 "Materials" | 60 | 28 516,67 |

| VAT is included on the redemption value of the property | 19 | 60 | 5 703,33 |

| Accepted for deduction of VAT from the redemption price | 68 “Calculations for taxes and fees” | 19 | 5 703,33 |

Leasing transactions if the property is on the balance sheet of the lessee: example

Let's present the accounting of leasing on the balance sheet of the lessee (posting) using the example discussed above, supplementing it with information that depreciation on leased property is calculated using the straight-line method.

| Operation | Account debit | Account credit | Amount, rub. |

|---|---|---|---|

| The leasing object was accepted for accounting (3,540,000 * 100 / 120) | 08 “Investments in non-current assets” | 3 000 000 | |

| Presented VAT by the lessor | 19 | 76, subaccount “Rental obligations” | 540 000 |

| The object is accepted for accounting as part of fixed assets | 01 “Fixed assets”, subaccount “Property under lease” | 08 | 3 000 000 |

| Lease payment transferred (3,540,000 / 60) | 76, subaccount “Debt on leasing payments” | 51 | 59 000 |

| Monthly lease payment taken into account | 76, subaccount “Rental obligations” | 76, subaccount “Debt on leasing payments” | 59 000 |

| Accepted for deduction of VAT regarding the leasing payment | 68 | 19 | 9 833,33 |

| Monthly depreciation accrued (3 000 000 / 60) | 20, 26, 44, etc. | 02 “Depreciation of fixed assets”, subaccount “Property under lease” | 50 000 |

| ………… | |||

| The debt for the redemption value of the leased property is reflected | 76, subaccount “Rental obligations” | 34 220 | |

| The redemption value of the leased property is listed | 76, subaccount “Debt for redemption of property” | 51 | 34 220 |

| Fixed assets were transferred from leased to owned | 01, subaccount “Own fixed assets” | 01, subaccount “Property on lease” | 3 000 000 |

| Depreciation on leased property that has become the property of the lessee is reflected | 02, subaccount “Property on lease” | 02, subaccount “Own fixed assets” | 3 000 000 |

The topic of the article was suggested by an accountant Maria Vitalievna Malyshkina, Kirov.

Significant changes have not been made to the regulations governing the accounting of fixed assets for a long time. However, they are planned and everyone knows about it - more than 3 years ago, projects of PBUs for accounting for fixed assets, as well as projects of PBUs for accounting for leases, were released. We will not discuss why these documents still have the status of projects. Let's talk about something else: how a lessee, who records the leased asset on his balance sheet, should determine its initial cost. After all, the amount of property tax on the property may depend on this value. clause 1 art. 374 Tax Code of the Russian Federation.

Conservative approach

It is familiar to all accountants: the lessee collects all costs associated with obtaining the leased asset in account 08 “Investments in non-current assets”, subaccount “Purchase of individual fixed assets under a leasing agreement”. Costs include all payments under the leasing agreement for the entire term of its validity (of course, minus input VAT) pp. 7, 8 PBU 6/01; clause 8 of the Directives, approved. By Order of the Ministry of Finance dated February 17, 1997 No. 15; Letter of the Ministry of Finance dated November 11, 2008 No. 03-05-05-01/66.

When the leased asset is ready for operation, its value is written off from the credit of account 08 “Investments in non-current assets” to the debit of account 01 “Fixed assets”, subaccount “Leased property” para. 2 clause 8 of the Directives, approved. By Order of the Ministry of Finance dated February 17, 1997 No. 15.

Thus, most lessees include in the initial cost of the leased asset:

- the total amount of payments under the leasing agreement, including the purchase price;

- additional costs associated with receiving the leased asset and bringing it to a condition suitable for use. For example, the costs of delivering equipment, setting it up and setting it up.

With this approach, current lease payments (if there was no increase in their amount during the term of the contract) are not taken into account as independent expenses. Only accrued depreciation is included in expenses. And current payments made under the leasing agreement go towards repaying accounts payable to the lessor.

After the expiration of the lease agreement and the purchase of property in accounting, it is not necessary to determine the new initial cost of the fixed asset that has become its own, as it should be done in “profitable” tax accounting.

Example. Determining the initial cost of the leased asset from the lessee using a conservative approach

/ condition / The total amount of payments under the leasing agreement is RUB 500,000. excluding VAT, including the redemption price in the amount of 50,000 rubles. The lease agreement is valid for 3 years.

The lessee's expenses for delivery of leased equipment amounted to RUB 20,000. excluding VAT.

The established useful life of the leased asset is 6 years.

