I present the best forex books on Elliott waves, which you can download for free.

1 . The most popular wave analysis course

Wave analysis usually causes very great difficulties. A course that is very popular will help you quickly and clearly with numerous examples and lessons.

2. Ralph Elliott "The Law of Nature. The Secret of the Universe"

Here is a book by the father of Elliott wave theory, Ralph Elliott, written in 1946. This work brought together all of Elliott's previous works in a final monograph. Ralph calls the book “The Law of Nature”, through the prism of his discovery, found on stock price charts, he describes the real “Divine Law”, shows the principle by which human society develops, the ancient pyramids were built, and by what rules any processes that can be traced occur everywhere in nature.

Here is a book by the father of Elliott wave theory, Ralph Elliott, written in 1946. This work brought together all of Elliott's previous works in a final monograph. Ralph calls the book “The Law of Nature”, through the prism of his discovery, found on stock price charts, he describes the real “Divine Law”, shows the principle by which human society develops, the ancient pyramids were built, and by what rules any processes that can be traced occur everywhere in nature.

3. A. Frost, R. Prechter “A Complete Course on the Elliott Wave Law”

Elliot waves are one of the most popular market forecasting methods. The authors of the work are not theorists: one of the creators of the book is the winner of the trading championship in 1984; accounts with real money were used in the work. The creators warn: you cannot master Elliott’s theory right away, especially from fragmentary articles on the Internet, you need to study this tutorial and apply a lot of effort and patience. The presented manual is suitable for serious and thoughtful work for people who truly want to comprehend the laws and secrets of waves.

Elliot waves are one of the most popular market forecasting methods. The authors of the work are not theorists: one of the creators of the book is the winner of the trading championship in 1984; accounts with real money were used in the work. The creators warn: you cannot master Elliott’s theory right away, especially from fragmentary articles on the Internet, you need to study this tutorial and apply a lot of effort and patience. The presented manual is suitable for serious and thoughtful work for people who truly want to comprehend the laws and secrets of waves.

4. J. Frost, R. Prechter “The Elliott Wave Principle. The Key to Market Behavior

The book presented is a true classic, a work of the 20th edition. Robert Prector and J. Frost are probably the most famous authors on the topic of Elliott waves, of course after the creator of the theory himself. It is with the help of the presented book that most people are familiar with the theory and can rightfully appreciate and apply it in their trading.

The book presented is a true classic, a work of the 20th edition. Robert Prector and J. Frost are probably the most famous authors on the topic of Elliott waves, of course after the creator of the theory himself. It is with the help of the presented book that most people are familiar with the theory and can rightfully appreciate and apply it in their trading.

Back in the 30s, a method was born that changed people's worldview on the nature of stock prices. Regularities were found that do not become obsolete, the laws by which the exchange price moves were revealed.

5. Boriskin V. In "Harmonic wave analysis"

We can say this is a unique book about wave analysis. Practicing traders should read this book; Elliott's complex theory is significantly simplified and expanded. The work combines theory with practice. The visitor will be pleased with clear pictures in color and numerous explanations. This work is not a break from reality and not a theory far from “life”. The work was written by real traders, the authors understood how important clear formulations are and the ability to use the acquired knowledge immediately after reading. The book has become a real “Know-how” that combines two approaches at the same time: the one that most traders practice and the wave theory.

We can say this is a unique book about wave analysis. Practicing traders should read this book; Elliott's complex theory is significantly simplified and expanded. The work combines theory with practice. The visitor will be pleased with clear pictures in color and numerous explanations. This work is not a break from reality and not a theory far from “life”. The work was written by real traders, the authors understood how important clear formulations are and the ability to use the acquired knowledge immediately after reading. The book has become a real “Know-how” that combines two approaches at the same time: the one that most traders practice and the wave theory.

6. Bolton "Complete works on Elliott waves"

One of the earliest works on Elliott waves. The book was written long ago in the 60s of the 20th century. Author A.G. Bolton is a man who is impressed by the market predictions of this method. However, the author does not limit himself to a terse retelling; Bolton had his own critical thinking and opinion on the topic. Some points have been simplified, some have been added. The main idea of writing a textbook is to rid the theory of uncertainty, make the rules clearer and more accessible for practical use. The described theory was discovered by Elliott in the mid-30s.

One of the earliest works on Elliott waves. The book was written long ago in the 60s of the 20th century. Author A.G. Bolton is a man who is impressed by the market predictions of this method. However, the author does not limit himself to a terse retelling; Bolton had his own critical thinking and opinion on the topic. Some points have been simplified, some have been added. The main idea of writing a textbook is to rid the theory of uncertainty, make the rules clearer and more accessible for practical use. The described theory was discovered by Elliott in the mid-30s.

7. G. Neely “Mastering Elliott Wave Analysis”

A book about the scientific approach of Elliott wave laws. The presented method is the first successful attempt to represent the theory with rigorous, consistent algorithms. All the nuances that make up the forecast method are carefully analyzed. There is nothing superfluous in the book, the work was created and perfected over 10 years - the authors claim that every sentence is important, you should not read between the lines of the work. The subject is revealed in depth and detail; the reader will appreciate the accessibility of the language, simplicity of presentation and quality of teaching. The authors were able to significantly improve the teaching created almost 100 years ago, found new, previously unknown models, all this increased the significance and value of the method.

A book about the scientific approach of Elliott wave laws. The presented method is the first successful attempt to represent the theory with rigorous, consistent algorithms. All the nuances that make up the forecast method are carefully analyzed. There is nothing superfluous in the book, the work was created and perfected over 10 years - the authors claim that every sentence is important, you should not read between the lines of the work. The subject is revealed in depth and detail; the reader will appreciate the accessibility of the language, simplicity of presentation and quality of teaching. The authors were able to significantly improve the teaching created almost 100 years ago, found new, previously unknown models, all this increased the significance and value of the method.

8. Dmitry Vozny “Elliott Code: wave analysis of the forex market"

A book by a Russian author about Elliott waves. The material is adapted for the Forex market; Vozny himself is a leading analyst of the Forex broker Alpari, a researcher and a talented writer. The author not only retells a theory that was once created, he is the creator of his own branch model with unique markup and numerous additions and clarifications. The work was approved by the wave guru - Prector, the author of a famous manual on wave analysis, a recognized expert in this field, who was the guru of the decade in the 80s.

A book by a Russian author about Elliott waves. The material is adapted for the Forex market; Vozny himself is a leading analyst of the Forex broker Alpari, a researcher and a talented writer. The author not only retells a theory that was once created, he is the creator of his own branch model with unique markup and numerous additions and clarifications. The work was approved by the wave guru - Prector, the author of a famous manual on wave analysis, a recognized expert in this field, who was the guru of the decade in the 80s.

9. Vozny "A Short Course on the Elliott Wave Law"

You can call this brochure the second part of Vozny’s book “The Elliott Code”; unlike the first, this 84-page manual provides a summary of the theory as a whole, which will be useful to traders who practice this theory directly in trading. The purpose of the book was not to teach you Elliott waves, but only to reinforce, repeat and generalize the material. Of course, you should not start studying theory from this book. It is better to read it when you already have a grasp of the material, but feel that there are gaps left or just want to have a “cheat sheet” at hand. Having learned the theory, you may be able to make more far-sighted decisions on forecasting the price of the selected instrument; your vision will become broader and more global.

You can call this brochure the second part of Vozny’s book “The Elliott Code”; unlike the first, this 84-page manual provides a summary of the theory as a whole, which will be useful to traders who practice this theory directly in trading. The purpose of the book was not to teach you Elliott waves, but only to reinforce, repeat and generalize the material. Of course, you should not start studying theory from this book. It is better to read it when you already have a grasp of the material, but feel that there are gaps left or just want to have a “cheat sheet” at hand. Having learned the theory, you may be able to make more far-sighted decisions on forecasting the price of the selected instrument; your vision will become broader and more global.

10. Balan "Elliott Wave Principle: Application to Forex Markets"

A book about wave theory, specially adapted for the Forex market. The volume of material is insignificant: 109 pages, however, this is rather a plus - it is always better to have a clear outline than a watery book. The forex market dates back to the 70s, after the rupture of the Bretton Woods agreement and the transition to free floating exchange rates. During this time, a lot has changed. The crash of 1987 showed that Forex is the most liquid and transparent market. The author, when creating the book, tried to make the product friendly and understandable for the reader. The tutorial consists of 8 parts: introduction to the theory, main concepts, waves with deviations from the norm, practical instructions, points of difficulty, trading plan, real examples for practical use, thoughts on the future of the theory.

A book about wave theory, specially adapted for the Forex market. The volume of material is insignificant: 109 pages, however, this is rather a plus - it is always better to have a clear outline than a watery book. The forex market dates back to the 70s, after the rupture of the Bretton Woods agreement and the transition to free floating exchange rates. During this time, a lot has changed. The crash of 1987 showed that Forex is the most liquid and transparent market. The author, when creating the book, tried to make the product friendly and understandable for the reader. The tutorial consists of 8 parts: introduction to the theory, main concepts, waves with deviations from the norm, practical instructions, points of difficulty, trading plan, real examples for practical use, thoughts on the future of the theory.

11. Joseph "Simplified Elliott Wave Analysis"

The book is small - only 80 pages. The author about the book. The majority, about 90 percent of traders, refuse to use Elliott waves in trading, claiming that they do not work at all. At first I thought the same, but after applying simple approaches to the method and trading with them for seventeen years, I realized that speculators lose a lot by abandoning Elliott waves. This is the only method that determines the strength and timing of a trend. The main reason for abandoning the system is confusion, complex, ambiguous rules. After a lot of painstaking work, which took a lot of time, it was finally possible to create a simple theory in which only precise, consistent principles are applied

The book is small - only 80 pages. The author about the book. The majority, about 90 percent of traders, refuse to use Elliott waves in trading, claiming that they do not work at all. At first I thought the same, but after applying simple approaches to the method and trading with them for seventeen years, I realized that speculators lose a lot by abandoning Elliott waves. This is the only method that determines the strength and timing of a trend. The main reason for abandoning the system is confusion, complex, ambiguous rules. After a lot of painstaking work, which took a lot of time, it was finally possible to create a simple theory in which only precise, consistent principles are applied

12. Safonov “Practical use of Elliott waves in trading: diagnostics, forecasting and decision making”

The tutorial consists of 3 parts. The first is the introductory part. He will talk about the essence of the theory and its place in the trading environment. The second part will outline the advantages and disadvantages of the theory, you will delve into the methodology and psychology of Elliott theory and gain your understanding. Disadvantages have their place in this part; they will be identified in this section. The material will push the reader to his own opinion about the theory. The final, 3rd part is intended for trading traders.

The tutorial consists of 3 parts. The first is the introductory part. He will talk about the essence of the theory and its place in the trading environment. The second part will outline the advantages and disadvantages of the theory, you will delve into the methodology and psychology of Elliott theory and gain your understanding. Disadvantages have their place in this part; they will be identified in this section. The material will push the reader to his own opinion about the theory. The final, 3rd part is intended for trading traders.

Even more books on dozens of stock exchange topics:

Trader's library: more than 150 books on dozens of stock exchange topics

How to supplement learning from books?

Everyday on weekdays (from 6:30 to 18:30 ) there are free online classes - per weekmore than 50 (!)various lessons - theory and practice of trading. Conducted by teachers in real time, practical lessons are taught real experienced traders.

Free / no registration required. There is a chat. I recommend!

Motivation for learning to trade - results from real traders

millionaires (profitability charts, detailed discussion of work):

P Why do some forex brokers have % of successful clients?

Reaches up to 40%, while for others it does not reach 5% ?

In the 1930s, Ralph Nelson Elliott discovered that stock market prices followed recognizable patterns. The patterns he identified are repeatable according to form, but not necessarily in time or amplitude. Elliott counted 13 similar patterns, or “waves,” that appear again and again in market price data. He named, defined and illustrated these patterns. He then described how, when linked, they form their own larger counterparts, which in turn form the same patterns in even larger sizes, and so on, leading to a structured progression. He called this phenomenon the wave principle.

While it is the best forecasting tool in existence, the wave principle is not primarily a forecasting tool. This is primarily a detailed description of the behavior of markets. Such a description provides a wealth of information about the market's position within the behavioral continuum and thus its likely future path. The main significance of the wave principle is that it provides context for market analysis. This context guides thinking in a certain way and makes it possible to understand the overall situation and outline the perspective. At times, the accuracy of the wave principle in detecting and even anticipating changes in direction is almost incredible. Many areas of mass human activity are consistent with the wave principle, but its application to the stock market is most famous and effective. In any case, the stock market depends much more on the human factor than it seems to the casual observer or even to those who are trying to build their wealth on it. The aggregate level of stock prices is a direct and immediate criterion in assessing overall human productivity. The fact that the assessment of such changes in accordance with certain models is a fact full of deep meaning, which can revolutionize the social sciences. However, it is not relevant to our present discussion.

Genius R.N. Elliott - in the amazing discipline of thinking with which he began to study the charts of the Dow Jones Industrial Average and its predecessors. Elliott studied them with such thoroughness and accuracy that he was able to construct a system of principles that reflected all the events in the market that he knew about by the mid-40s. At a time when the Dow was close to 100, Elliott predicted the great bull market of the next decades that would exceed all expectations of the time; However, most investors did not think it was possible for the Dow to rise above its 1929 peak. As we will see, exceptionally accurate market forecasts have accompanied the entire history of the Elliott Wave Approach.

Elliott had theories that he relied on to build his models, which we will discuss in Chapter 3. For now, it is enough to note that the models described in Chapters 1 and 2 have stood the test of time.

Quite often one can encounter different interpretations of the market status of Elliott waves, especially when experts do not bother to deeply study the indices. However, most doubts can be dispelled by examining the graphs simultaneously on arithmetic and semi-logarithmic scales and carefully following the rules and guidelines outlined in this book. Welcome to Elliott's world!

Basic principles

According to the wave principle, every market decision produced meaningful information and at the same time produces significant information. Every transaction, being result, woven into the fabric of the market and, becoming known to investors, joins the chain reasons behavior of other people. This feedback cycle is guided by the social nature of man, taking on certain forms. Because such shapes are repeated, they have predictive value. Sometimes the market seems to reflect external conditions and events, but there are times when it has nothing to do with what most people consider causal relationships. The market has its own laws. It is not driven by the linear cause-and-effect relationship that everyone is accustomed to through everyday life experience. News doesn't drive prices. And the market is not the cyclical rhythmic machine that some people think it is. Its movement reflects the repetition of forms, which does not depend on the supposed causal events, and is also not strictly connected with any periodicity.

The market movement has a wave-like character. Waves are a pattern of directed movement. More precisely, a wave is a pattern that arises naturally; we will try to show this in this chapter.