/ solution / In accounting, equipment is reflected at its original cost of 520,000 rubles. Its cost is written off as expenses through depreciation, which is accrued starting from the month following the month of acceptance for accounting.

The amount of monthly depreciation is 7222.22 rubles. (RUB 520,000 / 6 years / 12 months).

The amount of monthly leasing payments is 12,500 rubles. excluding VAT ((RUB 500,000 – RUB 50,000) / 3 years / 12 months) are not taken into account as independent expenses in accounting.

Discounting Approach

However, let’s not forget that buyout leasing involves the purchase of the leased asset by the lessee (lessee) with the money he borrowed from the lessor (that is, the lessor). Thus, the lessee must not only compensate the lessor for the cost of the fixed asset itself, but also pay him interest.

You can read about discounting debt in accounting when payments are deferred:The draft PBUs proposed on the Ministry of Finance’s website also make us think that there may be an alternative to the conservative approach described above: for accounting for fixed assets and for accounting for leases. They suggest that the initial cost of a fixed asset in an installment purchase should be determined on the basis of the market value of its acquisition, subject to immediate payment clause 17 of the draft PBU “Accounting for fixed assets” (Attention! PDF format).

In a buyout lease, the present value of the lease payments is determined as the amount that the lessee would pay for a similar fixed asset if he were to purchase it on an immediate payment basis. clause 7 of the draft PBU “Lease Accounting” (Attention! PDF format). When purchasing fixed assets on lease, as a rule, this amount is equal to the purchase price of the leased asset by the lessor (if there are no other expenses). Also, other payments must be taken into account in the initial cost, provided for by the agreement. This includes taking into account bank commissions, insurance and other payments and pp. 6-8 of the draft PBU “Lease Accounting” (Attention! PDF format).

Next, the effective interest rate is determined for subsequent accrual of interest expenses. That is, the cost of acquiring a fixed asset is the body of the loan, on which interest is charged. And each lease payment includes repayment of both the interest part and part of the principal debt. As a result, not only depreciation charges are recognized in current expenses, but also accrued interest. pp. 7, 8 of the draft PBU “Lease Accounting” (Attention! PDF format).

As you can see, the procedure established in draft PBUs resembles the rules for tax accounting of expenses under a leasing agreement from the lessee, although there are still differences clause 1 art. 257, sub. 10 p. 1 art. 264 Tax Code of the Russian Federation.

Example. Determining the initial cost of the leased asset from the lessee using an alternative method

/ condition / Let's use the conditions of the previous example and supplement them. The leased asset was purchased by the lessor for RUB 380,000. excluding VAT.

/ solution / The initial cost of the leased asset in accounting is determined in the amount of 400,000 rubles, which includes:

- the cost of its purchase is 380,000 rubles;

- delivery costs - 20,000 rubles.

Costs in the amount of 120,000 rubles. (the difference between the total amount of payments under the leasing agreement is 500,000 rubles and the purchase price of the leased asset is 380,000 rubles) - this is interest expense. They will be gradually taken into account in accounting during the term of the leasing agreement.

The redemption price does not appear as an independent expense in accounting.

What approach to take?

PBU projects today remain projects. And PBU 6/01 and the Instructions for reflecting transactions under a leasing agreement in accounting remained unchanged and should be applied to the extent that does not contradict later regulatory acts on accounting. This is how a specialist from the Ministry of Finance commented on the current situation.

FROM AUTHENTIC SOURCES

Head of the Accounting and Reporting Methodology Department of the Department for Regulation of Accounting, Financial Reporting and Auditing Activities of the Ministry of Finance of Russia

“The Order of the Ministry of Finance dated February 17, 1997 No. 15 has not been canceled. Therefore, even now in accounting, the initial cost of the leased asset from the lessee should be determined by the amount of all lease payments under the agreement.

But there is a subtle point here: in practice we have the word “ everyone" is interpreted incorrectly - the conclusion is drawn that all lease payments should supposedly be added up in a nominal amount. This is wrong. And such an interpretation does not follow from Order No. 15 at all.

When adding up lease payments, you need to take into account not only their nominal amount, but also the timing of their payment. The term is the same integral characteristic of financial and economic life as the amount of money, and an integral condition of the contract. Deadlines are also specified in the contract and must be taken from the contract. And taking into account the timing, the amount of payment accepted for accounting now must be less than the nominal amount payable in the future. The difference is interest expenses not yet accrued.