Five-wave model

Price movements in markets take the form of five waves of a certain structure. Three of them, labeled 1, 3, and 5, actually cause directional movement. They are interspersed with two oppositely directed waves, marked 2 and 4 (Figure 1-1). These two oppositely directed waves are obviously necessary for the continuation of the general movement.

Elliott noted three consistent properties of the five-wave form. Here they are: wave 2 never crosses the starting point of wave 1; wave 3 is never the shortest of the waves; wave 4 never enters the price territory of wave 1. R.N. Elliott did not specifically state that there is only one major form, the five-wave pattern, but this is certainly true. At any given time, the market is at some point in the five-wave trend development model. Since the five-wave pattern is the main form of market movement, all other patterns are part of the five-wave sequence.

Wave type

Wave development occurs in two forms: driving and corrective. Motive waves have a five-wave structure, corrective waves have a three-wave structure (with options). The driving view is represented by the five-wave pattern shown in rice. 1–1, and its co-directional components, for example waves 1, 3 and 5. This structure is called “driving” because its energy sets the market in motion. The corrective type of waves is present in all countertrend interruptions, including waves 2 and 4, shown in rice. 1–1. Their structure is called “corrective” because they arise as a response to the previous driving wave, making only a partial return, or “correcting” the progress made. Thus, these two types of waves are fundamentally different, both in role and structure, which we will consider in more detail. Fig. 1–2 ends, followed by a similar cycle, and after that another five-wave movement. This development results in a five-wave pattern larger in scale than the waves from which it is composed. The result is shown in rice. 1–3, where the peak is indicated by symbol (5). This five-wave pattern of a higher degree is then corrected by a three-wave pattern of the same degree; this completes the next largest complete cycle, shown in rice. 1–3.

“The Elliott Wave Principle” by R. Prechter and A. Frost – Wall Street classic, 20th edition translation. Largely thanks to the book by Prechter and Frost, most modern professional investors, traders and analysts are familiar with Elliott's theory and use it in practice. While studying financial markets, Ralph Nelson Elliott discovered that prices move in recognizable patterns. He named, defined and illustrated these patterns. The wave principle is not only one of the best forecasting methods, it is primarily a detailed description of market behavior. Such a description provides a wealth of information about the market's position within the behavioral continuum and thus indicates its likely future path. The book is intended for investors, traders, analysts, and financiers.

* * *

The given introductory fragment of the book The Elliott Wave Principle: The Key to Understanding the Market (Robert Prechter, 2012) provided by our book partner - the company liters.

Part 1. Elliott Theory

Chapter 1. General concept

Hamilton Bolton began the introductory article to The Elliott Wave Principle - A Critical Appraisal with the following statement:

“Looking back at the many completely unpredictable events that occurred in the twentieth century that affected the stock market, such as the Depression, World War, Post-War Revival and Boom, I am each time surprised at how closely the Elliott Wave Principle fit into the real facts of economics. Having been tested over a significant period of modern history, Elliott's principle has proven its value in practical trading."

In the 1930s, Ralph Nelson Elliott discovered that stock market prices followed recognizable patterns. The patterns he identified are repeatable according to form, but not necessarily in time or amplitude. Elliott counted 13 similar patterns, or “waves,” that appear again and again in market price data. He named, defined and illustrated these patterns. He then described how, when linked, they form their own larger counterparts, which in turn form the same patterns in even larger sizes, and so on, leading to a structured progression. He called this phenomenon the wave principle.

While it is the best forecasting tool in existence, the wave principle is not primarily a forecasting tool. This is primarily a detailed description of the behavior of markets. Such a description provides a wealth of information about the market's position within the behavioral continuum and thus its likely future path. The main significance of the wave principle is that it provides context for market analysis. This context guides thinking in a certain way and makes it possible to understand the overall situation and outline the perspective. At times, the accuracy of the wave principle in detecting and even anticipating changes in direction is almost incredible. Many areas of mass human activity are consistent with the wave principle, but its application to the stock market is most famous and effective. In any case, the stock market depends much more on the human factor than it seems to the casual observer or even to those who are trying to build their wealth on it. The aggregate level of stock prices is a direct and immediate criterion in assessing overall human productivity. The fact that the assessment of such changes in accordance with certain models is a fact full of deep meaning, which can revolutionize the social sciences. However, it is not relevant to our present discussion.

Genius R.N. Elliott - in the amazing discipline of thinking with which he began to study the charts of the Dow Jones Industrial Average and its predecessors. Elliott studied them with such thoroughness and accuracy that he was able to construct a system of principles that reflected all the events in the market that he knew about by the mid-40s. At a time when the Dow was close to 100, Elliott predicted the great bull market of the next decades that would exceed all expectations of the time; However, most investors did not think it was possible for the Dow to rise above its 1929 peak. As we will see, exceptionally accurate market forecasts have accompanied the entire history of the Elliott Wave Approach.

Elliott had theories that he relied on to build his models, which we will discuss in Chapter 3. For now, it is enough to note that the models described in Chapters 1 and 2 have stood the test of time.

Quite often one can encounter different interpretations of the market status of Elliott waves, especially when experts do not bother to deeply study the indices. However, most doubts can be dispelled by examining the graphs simultaneously on arithmetic and semi-logarithmic scales and carefully following the rules and guidelines outlined in this book. Welcome to Elliott's world!

Basic principles

According to the wave principle, every market decision produced meaningful information and at the same time produces significant information. Every transaction, being result, woven into the fabric of the market and, becoming known to investors, joins the chain reasons behavior of other people. This feedback cycle is guided by the social nature of man, taking on certain forms. Because such shapes are repeated, they have predictive value. Sometimes the market seems to reflect external conditions and events, but there are times when it has nothing to do with what most people consider causal relationships. The market has its own laws. It is not driven by the linear cause-and-effect relationship that everyone is accustomed to through everyday life experience. News doesn't drive prices. And the market is not the cyclical rhythmic machine that some people think it is. Its movement reflects the repetition of forms, which does not depend on the supposed causal events, and is also not strictly connected with any periodicity.

The market movement has a wave-like character. Waves are a pattern of directed movement. More precisely, a wave is a pattern that arises naturally; we will try to show this in this chapter.

Five-wave model

Price movements in markets take the form of five waves of a certain structure. Three of them, labeled 1, 3, and 5, actually cause directional movement. They are interspersed with two oppositely directed waves, marked 2 and 4 (Figure 1-1). These two oppositely directed waves are obviously necessary for the continuation of the general movement.

Elliott noted three consistent properties of the five-wave form. Here they are: wave 2 never crosses the starting point of wave 1; wave 3 is never the shortest of the waves; wave 4 never enters the price territory of wave 1. R.N. Elliott did not specifically state that there is only one major form, the five-wave pattern, but this is certainly true. At any given time, the market is at some point in the five-wave trend development model. Since the five-wave pattern is the main form of market movement, all other patterns are part of the five-wave sequence.

Wave type

Wave development occurs in two forms: driving and corrective. Motive waves have a five-wave structure, corrective waves have a three-wave structure (with options). The driving view is represented by the five-wave pattern shown in rice. 1–1, and its co-directional components, for example waves 1, 3 and 5. This structure is called “driving” because its energy sets the market in motion. The corrective type of waves is present in all countertrend interruptions, including waves 2 and 4, shown in rice. 1–1. Their structure is called “corrective” because they arise as a response to the previous driving wave, making only a partial return, or “correcting” the progress made. Thus, these two types of waves are fundamentally different, both in role and structure, which we will consider in more detail.