In practice, in order not to engage in complex mathematical exercises on discounting, it is appropriate to consider the current value of all lease payments equal to the market value of the leased object (adjusted for the amounts already actually paid in advance). In practice, this is precisely the cost of acquisition by the lessor of the object from the supplier. In most cases, it is known to the lessee. This amount must be included in the initial cost of the fixed asset in correspondence with accounts payable for lease payments. Then this amount should be increased in the usual manner by those capital investments that the lessee will make at his own expense, and you will get the cost at which the leased fixed asset should be taken into account.

And accounts payable, in their order, will gradually increase by interest and decrease by the amounts actually paid. If the interest rate is initially calculated correctly, then at the end of the lease, after paying the last payment (often the last payment is the surrender price), the accounts payable should be zero.”

If you took a conservative approach, then you should not rush to admit mistakes or recalculate the initial cost and current expenses. The second approach, which involves reflecting the leased asset in accounting at present value, is not clearly stated anywhere. The Ministry of Finance has not issued any official letters on this matter.

In addition, the initial cost of the first (conservative) approach is higher. Consequently, the property tax base is larger if the leased item is subject to this tax. Therefore, it is very likely that if you take the progressive path and show a lower initial cost of the leased asset than with the conservative option, you will get into trouble when checking your property tax. If you dare to do this, we recommend individually send to the Ministry of Finance a question about the formation of the initial cost of the leased asset, and save the received answer.

In the meantime, the conservative approach is safe from a tax point of view, although it reduces the quality of accounting.

When the projects we mentioned acquire the status of full-fledged PBUs, then lessees will be forced to take into account leasing costs in a new way. And even then, most likely, only for those leased items that will be acquired after the new ones come into force accounting provisions. Then there will be no claims against lessees from tax authorities regarding understatement of the property tax base.

Your company has already entered into a leasing agreement and you have questions about how to reflect leasing in accounting? In this article you can find the necessary information and examples accounting entries for various leasing operations.

Accounting for transactions under a leasing agreement is regulated by Order of the Ministry of Finance of the Russian Federation No. 15 dated February 17, 1997.

Leasing transactions depend on whose balance sheet the leased property is reflected in: the lessor or the lessee. The party on whose balance sheet the leased property is accounted for must be indicated in the leasing agreement.

Accounting for leasing when reflecting property on the lessor’s balance sheet

payment schedule.

If the leasing agreement provides for the reflection of the leased asset on the lessor's balance sheet, the lessee reflects the leased property on off-balance sheet account 001 "Leased fixed assets".

The accrual of leasing payments is reflected in the credit of account 76 “Settlements with various debtors and creditors” in correspondence with cost accounts: 20, 23, 25, 26, 29 – when accounting for leasing payments on property that is used in production activities, 44 – on property used in the activities of a trade organization, 91.2 - for property that is used for non-production purposes. Further, for simplicity, in the leasing accounting examples, only entries for the 20th account will be given.

Dt 001 - 1,000,000(the leased asset is accepted for accounting at cost excluding VAT)

Dt 60 – Kt 51 – 236,000(advance payment (down payment) under the leasing agreement has been paid)

It is necessary to take into account that the advance payment under the leasing agreement can be charged as expenses (advance offset) not immediately, but throughout the entire agreement. In the above payment schedule, the advance payment under the contract is offset evenly (RUB 6,555.56 each) over 36 months.

Dt 20 – Kt 76 – 29,276.27(accrued leasing payment No. 1 – 34,546 minus VAT – 5,269.73)

Dt 19 – Kt 76 – 5,269.73(VAT charged on lease payment No. 1)

Dt 20 – Kt 60 – 5,555.56(part of the advance payment under the leasing agreement is credited - 6,555.56 minus VAT 1,000)

Dt 19 – Kt 60 – 1,000(VAT is calculated based on the advance payment)

Dt 68 – Kt 19 – 6,269.73(VAT submitted to the budget)

Dt 76 – Kt 51 – 34 546(listed leasing payment No. 1)

The commission that is paid at the beginning of the leasing transaction (commission for concluding the transaction) is charged in accounting to the same expense accounts as current leasing payments.

Postings for the redemption of the leased asset

If there is a buyout price in the leasing agreement (this amount is not included in the leasing payment schedule, for example, let’s take it equal to 1,180 rubles including VAT), the following entries are made in accounting:

Dt 08 – Kt 76 – 1,000(reflects the costs of repurchasing the leased asset upon transfer of ownership to the lessee)

Dt 19 – Kt 76 – 180(VAT is charged when purchasing the leased asset)

Dt 68 – Kt 19 – 180(VAT submitted to the budget)

Dt 76 – Kt 51 – 1 180(the amount of redemption of the leased asset has been paid)

Dt 01 – Kt 08 – 1 000(the leased asset was accepted for accounting as part of its own fixed assets)

Accounting for leasing when reflecting property on the lessee’s balance sheet

The legislation regulating leasing accounting does not contain unambiguous instructions on the reflection of transactions under a leasing agreement if the lessee is the balance holder of the property.