Full cycle

One complete cycle consists of eight waves and, in addition, is composed of two different phases: a five-wave driving phase (also called the “five” or “five-wave”), the internal waves of which are indicated by numbers, and a three-wave corrective phase (also called the “three” or "three-wave"), the internal waves of which are designated by letters. Just as wave 2 corrects wave 1 by rice. 1–1, sequence A, B, C adjusts the sequence 1, 2, 3, 4, 5 to rice. 1–2.

Composite design

When the initial eight-wave cycle shown in rice. 1–2, ends, it is followed by a similar cycle, and after that another five-wave movement. This development results in a five-wave pattern larger in scale than the waves from which it is composed. The result is shown in rice. 1–3, where the peak is indicated by symbol (5). This five-wave pattern of a higher degree is then corrected by a three-wave pattern of the same degree; this completes the next largest complete cycle, shown in rice. 1–3.

As shown in rice. 1–3, each co-directional component of the driving wave (i.e., its internal waves 1, 3 and 5) is a smaller copy of this driving wave. In addition, each full-cycle component (i.e., waves 1 + 2 or 3 + 4) of a completed cycle is a smaller copy of that cycle.

The most important point to understand is: rice. 1–3 not only shows a larger version rice. 1–2, it shows itself rice. 1–2, but in more detail. On rice. 1–2 each of subwaves 1, 3 and 5 is a driving wave, which, in turn, consists of a “five” wave, and each of subwaves 2 and 4 turns out to be a corrective wave and consists of a “three”. The waves and in Figure 1–3, if examined “under a microscope,” would take the same shape as the waves and. The shape is constant regardless of scale. We can use rice. 1–3, to illustrate two waves, eight waves, or thirty-four waves, depending on the scale we are describing.

Essence of the design

Note that within the framework of the correction model shown in rice. 1–3 like a wave, each of the downward waves (A) and (C) in turn consists of five waves: 1, 2, 3, 4 and 5. Similarly, the upward wave (B) consists of three waves : A, B and C. This construction reveals a very important fact: driving waves are not always directed upward, and corrective waves are not always directed downward. The type of wave is determined not by its absolute direction, but primarily by its relative direction. With the exception of four special cases that will be discussed later in this chapter, waves are considered to be of the driving type (five) when they are directed in the same direction as the wave of the higher degree of which they are components, and of the corrective type (three or its variation) - when directed opposite to it. Waves (A) and (C) are moving, being directed in the same way as the wave. Wave (B) turns out to be corrective, since it corrects wave (A) and is directed opposite to the wave. In summary, the fundamental tendency of the wave principle is that a price movement in the same direction as a larger trend develops in five waves, while a reaction against a larger trend develops in three waves, and this is true for trends of any degree.

The relationship between shape, degree and relative direction is shown in rice. 1–4. This illustration reflects a general principle: in any market cycle, waves will subdivide as shown in the table.

Neither rice. 1–2, neither rice. 1–3 or rice. 1–4 do not imply finality. As before, this larger cycle automatically becomes two parts of the next higher degree wave. As long as the forward movement continues, the process of building waves of higher degrees continues. The reverse process of subdivision into smaller degrees obviously proceeds in exactly the same way. As far as we can determine, moreover, all waves are simultaneously included as part of others and compiled from other waves.

Why 5–3?

Elliott himself never thought about why the essential form of markets turns out to be five waves in progress and three waves in regression. He simply noted: what happens happens. Does the essence form have to consist of five and three waves? Think about it and you will realize that this is the minimum and therefore the most effective requirement to achieve both oscillation and progress in linear motion. The only one the wave does not allow oscillation. The smallest division that creates oscillations is the division into three waves. Three waves the directions of which alternate, do not provide forward movement(if you do not set additional conditions limiting their size. For progress to occur in a certain direction, despite periods of correction, movement in the direction of the main trend must consist of at least five waves. In this case, fluctuations may persist against the background of directional price movement. Although waves there could be more, the most efficient form of intermittent forward movement is 5-3, and nature tends to take the most efficient path.

Wave degree: designation and classification

All waves can be classified by their relative sizes or degrees. The degree of a wave is determined by its size and position relative to the waves, its constituents (its components), adjacent to it and enclosing it. Elliott gave names to the waves of nine degrees, from the smallest, visible only on the hourly chart, to the largest wave, the existence of which he could assume based on the data available at the time. He chose the following terminology for these powers, from largest to smallest: major supercycle, supercycle, cycle, primary, intermediate, minor, minute, minuette and subminuette. Cycles consist of primary waves, which, in turn, are divided into intermediate ones, and then into waves of the smallest degrees. Other terminology can be used, although this is the one we are accustomed to, and today most practitioners feel quite comfortable using Elliott's classification.

In order to mark waves on a chart, a certain scheme is needed to distinguish the degrees of waves in market progression. As shown in the table below, we have standardized the order of the wave designations, which include numbers and letters and there are several points that were missing until now. Progression is infinite in both directions. It is based on easy-to-remember repetition. Moving waves are indicated by alternating sets of Roman and Arabic numerals. Waves of large degrees are marked by three sets of Roman numerals, which, as the scale of the waves decreases, are followed by three sets of Arabic numerals, which in turn are replaced by another set of Roman numerals, etc. The notation of corrective waves similarly alternates between three capitals and three lower case. Lowercase Roman numerals are used for degrees below minor and capital Roman numerals for higher degrees, so a quick glance at the graph reveals a certain perspective on its timeline. (Some of the drawings in the book deviate from this standard because they were created before its adoption.)

For a scientist, the most desirable designations are usually those of the type 11, 12, 13, 14, 15, etc., where the subscripts indicate the degree of the wave. However, it is quite difficult to read a large number of such symbols on a graph. The above standard provides quick visual orientation.

It is important to understand that these names and designations are used in a special way for the wave degrees being defined. Using this classification, the analyst can accurately determine the position of a wave in the overall forward movement of the stock market, much like latitude and longitude are used to determine geographic location. The phrase “The Dow Jones Industrial Average is in the minute wave of the minor wave 1 of the intermediate wave (3) of the primary wave of the cyclical wave I of the supercyclical wave (V) of the current major supercycle” defines a specific a point on the market's historical path forward.

All waves have a certain degree. However, it may be impossible to accurately determine the extent of the current wave, particularly the subwaves that form the beginning of a new wave. Degrees are determined not based on the price or time size of the wave, but on its shape, which is a function of price and time. Fortunately, the exact determination of the degree is usually not important for successful forecasting, since it turns out to be much more important relative degree. Knowing that a big price movement is expected is much more important than giving it an exact name. Subsequent developments usually help to accurately determine the extent of the wave.

Wave functions

Each wave performs one of two functions: it is either action, or opposition. The wave can either continue the movement of the wave to a greater extent or interrupt it. The wave function is determined by its relative direction. Active, or trendy, the wave is directed Also, as well as a wave of greater (by one) degree of which it is a part. Opposing, or counter-trend, a wave is any wave that is directed opposite to a wave of greater (by unit) degree of which it is a component. Active waves are designated by odd numbers and letters (for example, 1, 3, 5, a, c to rice. 1–2). Counteracting waves are designated by even numbers and letters (for example, 2, 4, b on rice. 1–2).

All opposing waves develop correctly. If all active waves developed as motive waves, then there would be no need for different terms. Indeed, most active waves are divided into five sub-waves. However, as will be shown in the following sections, some active waves develop according to a corrective scheme, i.e., they are divided into three waves or variations thereof. Detailed knowledge of model design is required in order to understand the difference between function actions And moving view, which is not reflected on rice. 1–1-1-4. A thorough understanding of the forms discussed later in this chapter will make it clear why we introduced these terms into the Elliott wave vocabulary.

Variations on the main theme

The wave principle would be easily applicable if the essence of the design proposed above were a complete description of market behavior. The reality, fortunately or unfortunately, is not so simple. Although an idea like cyclicality in markets or in human life implies exact repeatability, the wave concept allows for enormous variability, which has a lot of factual evidence. Later in this chapter, the actual behavior of markets will be described in detail. This is what Elliott sought to describe, and he succeeded in doing so.

There are many specific variations on the basic theme, and Elliott has meticulously described and illustrated them. In addition, he noted the important fact that each model has certain the necessary conditions And trends. Thanks to these observations, he was able to formulate numerous rules and regulations that help to correctly identify the wave. A deep penetration into such details is necessary to understand what can happen in the market and what cannot happen, which is no less important.

Chapters 2 and 4 will provide plenty of guidance on how to interpret the wave correctly. If you have No desire to become a market analyst, or if you are afraid of getting bogged down in technical details, skim the next paragraph and then move on to Chapter 3. A quick read of the very condensed summary below will ensure that you at least recognize the concepts and terms that we will cover next refer to as necessary aspects of the wave principle.

Summary of additional technical aspects

Additional technical aspects regarding waves will be discussed in detail until the end of Chapter 2. They are stated here as briefly as possible: Most driving waves take the form of an impulse, that is, they behave according to a five-wave pattern similar to the one shown in rice. 1–1 By 1–4, and in which sub-wave 4 is not included in the area of sub-wave 1, and sub-wave 3 is not the shortest. The graph of a five-wave impulse is usually limited by parallel lines. One of the driving waves in the pulse, i.e. 1, 3 or 5, is typically extended, i.e. much longer than the other two. There are two rare variations of driving waves called diagonal triangles, which are wedge-shaped patterns. Diagonal triangles occur at the beginning of a five-wave sequence in only one case (wave 1 or A) and in all other cases only at the end (wave 5 or C) of a larger wave. Corrective waves have significantly more variations. The main ones are called zigzags (shown in rice. 1–2, 1–3 and 1–4), horizontal corrections and triangles (the designations of which include the letters D and E). These three simple correction patterns can be sequenced to form more complex corrections (the components of which are designated W, X, Y and Z). In impulses, waves 2 and 4 almost always alternate in shape, with one correction typically belonging to the zigzag family, and the second not. Corrections usually end within wave 4 of the previous impulse of the same degree. Each wave reflects characteristic trading behavior and “personality” in terms of the accompanying rate of price changes and investor sentiment.

Many readers can now skip straight to Chapter 3. For those who want to get into the details, a detailed description of the features of waveforms is provided.

Analytical details

Moving waves

Motive waves are divided into five sub-waves. Their direction always coincides with the direction of the trend of a higher degree (by one). They are generally easy to recognize and interpret.

Within a driving wave, wave 2 always returns less than 100% of wave 1, and wave 4 always returns less than 100% of wave 3. Additionally, wave 3 never enters the price range of wave 1. The goal of a driving wave is to achieve progress, and these rules for its formation ensure such movement.

Additionally, Elliott discovered that wave 3 is often the longest (relative to its price size) and never the shortest of the three active waves (1, 3, and 5) of the driving wave. This rule is always true when comparing percentage price changes within driving waves 1, 2 and 3. But even when comparing the absolute price sizes of three driving waves, this rule most often turns out to be valid. There are two types of driving waves: impulses and diagonal triangles.

End of introductory fragment.

The book “The Elliott Wave Principle” by Prechter and Frost is a unique work of two talented authors. It was this textbook that introduced Elliott’s theory and taught many traders, analysts, as well as experienced and novice investors to use it in practice.

"Elliott Wave Principle. The Key to Understanding the Market, Robert Prechter, Alfred Frost

Ralph Nelson Elliott- famous American financier. By studying the charts of various stock indices, he discovered that price values on the market change according to certain patterns that can be recognized and identified. He named these models and illustrated them. According to the theory, based on sufficient information about the position of the market, it is possible to predict its future path. How the price will behave can be found out and highlighted on the chart in the form of waves. and now remain one of the best in the field of financial forecasting.

Elliott's discovery served to create a market analysis system, which is discussed in the textbook “Elliott Wave Principle. The key to understanding the market." The publication is divided into several main parts. The first chapters are devoted to the theory of wave analysis, they examine the conditions for the development of the legendary system from the perspective of history. Next, the authors invite the reader to familiarize themselves with the catalog of basic wave models, and also give advice for their use in practice. The book provides examples of trading plans and highlights the authors' personal views on the theory of chaos and fractals.

The Elliott Wave Principle is a unique book of its kind. Many other textbooks covering wave theory focus on futures and securities analysis, while Prechter and Frost's brainchild focuses on the Forex market. The textbook was published in 1978, but the principles set out in it remain relevant today. Like wave theory itself, the textbook has stood the test of time and become a true Wall Street classic. The authors themselves describe the book as follows: “You will see what Elliott is talking about as clearly as if you had discovered it yourself, and the stock market will appear before you in a new light.”

Download Elliott Wave Principle

- Buy and download the book “The Elliott Wave Principle. The key to understanding the market" in fb2, epub, pdf, mobi and fb3 formats is available on the Litres website. The resource provides access to a free fragment from the book.

- By purchasing a premium subscription to the website mybook.ru, you can read the book “The Elliott Wave Principle” online.

- An introductory fragment of the book “The Elliott Wave Principle” by Prechter and Frost can be downloaded for free on the website avidreaders.ru. The textbook is available in fb2, rtf, epub, pdf, txt formats.

- Read online the book “The Elliott Wave Principle. The Key to Understanding the Market" by Robert Prechter and Alfred Frost can be found on the online library website Lib.in.ru.

- You can buy the textbook “Elliott Wave Principle” in paper copy on the store’s website. Here you can book your purchase and arrange delivery to any region of Russia.

- You can also buy the book in hardcover on the website Ozon.ru.

About the authors

(Robert R. Prechter) is a famous American trader, stock exchange analyst, and writer. In 1971 he graduated from Yale University with a degree in Psychology. He played drums in a rock band for four years, but then chose a completely different path - he began working as a technician at Merrill Lynch in New York. While carrying out his duties, Robert simultaneously studied Elliott's research, in which he showed interest even during his passion for music. He realized that the flow of prices in the market is inextricably linked with the psychology of society.

(Robert R. Prechter) is a famous American trader, stock exchange analyst, and writer. In 1971 he graduated from Yale University with a degree in Psychology. He played drums in a rock band for four years, but then chose a completely different path - he began working as a technician at Merrill Lynch in New York. While carrying out his duties, Robert simultaneously studied Elliott's research, in which he showed interest even during his passion for music. He realized that the flow of prices in the market is inextricably linked with the psychology of society.

In 1979, Robert left the bank and began publishing the Elliott Wave Theorist newsletter. Prechter was named "Guru of the Decade" by CNBC for more than quadrupling his real money account at the American Open Trading Championship. Robert Prechter's books are known all over the world - he wrote more than 10 works on wave theory and socionomics. A talented analyst believes that Elliott's theory is significant in sociology in the same way as Newton's works are in physics.

Alfred Frost (Alfred Frost) is an American financier and another follower of Elliott's ideas. He studied in Kingston, a city in the south of the Canadian province of Ontario. He graduated from Queen's University and devoted his life to studying the financial system. In 1990, he was a member of several international legal committees. Alfred Frost, in collaboration with Robert Prechter, worked on the book “The Elliott Wave Principle. The Key to Understanding the Market", which is considered one of the most famous works on this topic.