Currently, the practice of communication between lessees and leasing companies with auditors and inspection bodies has developed, and a certain scheme of leasing transactions has been formed.

Accounting for leasing when reflecting property on the lessee’s balance sheet

If, under the terms of the leasing agreement, the property is taken into account on the lessee’s balance sheet, upon receipt of the leased asset in the lessee’s accounting, the value of the property minus VAT is reflected in the debit of account 08 “Investments in non-current assets” in correspondence with the credit of account 76 “Settlements with various debtors and creditors”.

When a leased asset is accepted for accounting as part of fixed assets, its value is written off from credit 08 of account to debit 01 of account “Fixed Assets”.

The accrual of lease payments is reflected in the debit of account 76, subaccount, for example, “Settlements with the lessor” in correspondence with account 76, subaccount, for example, “Settlements for leasing payments”.

Depreciation on the leased asset is calculated by the lessee. The amount of depreciation of the leased asset is recognized as an expense for ordinary activities and is reflected in the debit of account 20 “Main production” in correspondence with the credit of account 02 “Depreciation of fixed assets, subaccount for depreciation of leased property.

Tax accounting of leasing when reflecting property on the lessee’s balance sheet

In the tax accounting of the lessee, leased property is recognized as depreciable property.

The initial cost of the leased asset is determined as the amount of the lessor's expenses for its acquisition.

For profit tax purposes, the monthly depreciation amount is determined based on the product of the original cost of the leased asset and the depreciation rate, which is determined based on the useful life of the leased property (taking into account the classification of fixed assets included in depreciation groups). In this case, the lessee has the right to apply a coefficient of up to 3 to the depreciation rate. The specific size of the increasing coefficient is determined by the lessee in the range from 1 to 3. This coefficient does not apply to leased property belonging to the first to third depreciation groups.

Leasing payments minus the amount of depreciation on leased property are expenses associated with production and sales.

An example of accounting for leasing when reflecting property on the lessee’s balance sheet

Leasing transactions correspond to the payment schedule for property leasing located at the link

The lessee received a passenger car under a leasing agreement, payment schedule parameters:

- leasing agreement term – 3 years (36 months)

- the total amount of payments under the leasing agreement is 1,479,655.10 rubles, incl. VAT – 225,710.10 rubles

- advance payment (down payment) – 20%, 236,000 rubles, incl. VAT – 36,000 rubles

- car cost – 1,180,000 rubles, incl. VAT – 180,000 rubles

The expected period of use of the leased property is four years (48 months). The car belongs to the third depreciation group (property with a useful life of 3 to 5 years). Depreciation is calculated using the straight-line method.

Let's determine the amount of monthly depreciation in accounting. Because the cost of the property (including the leasing company's remuneration) is equal to 1,253,945 rubles (1,479,655.10 - 225,710.10), monthly depreciation will be 1,253,945: 48 = 26,123.85 rubles.

A passenger car belongs to the third depreciation group, therefore, a period of 48 months can be established in tax accounting. The monthly depreciation rate is 2.0833% (1: 48 months x 100%), the monthly depreciation amount is 1,000,000 x 2.0833% = 20,833.33 rubles.

In accordance with clause 10, clause 1 of Article 264 of the Tax Code of the Russian Federation, the amount of the lease payment recognized monthly as an expense for profit tax purposes is 8,442.94 rubles (34,546 (lease payment) - 5,269.73 (VAT as part of the lease payment) – 20,833.33 (monthly depreciation in tax accounting)).

Expenses under the leasing agreement are formed monthly in accounting due to depreciation (26,123.85 rubles), in tax accounting - due to depreciation (20,833.33 rubles) and leasing payment (8,442.94 rubles), a total of 29,276 ,27 rubles.

Because in accounting, the amount of expenses for 36 months (the term of the leasing agreement) is less than in tax accounting, this leads to the emergence of taxable temporary differences and deferred tax liabilities.

During the term of the leasing agreement, the lessee has a monthly taxable temporary difference in the amount of 3,152.42 rubles (29,276.27 - 26,123.85) and a corresponding deferred tax liability arises in the amount of 630.48 rubles (3,152.42 x 20% ).