If you find an error, please highlight a piece of text and click Ctrl+Enter! Thank you very much for your help, it is very important for us and our readers!

Ralph Elliott(1871-1948), an accountant by profession, worked in the restaurant business and railway transport. At various times he served with various railroad companies in Mexico and several other Central American countries. In 1927, he retired for health reasons, the result of a serious illness he suffered in Guatemala, after which he spent several years recovering with difficulty at home in California.

During his long period of recovery, Elliott developed his theorystock market behavior. He appears to have been greatly influenced by the Dow theory, which, it should be noted, has much in common with his own. In 1934, he wrote to Collins, who was then editor of the stock exchange newsletter Investment Advisory, and said that he was a subscriber to Robert Rea's newsletter and, therefore, familiar with the latter's book on the Dow theory. He also wrote that the concept of waves is "a much needed complement to the Dow theory."

Elliott told Collins about his discovery and expressed hope that he could join his firm. A lively correspondence followed, and soon Collins, believing in the significance of Elliott's discovery, helped the latter launch a career on Wall Street and even agreed to publish his book "The Wave Principle" in 1938. Collins also introduced Elliott to the editors of Financial World magazine. After this, Elliott wrote a series of twelve articles in which he outlined his theory. The articles were published in 1939.

And in 1946, two years before his death, Elliott wrote his most important work on "wave theories": “Nature's Law - The Secret of the Universe.” The title of the work may sound a little pompous. The fact is that Elliott considered his concept of the securities market to be part of a much larger whole - and namely, the universal law of nature that governs all spheres of human life. Although it would be very interesting to consider Elliott’s theory from this point of view, we are nevertheless forced to leave this fundamental topic and pay attention to those aspects of the wave theory that are directly related to securities market.

Elliott's works might have been completely forgotten if not for E. Bolton, who in 1953 began publishing works on wave theory as an annual supplement to the Bank Credit Analyst magazine. Publications continued for fourteen years until Bolton's death in 1967. Back in 1960, Bolton published a book "The Elliott Wave Principle - A Critical Analysis"(Elliott Wave Principle - A Critical Appraisal), which became the first major work devoted to the wave theory since the death of its founder.

In 1967, E. Frost continued publishing supplements, and in 1970 he wrote his last major work on Elliott’s theory, published in the “wave” supplement of the Bank Credit Analyst magazine. In 1980, Prechter published Elliott's collected works. Readers now have access to Elliott's classic, long-out-of-print works. Prechter himself is considered one of the leading experts on wave theory. He publishes a monthly newsletter "Bulletin of Elliott Wave Theory", which highlights the challenges of applying the wave concept to the equity, interest rate, and precious metals markets. Issues related to the use of wave theory in commodity futures markets are discussed in another newsletter, also edited by R. Prechter, authored by D. Weiss.

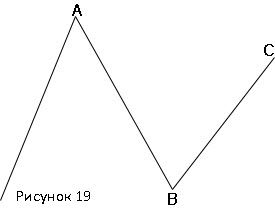

A “zigzag” is a three-wave corrective configuration directed against the main trend. This pattern breaks down into a sequence: 5-3-5. Figure 8 shows examples of corrective zigzags for a bull market.

2. Plane waves

A flat correction, unlike a zigzag correction, forms a 3-3-5 configuration. Please note that in the examples of Figures 10, 12, wave A consists of three waves, not five. In general, a flat wave is more of a consolidation configuration than a correction. It shows the strength of the bull market. Figures 9-12 show examples of classical plane waves.

Thus, in a bull market, during the recovery, wave B reaches the top of wave A, demonstrating higher market potential. The final wave C ends its course at the base of wave A or slightly lower - in contrast to the zigzag pattern, which goes much lower. There are two exceptions to the classic flat correction configuration. The first type of such exception is shown in Figures 13-16. Please note that in a bull market (Figure 13, 14), the top of wave B exceeds the top of wave A, and wave C, in turn, falls below the bottom of wave A.

The second exception occurs when wave B reaches the top of wave A, while wave C never reaches the bottom of wave A. Naturally, in this case, the bull market has higher market potential. Examples of this deviation from the rules for bull and bear markets are shown in Figures 17-20.

The latest version of the flat correction indicates the presence of even greater market potential. It is called a "running" correction. An example of a running correction in a bull market is shown in Figure 21. Notice that wave b rises well above the top of wave a, while wave c remains above the top of wave 1, which, recall, is an impulse one. This corrective configuration is quite rare; it is typical for a market whose potential is so significant that the correction never manages to fully form.

3. Triangles

Triangles usually appear on the fourth wave, preceding the final move in the direction of the main trend (they can also appear on wave b, part of an a-b-c corrective configuration). Thus, with an upward trend, triangles can be characterized as a bullish and bearish pattern at the same time. We call it bullish because the triangles show a resumption of the upward trend. And they are bearish because they also signal that prices are approaching the top, which, as a rule, happens after another wave of growth.

The principles of interpreting triangles according to Elliott are almost the same as the classical analysis of these models. However, wave theory allows us to do this more accurately. From classical analysis it is known that a triangle is usually a trend continuation pattern - this is exactly how Elliott describes it. In wave theory, a triangle is a configuration characteristic of consolidation during a period of stagnation.

It is divided into five waves, each of which in turn consists of three waves. Elliott also identifies four different types of triangles - ascending, descending, symmetric And expanding. In Figure 22 you see examples of all four variations of the pattern for rising and falling trends.

In the futures commodity markets, graphical patterns are sometimes not fully formed - unlike the securities market, so triangles here can only have three waves instead of five (however, we must remember that the minimum requirement for the formation of a triangle continues to be four points, two top and two lower ones, which allow you to draw two converging trend lines). According to the Elliott wave theory, the fifth and final wave of the triangle pattern sometimes “breaks through” the trend line, thereby giving a false signal, but then the movement resumes in the original direction.

According to Elliott, the measurement criteria for the fifth and final wave after the completion of the triangle are generally similar to traditional ones: after the breakout, the market must travel a distance equal to the widest part of the triangle (its height). There is another interesting point here regarding the estimation of when the market will reach its final top or bottom. According to Prechter, the apex of the triangle (that is, the point at which the trend lines converge) often corresponds to the moment of completion of the fifth and final wave.

4. Double and triple triplets

The last type of corrective waves is a complex configuration, which is relatively rare on charts, consisting of two or three simple models (Figures 23,24). In the first example (Figure 23) we see seven waves, which are a combination of two configurations of the a-b-c type. In Figure 24, three configurations a-b-c combine to form eleven waves. Notice how similar these complex patterns are to a classic trading range (or consolidation rectangle).

This concludes our review of the main models of the Elliott wave theory. Next, we must touch upon two important features of wave analysis - firstly, the so-called “alternation rule” and, secondly, the patterns of constructing a price channel.

Alternation rule

In its most general form this rule or principle states: The market usually doesn't behave the same way twice in a row.. For example, if the last time a trend changed, a certain pattern formed, then the next time there is a change in the same direction, it most likely will not happen again. The rotation rule cannot tell us exactly what will happen to the market, but it does tell us what exactly should not happen.

A more narrow application of this rule in practice usually comes down to determining what type of correction should be expected. Corrective configurations tend to alternate. In other words, if corrective wave 2 was a simple a-b-c pattern, then wave 4 most likely forms a complex configuration - for example, a triangle. Conversely, if wave 2 is a complex pattern, wave 4 will be simple. Examples of the alternation rule are in Figure 25.