Separately, it is necessary to say about advance accounting ( down payment by agreement). The following situations are possible:

1. When transferring property for leasing, the lessor provides an invoice for the full amount of the advance(in the given schedule of leasing payments - by 236,000 rubles). In this case, the entire amount of the advance payment of the advance payment, minus VAT, in tax accounting is recognized as an expense for profit tax purposes.

I would like to note that under the leasing agreement, services are provided throughout the entire contract and the fiscal authorities have no reason to assess compliance with the criteria of paragraph 4, paragraph 2 of Article 40 of the Tax Code of the Russian Federation on the comparability of leasing payments, because individual payments cannot be considered as individual transactions, and the price under the leasing agreement should be analyzed in total for all payments of the agreement.

2. The advance payment under the leasing agreement is offset in equal payments throughout the entire leasing term. In this case, the offset portion of the advance payment is recognized as an expense in tax accounting for profit tax purposes.

In the given example of a leasing payment schedule, it is assumed that an advance invoice is issued to the lessee when the property is leased, i.e. In tax accounting, when transferring property into leasing, expenses in the amount of 200,000 rubles are reflected (the advance payment, which is a leasing payment, is not deducted, since in the first month when transferring property into leasing, it is not yet accrued). At the same time, a taxable temporary difference in the amount of 200,000 rubles and a corresponding deferred tax liability in the amount of 40,000 rubles (200,000 rubles x 20%) arise.

At the end of the leasing agreement, the lessee will continue to accrue monthly depreciation in accounting in the amount of 26,123.85 rubles. There will be no expenses in tax accounting. This will lead to a monthly reduction in deferred tax liabilities in the amount of RUB 5,224.77 (RUB 26,123.85 x 20%).

Thus, based on the results of the agreement, the total amount of deferred tax liabilities will be equal to zero:

40,000 (deferred tax liability for the advance payment) + 22,697 (630.48 x 36 – deferred tax liability for current lease payments) – 62,697 (5,224.77 x 12 – reduction of deferred tax liabilities for 12 months of depreciation in the accounting accounting after the end of the leasing agreement).

Postings upon receipt of the leased asset

Dt 60 – Kt 51 – 236,000(advance paid under the leasing agreement)

Dt 08 – Kt 76 (Settlements with the lessor) – 1,253,945(debt under the leasing agreement is reflected without VAT)

Dt 19 – Kt 76 (Settlements with the lessor) - 225,710.10(VAT reflected under the leasing agreement)

Dt 01 – Kt 08 – 1 253 945(a car received under a leasing agreement is accepted for registration)

Dt 76 – Kt 60 – 236,000(advance payment paid upon concluding the leasing agreement is included)

Dt 68 (Income tax) – Kt 77 – 40,000

Dt 68 (VAT) – Kt 19 – 36,000(VAT submitted on advance payment)

Postings for current lease payments

Dt 20 – Kt 02 – 26 123.85

Dt 76 (Settlements with the lessor) - Kt 76 (Settlements for leasing payments) - 34,546(leasing debt has been reduced by the amount of the lease payment)

Dt 76 “Calculations for leasing payments” – Kt 51 – 34,546(leasing payment transferred)

Dt 68 (VAT) – Kt 19 – 5,269.73(VAT is presented on the current lease payment)

Dt 68 (Income tax) – Kt 77 – 630.48(deferred tax liability reflected)

Postings at the end of the leasing agreement

Dt 01 (Own fixed assets) – Kt 01 (Fixed assets received under leasing) – 1,253,945(reflects the receipt of the car into ownership)

Dt 02 (Depreciation of leased property) – Kt 02 (Depreciation of own fixed assets) – 940,458.60(accrued depreciation on the car is reflected)

Postings within 12 months after the end of the leasing agreement

Dt 20 – Kt 02 (Depreciation of own fixed assets) – 26,123.85(depreciation has been calculated on the car)

Dt 77 – Kt 68 (Income tax) – 5,224.77(reflects a decrease in deferred tax liability)

There is also a method in which the initial cost of the leased asset in accounting is equal to the cost of purchasing a car from the lessor, i.e. coincides with the value in tax accounting. In this case, on account 76, when the property is accepted for accounting, only the debt for the value of the property is reflected.

Leasing payments are calculated monthly on credit 20 of account in correspondence with account 76 in the amount of the difference between accrued depreciation and the amount of the monthly lease payment.

Selecting the most reasonable option for reflecting leased property on the balance sheet of the lessor or lessee, as well as agreeing with the leasing company on the optimal scheme for reflecting lease payments is a very complex task that requires good knowledge of the specifics accounting leasing operations and peculiarities of wording in the leasing agreement and primary documents.