Building a channel

Another important aspect of wave theory is the use price channels. According to Elliott, drawing a Forex channel is a good method for identifying price targets. The channel also confirms the completion of the wave count. Once the upward trend has finally been established, the initial channel is built by drawing the main upward trend line along the bottoms of waves 1 and 2. Then, parallel to it, a second line is drawn through the top of wave 1, as shown in Figure 26. Often throughout the upward trend, the market does not go beyond these two lines.

If wave 3, accelerating its movement, breaks out of the upper line of the channel, then it is necessary to draw new boundaries of the channel - through the top of wave 1 and the bottom of wave 2 (Figure 26). Finally, the channel lines are drawn under two corrective waves - the second and fourth - and also usually above the top of wave 3 (Figure 27). If wave 3 is unusually strong (i.e., extended), the upper line can be drawn above the top of wave 1. The fifth wave must approach the upper border of the channel before its completion. When building a channel for long-term trends, it is recommended to use semi-logarithmic graphs along with arithmetic ones.

Wave 4 as a support area

Concluding the discussion of wave models and other related concepts of Elliott theory, it is necessary to touch upon one more important point - wave 4 function as areas of support in the event of a subsequent fall in prices. After five waves of an uptrend have passed and the market has entered a bearish phase, it usually does not fall below the previous fourth wave by a degree lower, that is, the fourth wave of the previous uptrend. Typically, the bottom of the fourth wave will contain the fall in prices, although there are exceptions to this rule. This pattern can be very useful in determining the maximum price target for a bear market.

Fibonacci numbers - the mathematical basis of wave theory

What do Leonardo Fibonacci, a thirteenth-century mathematician, have in common with Elliott Wave Theory and stock market dynamics? There are a lot of similarities. As Elliott himself admitted in his Law of Nature, the mathematical basis of his theory was a sequence of numbers discovered (or, to be more precise, rediscovered) by Fibonacci in the thirteenth century. In his honor, the sequence he discovered began to be called " Fibonacci numbers".

Fibonacci published three large works in his time, the most famous of which is called “Liber Abaci” (translated from Latin: “Book of Calculations”). Thanks to this book, Europe learned the Indo-Arabic number system, which later replaced the traditional Roman numbers of that time. Fibonacci's work was of great importance for the subsequent development of mathematics, physics, astronomy and technology. In "Libel Abaci" Fibonacci gives his sequence of numbers as a solution to a mathematical problem - finding the formula for the reproduction of rabbits. The numerical sequence is: 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144 ...

The Fibonacci sequence has very interesting peculiarities, not the least of which - almost constant relationship between numbers.

- Sum any two adjacent numbers is equal to the next number in the sequence. For example: 3+5=8, 5+8=13 and so on.

- Attitude of any number in the sequence to the next one approaches 0.618 (after the first four numbers). For example: 1/1=1.00; 1/2=0.50; 2/3=0.67; 3/5=0.60; 5/8=0.625; 8/13:=0.615; 13/21=0.619 and so on. Notice how the ratio values fluctuate around the value of 0.618, with the range of fluctuations gradually narrowing; and also by values: 1.00; 0.50; 0.67. Below we will talk about the meaning they have for analyzing ratios and determining percentage levels of correction length.

- Attitude any number to the previous one is approximately equal to 1.618 (the reciprocal of 0.618). For example: 13/8=1.625; 21/13=1.615; 34/21=1.619. The higher the numbers, the closer they get to the values of 0.618 and 1.618.

- Attitude of any number, the next one after it approaches 0.382, and the one before it approaches 2.618 after one). For example: 13/34=0.382; 34/13=2.615.

The Fibonacci sequence contains other interesting relationships, or coefficients, but the ones we have just given are the most important and well-known. As we have already emphasized above, in fact, Fibonacci is not the discoverer of his sequence. The fact is that the coefficient 1.618 or 0.618 was known to the ancient Greek and ancient Egyptian mathematicians, who called it " golden coefficient" or " golden ratio".

We find traces of it in music, visual arts, architecture and biology. The Greeks used the principle of the "golden ratio" in the construction of the Parthenon, the Egyptians - the Great Pyramid of Giza. The properties of the “golden coefficient” were well known to Pythagoras, Plato and Leonardo da Vinci.

Some researchers have tried to find traces of the Fibonacci sequence in completely unexpected areas. Someone measured the average height of the navel of sixty-five women. It turned out that it is 0.618. This can be considered a curiosity, but, nevertheless, it should be recognized that Fibonacci numbers are found everywhere - literally in every area of human life.

Logarithmic spiral

In this chapter, we are not going to exhaustively analyze such concepts as "golden ratios", "golden rectangles" and "logarithmic spirals", not to mention the mathematical foundations of wave theory and the Fibonacci number sequence itself. However, it is necessary to mention that based on the “golden coefficient” it is possible to construct the so-called “ logarithmic spiral", which is believed to partly explain the universal principle of growth, a certain law common to our entire universe.

It is believed that the spiral retains a constant shape, no matter what form it appears. The principle of the spiral covers the entire set of natural elements - from the smallest to the truly gigantic. Let's give just two examples: a snail shell, on the one hand, and the shape of our galaxy, on the other. In both cases we are dealing with the same logarithmic spiral(another example of which is the human ear). It is believed that the dynamics of the securities market should follow the same spiral, because the latter not only represents an excellent example of the manifestation of mass psychology, but is also one of the forms of natural development that determines the entire progress of mankind.

Fibonacci Ratios and Retracement Length Percentages

We have already said that the three most important aspects of Elliott's theory are waveform, wave ratio and time. We have already discussed wave configurations - this is their most important characteristic, surpassing the other two in importance. Now we'll talk about practical application of Fibonacci ratios and the percentages of the correction length based on them. These ratios can be used in the analysis of both price dynamics and market timing, although in the latter case they are considered less reliable. Later we will return to the question of the time aspect of wave theory.

First of all, if you look at the example (Figure 1), you will see that Fibonacci numbers are always visible in the cyclical nature of the main wave patterns. Thus, one complete cycle consists of eight waves - five ascending and three descending. As we remember, the numbers 3 and 5 are included in this sequence. Further breaking down the waves into smaller ones gives us thirty-four and one hundred and forty-four waves - again Fibonacci numbers.

However, the mathematical justification of the theory of waves, which, as has been repeatedly emphasized, is based on the Fibonacci number sequence, of course, does not come down to a simple counting of waves. Proportional relationships, expressed in numerical values, arise between different waves. The most common are the following Fibonacci ratios:

- Since only one of the three impulse waves is extended, the other two are equal in length and completion time. If the fifth wave is extended, waves 1 and 3 should be almost equal. When the third wave extends, waves 1 and 5 will be more or less equal.

- The minimum reference point for the top of wave 3 will be the point whose coordinates are obtained by multiplying the length of wave 1 by 1.618 and adding the product to the indicator of the bottom of wave 2, that is, to the value corresponding to its lowest point.

- The high point of wave 5 can be established by multiplying the length of wave 1 by 3.236 (2 x 1.618). The resulting product should be added to the value of the top or bottom of wave 1. Accordingly, we will obtain the maximum or minimum guideline.

- When waves 1 and 3 are equal and wave 5 is expected to extend, then the price target can be obtained as follows. First, you should measure the distance from the bottom of wave 1 to the top of wave 3, and multiply it by 1.618. The resulting product, in turn, is added to the value of the lowest point of wave 4.

- During correction (in the case of a normal zigzag correction of the 5-3-5 type), wave c often reaches the length of wave a.

- The possible wavelength c can also be measured by multiplying 0.618 by the wavelength a, and subtracting the resulting product from the value of the base of wave a.

- In the case of a 3-3-5 flat correction where wave b reaches or even overlaps the top of wave a, wave c will be approximately 1.618 times the length of wave a.

- In a symmetrical triangle, the ratio of each subsequent wave to the previous one is approximately 0.618.

Percentage expression of retracement length based on Fibonacci ratios Although there are other ratios, the ones we have given above are the most commonly used. These coefficients help determine price targets for both impulse and corrective waves. However, price targets can also be set using correction length percentages.

The most common values for such ratios are 61.8% (usually rounded to 62%), 38% and 50%. As you remember, we have already said that the length of the correction is a predictable value and, in percentage terms, is usually equal to 33%, 50% and 67% of the previous market movement. However, using the Fibonacci number sequence, the percentage values of the correction length can be determined even more accurately. Thus, with a strong trend, the minimum correction length is usually about 38%. In the case of a weak trend, the correction length, as a rule, does not exceed 62%.

We already mentioned above that Fibonacci ratios approach 0.618 starting from the fifth number. The first three values in the series of coefficients are: 1/1 (100%), 1/2 (50%), 2/3 (67%). The well-known 50% ratio of the length of the correction is actually the Fibonacci ratio, as is the correction covering 2/3 of the previous move (a correction of one third of the previous move also fits into Elliott theory as the Fibonacci ratio - the ratio of any number to the next one through one). A complete (100%) return of prices to the level at which the previous bull or bear market began marks an important area of support or resistance.

Time references based on Fibonacci numbers

Until now we have only touched upon the problem of the time aspect of wave analysis. There is no doubt that there are also time relationships in the market, which are based on the Fibonacci sequence. However, they are more difficult to predict, which is why some Elliott followers consider time to be the least significant of the three components of wave theory. Time targets are established by progressive counting from the most significant market extremes.

The daily chart counts the number of trading days since a significant turning point. In this case, you can expect that subsequent tops or bottoms of the market will occur exactly on Fibonacci days, that is, on the 13th, 21st, 34th, 55th or 89th trading day in the future. The calculations are done in a similar way on weekly, monthly or even annual charts. Thus, a significant top or bottom of the market is found on the weekly chart, and then a suitable time reference is sought that coincides with one of the Fibonacci numbers.

Three aspects of wave theory - combined analysis

An ideal analytical situation occurs when the configuration of waves, their relationships and timing give a consistent picture. Suppose a study of the wave pattern showed that the fifth wave had completed, that it had traveled a distance equal to 1.618 times the distance from the low point of wave 1 to the high point of wave 3, and that, finally, since the beginning of the trend, the market had been moving from the last low for thirteen weeks, and thirty four - from the last maximum. Let us further assume that the fifth wave lasted twenty-one days. Based on this, we can conclude that the market is very close to reaching a significant top.

The study of price charts in securities markets shows that the time relationships of market dynamics obey the laws of the Fibonacci number series. However, the complexity of the analysis lies in the fact that possible relationships of this kind are quite diverse. Time references based on the Fibonacci sequence can be counted from top to top, from top to bottom, from bottom to bottom and finally from bottom to top. In fact, relationships of this kind are easily established. However, as trends develop, it is not always clear which of them are significant.

Features of the application of Elliott wave theory in the study of securities and commodity futures markets

We have already touched on some of the differences that appear in wave analysis of the securities markets, on the one hand, and commodity futures, on the other. For example, in securities markets, as a rule, wave 3 extends, and in commodity markets, wave 5. The consistent rule of the securities market, according to which wave 4 never overlaps wave 1, is often violated in commodity markets (on price charts for futures contracts intraday crossovers may occur). Sometimes cash market price charts show a clearer wave pattern than futures charts. The use of long-term charts in commodity futures markets can lead to distortions, which in turn are reflected in the construction of long-term Elliott wave patterns.

Perhaps the most significant difference between the two types of markets is that major upward trends in commodity markets can be "contained." In other words, bull market highs do not always exceed previous highs. In commodity markets, a full five-wave rally may not reach the top of the previous bull market. This circumstance is very significant; The existence of a long-term growth spiral in commodity markets, which is so important for stock market analysis, is called into question. Finally, another characteristic of commodity markets is that the most pronounced wave patterns appear after market breakouts from long-term extended bottoms.

It must be remembered that Elliott's theory was created to analyze stock market indices, namely the Dow Jones indices. It is less suitable for analyzing individual stock prices. It is very likely that it is not as effective for some less active futures markets, since wave theory is based, among other things, on the analysis of mass psychology.

Conclusion

Let's summarize briefly, summarizing the main provisions of the theory of waves, and then show specific areas of their practical application.

- A complete bull market cycle consists of eight waves: five rising waves followed by three falling waves.

- The trend is divided into five waves in the direction of the next in the hierarchy, longer trend.

- A correction always consists of three waves.

- Simple corrections come in two types: zigzags (5-3-5) and flat waves (3-3-5).

- Triangles typically form on fourth waves (this pattern always precedes the last wave). The triangle can also be a corrective wave B.

- Any wave is part of a longer one and is divided into shorter ones.

- Sometimes one of the impulse waves is stretched. The remaining two should remain equal in time and length.

- The mathematical basis of Elliott wave theory is the Fibonacci sequence.

- The number of waves that form a trend coincides with the Fibonacci numbers.

- Fibonacci ratios and retracement length ratios based on them are used to determine price targets. The ratio of the length of the correction to the previous market movement is often equal to 62%, 50% and 38%.

- The alternation rule warns that you should not expect the same manifestation of price dynamics two times in a row.

- Bear markets generally should not fall below the bottom of the previous fourth wave.

- Wave 4 should not overlap with wave 1 (although this rule is sometimes violated in futures markets).

- The main aspects of Elliott wave theory are (in order of importance): wave shape, wave ratio, and time.

- Wave theory was originally used to analyze stock indices, and its effectiveness is not so high in analyzing the price dynamics of specific stocks.

- Wave analysis demonstrates the best results in the most liquid markets.

- The main feature of commodity markets is the phenomenon of “containing” price movements during an upward trend.

"Elliott Wave Principle" can be called the most comprehensive theoretical tool used in the securities and futures markets. Elliott's ideas are based on more well-known approaches such as the Dow theory and the analysis of classical price patterns. Most of the latter are perfectly explained in terms of the wave structure. Wave theory is based on the concept of “price benchmarks,” which involves the use of Fibonacci ratios and correction length relationships based on them.

Wave theory incorporated many well-known theoretical principles, but Elliott went further: he streamlined them, while introducing a greater element of predictability into the analysis of market dynamics. Along with everything, it is worth remembering that wave theory should be used in combination with other technical analysis tools. And, perhaps, there is no theory that would contain answers to all questions. And it is unlikely that any movement of the commodity market can be accurately explained using this theory.

Sometimes the wave structure clearly shows the possible course of the market, sometimes it does not. When the course of the market is unclear, and they are trying to force it into the framework of Elliott's theory, while completely ignoring other methods of technical analysis, then this can be called a real abuse of a method that in other conditions can be quite useful. Unfortunately, abuse often leads to dire consequences. It is much wiser to view Elliott waves as only a partial answer to the eternal riddle of market forecasting. The effectiveness of wave theory only increases when it is used in combination with other analytical tools, and the chances of success increase.

Elliott Wave strategy training

Do you want to close 8 deals out of 10 with a profit?

Having attended a special course " Elliott wave theory"you will learn

add positions following the trend with minimal risks

Take part in the special course "Elliott Wave Theory" and close your trades with profit!